Zhejiang Changsheng Sliding Bearings Co., Ltd. (SZSE:300718) Held Back By Insufficient Growth Even After Shares Climb 31%

Zhejiang Changsheng Sliding Bearings Co., Ltd. (SZSE:300718) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.8% over the last year.

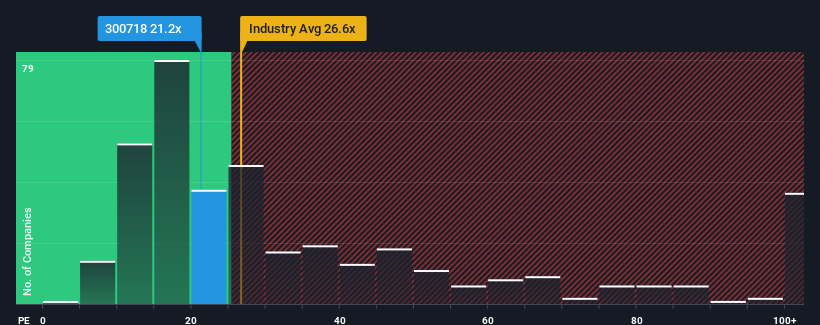

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 27x, you may still consider Zhejiang Changsheng Sliding Bearings as an attractive investment with its 21.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for Zhejiang Changsheng Sliding Bearings as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Zhejiang Changsheng Sliding Bearings

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Zhejiang Changsheng Sliding Bearings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 97% gain to the company's bottom line. The latest three year period has also seen an excellent 49% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 20% each year over the next three years. With the market predicted to deliver 24% growth each year, the company is positioned for a weaker earnings result.

With this information, we can see why Zhejiang Changsheng Sliding Bearings is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Despite Zhejiang Changsheng Sliding Bearings' shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Zhejiang Changsheng Sliding Bearings' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Zhejiang Changsheng Sliding Bearings that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Changsheng Sliding Bearings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300718

Zhejiang Changsheng Sliding Bearings

Zhejiang Changsheng Sliding Bearings Co., Ltd.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives