- China

- /

- Electrical

- /

- SZSE:300617

Jiangsu Ankura Intelligent Power Co., Ltd. (SZSE:300617) Soars 36% But It's A Story Of Risk Vs Reward

Those holding Jiangsu Ankura Intelligent Power Co., Ltd. (SZSE:300617) shares would be relieved that the share price has rebounded 36% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 23% over that time.

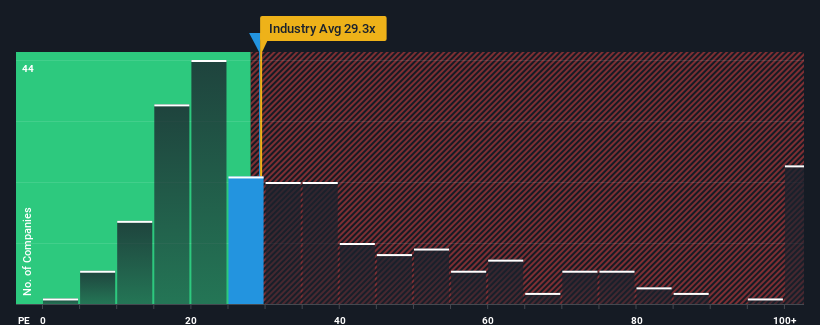

In spite of the firm bounce in price, there still wouldn't be many who think Jiangsu Ankura Intelligent Power's price-to-earnings (or "P/E") ratio of 29.1x is worth a mention when the median P/E in China is similar at about 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times haven't been advantageous for Jiangsu Ankura Intelligent Power as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Check out our latest analysis for Jiangsu Ankura Intelligent Power

Is There Some Growth For Jiangsu Ankura Intelligent Power?

There's an inherent assumption that a company should be matching the market for P/E ratios like Jiangsu Ankura Intelligent Power's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 11%. The last three years don't look nice either as the company has shrunk EPS by 4.7% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 103% over the next year. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

With this information, we find it interesting that Jiangsu Ankura Intelligent Power is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Jiangsu Ankura Intelligent Power's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Jiangsu Ankura Intelligent Power currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Jiangsu Ankura Intelligent Power you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300617

Jiangsu Ankura Intelligent Electric

Jiangsu Ankura Intelligent Electric Co., Ltd.

Flawless balance sheet and good value.

Market Insights

Community Narratives