Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SZSE:300445

Exploring Value Opportunities in Chinese Stocks This July 2024

Reviewed by Simply Wall St

As of July 2024, the Chinese market has shown resilience with modest gains in major indices like the Shanghai Composite and CSI 300, despite weaker-than-expected economic growth data. This context sets an intriguing stage for investors looking for value opportunities in a market that might be overshadowed by broader economic concerns. In such a market environment, identifying undervalued stocks often involves looking for companies with solid fundamentals that appear to be priced below their intrinsic value relative to their financial health and growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥163.86 | CN¥322.39 | 49.2% |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.00 | CN¥28.11 | 46.6% |

| Shanghai Baolong Automotive (SHSE:603197) | CN¥29.46 | CN¥56.88 | 48.2% |

| Anhui Anli Material Technology (SZSE:300218) | CN¥14.16 | CN¥26.64 | 46.9% |

| Beijing Kawin Technology Share-Holding (SHSE:688687) | CN¥23.47 | CN¥46.02 | 49% |

| Thunder Software TechnologyLtd (SZSE:300496) | CN¥42.81 | CN¥84.19 | 49.2% |

| Guangdong Shenling Environmental Systems (SZSE:301018) | CN¥20.51 | CN¥38.65 | 46.9% |

| INKON Life Technology (SZSE:300143) | CN¥7.36 | CN¥14.64 | 49.7% |

| China Film (SHSE:600977) | CN¥10.31 | CN¥20.31 | 49.2% |

| Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥9.64 | CN¥18.84 | 48.8% |

Let's explore several standout options from the results in the screener.

Sunrise Manufacture Group (SHSE:605138)

Overview: Sunrise Manufacture Group Co., Ltd., operating internationally with facilities in China, Vietnam, Cambodia, and Sri Lanka, focuses on the production and sale of textile fabrics and garments, boasting a market capitalization of CN¥2.49 billion.

Operations: The company generates revenue primarily through the production and sale of textile fabrics and garments across several key markets, including China, Vietnam, Cambodia, Sri Lanka, and other international locations.

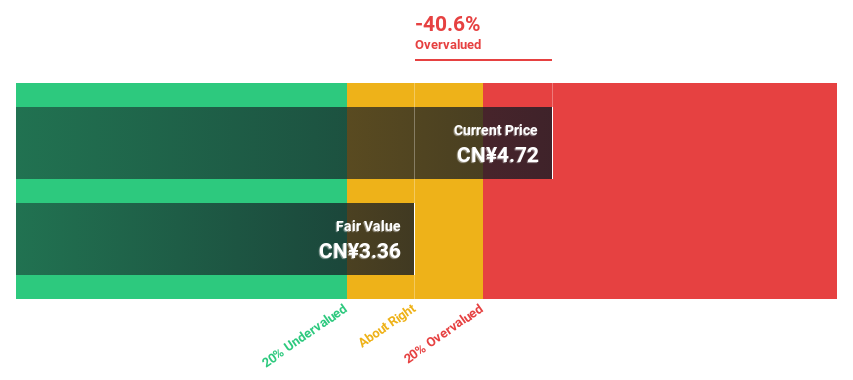

Estimated Discount To Fair Value: 36.5%

Sunrise Manufacture Group, priced at CN¥4.56, is significantly undervalued based on a DCF valuation with a fair value of CN¥7.18, indicating it trades 36.5% below its estimated worth. While the company's earnings are expected to surge by 41.73% annually over the next three years, outpacing the Chinese market's growth rate, its dividends and interest payments raise concerns due to poor coverage by earnings and free cash flows. Recent activities include a share buyback completion and an upcoming special shareholders meeting scheduled for July 17, 2024.

- Our growth report here indicates Sunrise Manufacture Group may be poised for an improving outlook.

- Navigate through the intricacies of Sunrise Manufacture Group with our comprehensive financial health report here.

Beijing ConST Instruments Technology (SZSE:300445)

Overview: Beijing ConST Instruments Technology Inc. specializes in the development and manufacturing of scientific and technological instruments, with a market capitalization of approximately CN¥3.14 billion.

Operations: The company generates revenue primarily from the manufacturing of instruments, totaling CN¥468.06 million.

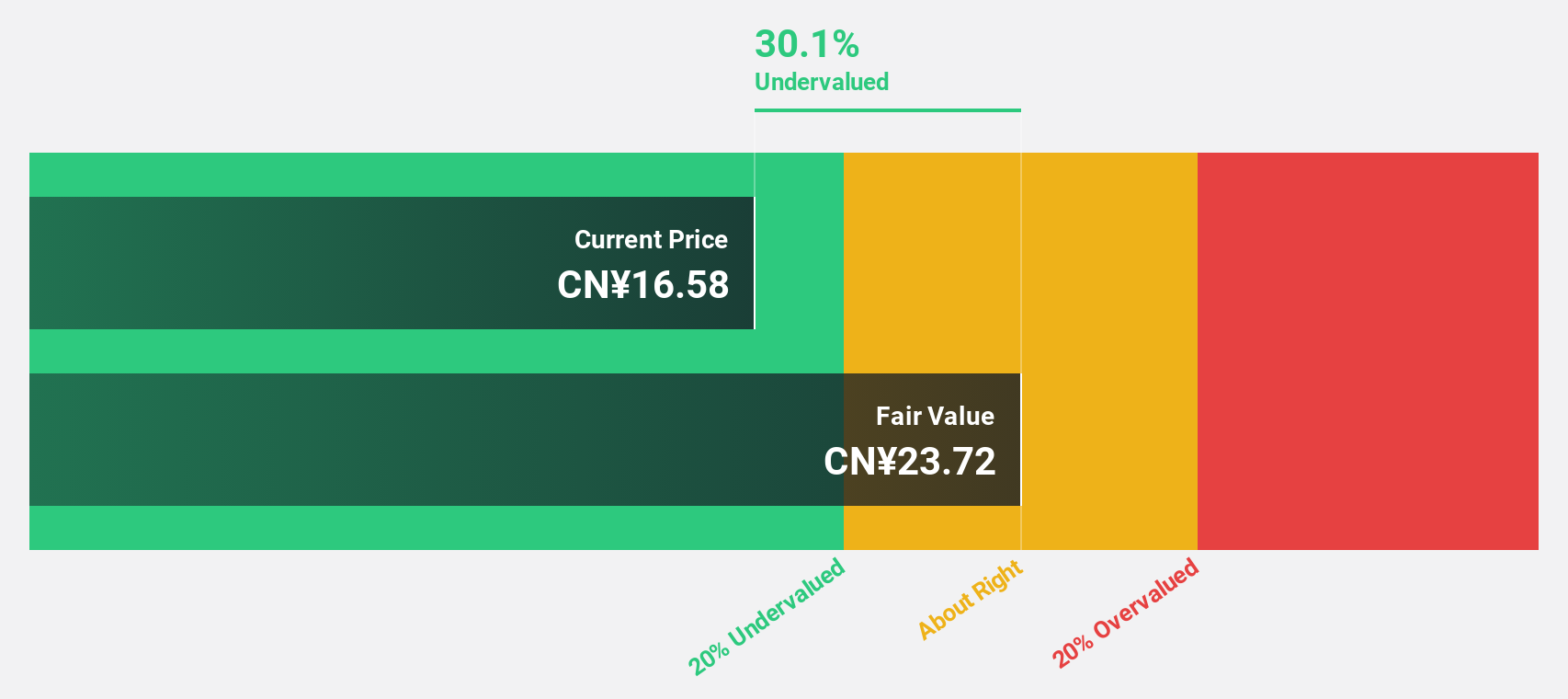

Estimated Discount To Fair Value: 42.5%

Beijing ConST Instruments Technology, with a current price of CN¥14.82, is trading at a 42.5% discount to its DCF-based fair value of CN¥25.79. The company's earnings and revenue are both expected to grow by over 20% annually in the coming years, outpacing the Chinese market averages significantly. However, its Return on Equity is projected to remain low at 12.8%. Recently, it announced a cash dividend of CNY0.80 per 10 shares payable on May 14, 2024.

- The growth report we've compiled suggests that Beijing ConST Instruments Technology's future prospects could be on the up.

- Take a closer look at Beijing ConST Instruments Technology's balance sheet health here in our report.

Changsha DIALINE New Material Sci.&Tech (SZSE:300700)

Overview: Changsha DIALINE New Material Sci.&Tech. Co., Ltd. focuses on the research, development, production, and sale of electroplated diamond wires in China, with a market capitalization of approximately CN¥2.54 billion.

Operations: The company primarily generates its revenue from the research, development, production, and sale of electroplated diamond wires.

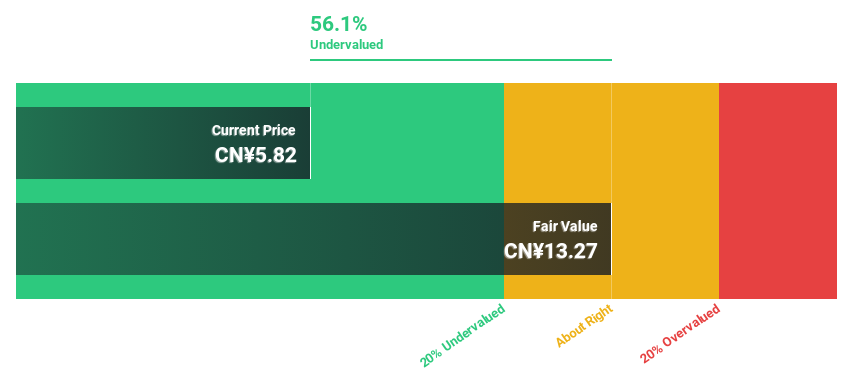

Estimated Discount To Fair Value: 39.8%

Changsha DIALINE New Material Sci.&Tech. is currently undervalued, trading at CN¥6.9, significantly below the estimated fair value of CN¥11.47 based on discounted cash flows. The company's earnings are expected to grow by 45.3% annually, outstripping the Chinese market forecast of 22.1%. Additionally, revenue growth is projected at 29.5% per year, also above the market average of 13.6%. Recent activities include a dividend payment and a share buyback completion worth CN¥35 million, enhancing shareholder value despite a highly volatile share price and past shareholder dilution.

- The analysis detailed in our Changsha DIALINE New Material Sci.&Tech growth report hints at robust future financial performance.

- Get an in-depth perspective on Changsha DIALINE New Material Sci.&Tech's balance sheet by reading our health report here.

Where To Now?

- Access the full spectrum of 101 Undervalued Chinese Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing ConST Instruments Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300445

Beijing ConST Instruments Technology

Beijing ConST Instruments Technology Inc.

Flawless balance sheet with high growth potential.