- Philippines

- /

- Hospitality

- /

- PSE:PLUS

3 Global Growth Companies With High Insider Ownership Growing Revenues Up To 20%

Reviewed by Simply Wall St

As global markets navigate mixed performances, with major indices like the Nasdaq Composite benefiting from technology-driven rallies and geopolitical events providing temporary relief, investors are increasingly focused on companies that demonstrate resilience and growth potential. In such an environment, growth companies with high insider ownership can be particularly appealing as they often align management's interests with those of shareholders, potentially fostering robust revenue growth even amidst economic uncertainties.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 58.2% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31.2% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| CD Projekt (WSE:CDR) | 29.7% | 49.6% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's dive into some prime choices out of the screener.

DigiPlus Interactive (PSE:PLUS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DigiPlus Interactive Corp. operates as a digital entertainment company in the Philippines and has a market cap of ₱102.79 billion.

Operations: The company's revenue is primarily derived from its Retail Group, which generates ₱89.49 billion, followed by the Casino Group at ₱526.65 million and the Network and License Group contributing ₱378.06 million.

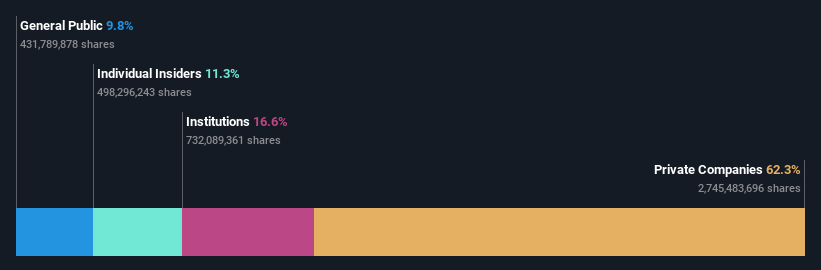

Insider Ownership: 17.4%

Revenue Growth Forecast: 10.9% p.a.

DigiPlus Interactive has demonstrated strong financial performance, with recent earnings and revenue growth outpacing the previous year. The company is trading at a significant discount to its estimated fair value, presenting potential value opportunities. Despite a volatile share price, insider confidence is evident through substantial buying activity over the past three months. Recent strategic moves include applying for licenses in South Africa's promising market and launching a pioneering surety bond program in the Philippines.

- Get an in-depth perspective on DigiPlus Interactive's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of DigiPlus Interactive shares in the market.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan is a technology-driven retail company operating in the People's Republic of China, Hong Kong, Macao, Taiwan, and internationally with a market cap of approximately HK$624.86 billion.

Operations: The company's revenue is primarily derived from two segments: Core Local Commerce, generating CN¥264.61 billion, and New Initiatives, contributing CN¥95.85 billion.

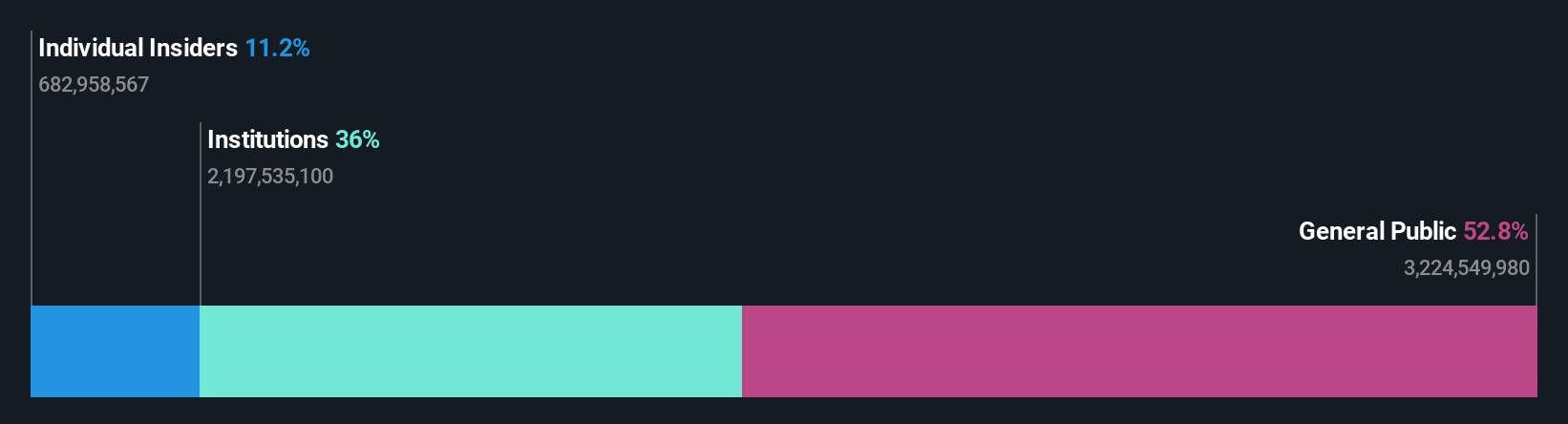

Insider Ownership: 11.2%

Revenue Growth Forecast: 10.8% p.a.

Meituan's projected earnings growth of 32.3% annually surpasses the Hong Kong market average, indicating strong potential for expansion. Despite trading at a significant discount to its estimated fair value, recent financial results show mixed performance with increased sales but lower net income compared to last year. The company completed a substantial share buyback worth billions, reflecting confidence in its long-term prospects despite no significant insider trading activity recently.

- Click here and access our complete growth analysis report to understand the dynamics of Meituan.

- Our comprehensive valuation report raises the possibility that Meituan is priced lower than what may be justified by its financials.

Sineng ElectricLtd (SZSE:300827)

Simply Wall St Growth Rating: ★★★★★★

Overview: Sineng Electric Co., Ltd. focuses on the research, development, manufacture, maintenance, and trading of power electronic products both in China and internationally, with a market cap of CN¥16.95 billion.

Operations: The company's revenue segments include power electronic products for domestic and international markets, contributing CN¥3.45 billion from inverters, CN¥1.27 billion from energy storage systems, and CN¥0.98 billion from photovoltaic power stations.

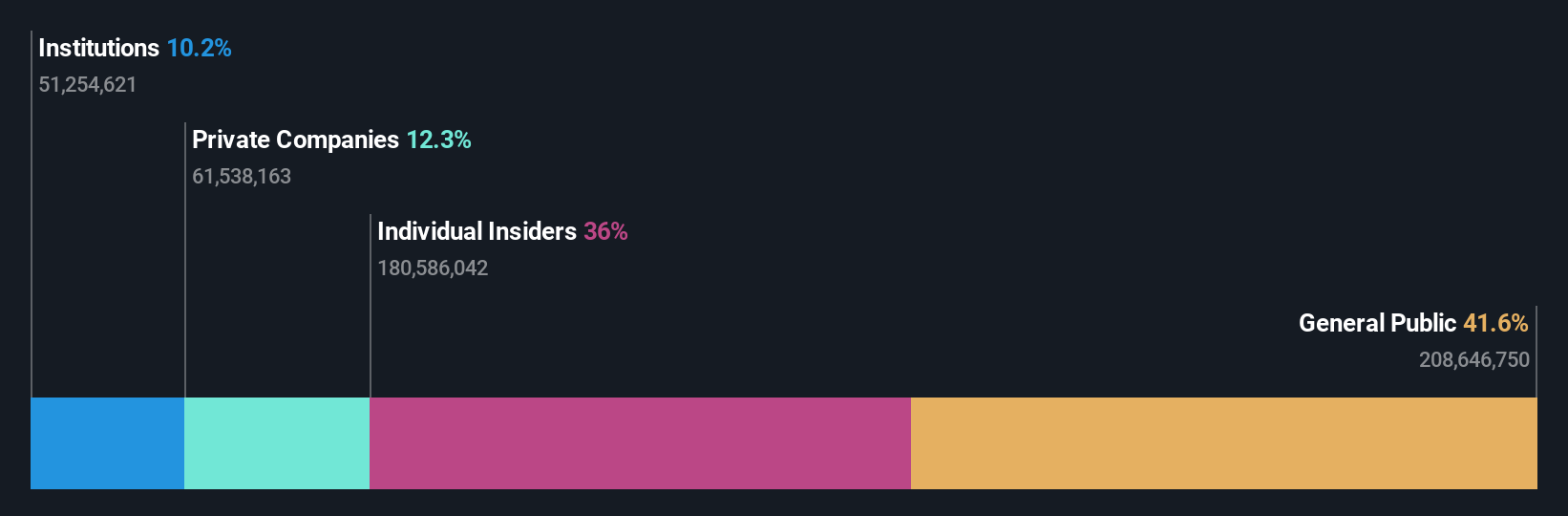

Insider Ownership: 36%

Revenue Growth Forecast: 20.6% p.a.

Sineng Electric's earnings are forecast to grow 30% annually, outpacing the Chinese market average. Recent results show sales increased to CNY 3.56 billion, with net income rising modestly. The company trades at a price-to-earnings ratio of 39.2x, below the market average, suggesting relative value despite high share price volatility. With no substantial insider trading activity reported recently and expected revenue growth exceeding 20% annually, Sineng Electric demonstrates potential for robust expansion in its sector.

- Dive into the specifics of Sineng ElectricLtd here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Sineng ElectricLtd's share price might be too pessimistic.

Make It Happen

- Explore the 823 names from our Fast Growing Global Companies With High Insider Ownership screener here.

- Contemplating Other Strategies? Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:PLUS

DigiPlus Interactive

Through its subsidiaries, operates as a digital entertainment company in the Philippines.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives