- China

- /

- Electrical

- /

- SZSE:300593

3 Growth Companies With High Insider Ownership Seeing Up To 34% Revenue Growth

Reviewed by Simply Wall St

As global markets experience broad-based gains with U.S. indexes approaching record highs, investor sentiment is buoyed by a strong labor market and positive economic indicators. Amidst this optimistic backdrop, growth companies with high insider ownership are capturing attention, as they often align management interests with shareholders and can potentially benefit from robust internal confidence in their business strategies.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 43.2% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 67.5% |

Here's a peek at a few of the choices from the screener.

Quick Intelligent EquipmentLtd (SHSE:603203)

Simply Wall St Growth Rating: ★★★★★★

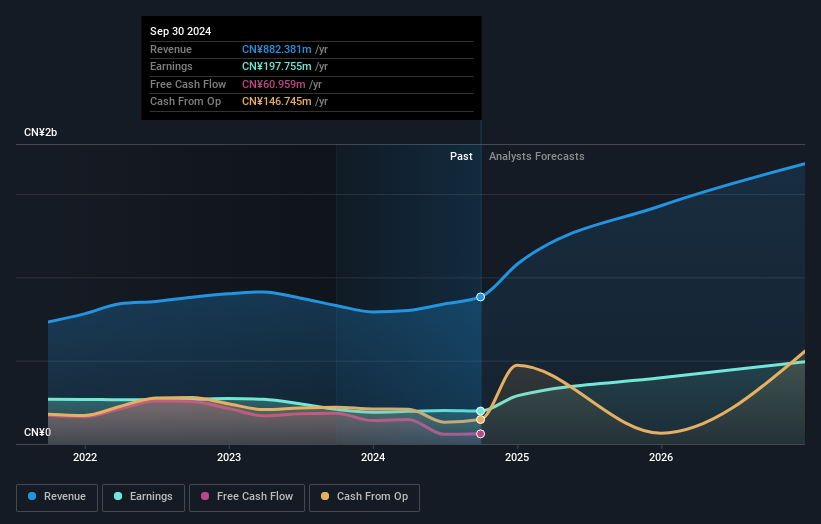

Overview: Quick Intelligent Equipment Co., Ltd. specializes in the R&D, manufacturing, and sale of precision assembly technology for electronics both in China and internationally, with a market cap of CN¥6.04 billion.

Operations: The company's revenue is primarily derived from its Special Equipment Manufacturing Industry segment, amounting to CN¥882.38 million.

Insider Ownership: 34.2%

Revenue Growth Forecast: 27% p.a.

Quick Intelligent Equipment Ltd. demonstrates strong growth potential with expected revenue and earnings growth rates surpassing 20% annually, outpacing the broader CN market. Despite a high price-to-earnings ratio of 31.5x, it remains below the market average of 35.4x, suggesting relative value. Recent financials show healthy progress with nine-month sales reaching CNY 683.14 million and net income at CNY 162.89 million, reflecting consistent year-over-year improvement in profitability metrics like EPS from continuing operations at CNY 0.65.

- Get an in-depth perspective on Quick Intelligent EquipmentLtd's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Quick Intelligent EquipmentLtd is priced higher than what may be justified by its financials.

WG TECH (Jiang Xi) (SHSE:603773)

Simply Wall St Growth Rating: ★★★★★☆

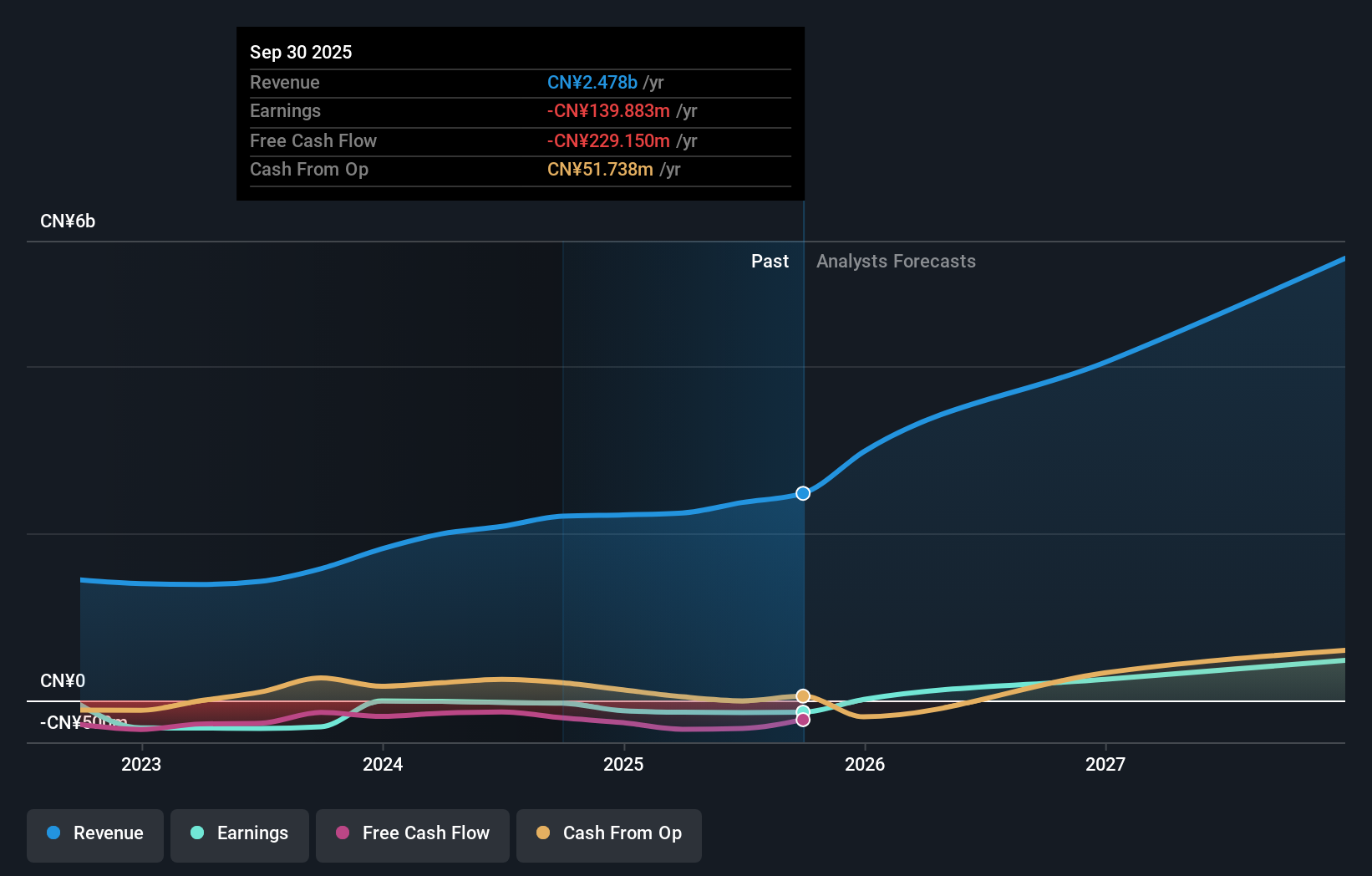

Overview: WG TECH (Jiang Xi) Co., Ltd. operates in the photoelectric glass finishing industry in China, with a market capitalization of approximately CN¥5.37 billion.

Operations: The company's revenue is primarily derived from its optoelectronics segment, which generated CN¥2.21 billion.

Insider Ownership: 34.3%

Revenue Growth Forecast: 34.6% p.a.

WG TECH (Jiang Xi) is positioned for significant growth, with revenue projected to increase at 34.6% annually, surpassing the broader CN market's growth rate. Despite current net losses and a volatile share price, the company is anticipated to become profitable within three years. Insider ownership changes include a private equity fund acquiring a 5.3% stake for CNY 281.43 million, highlighting investor confidence despite earnings challenges and low forecasted return on equity of 11.5%.

- Click to explore a detailed breakdown of our findings in WG TECH (Jiang Xi)'s earnings growth report.

- According our valuation report, there's an indication that WG TECH (Jiang Xi)'s share price might be on the cheaper side.

Beijing Relpow Technology (SZSE:300593)

Simply Wall St Growth Rating: ★★★★★☆

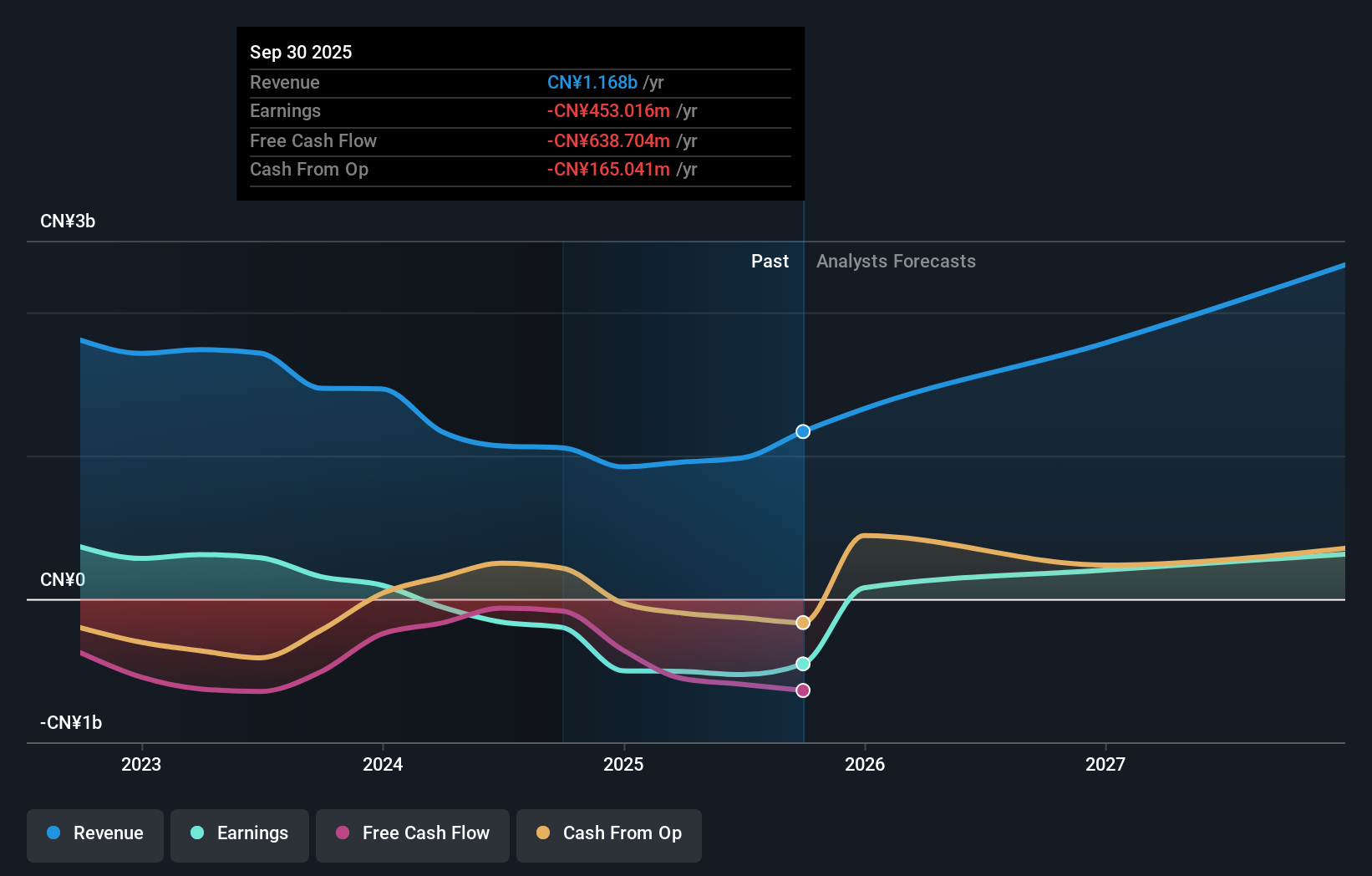

Overview: Beijing Relpow Technology Co., Ltd manufactures and sells power supply products both in China and internationally, with a market cap of CN¥6.72 billion.

Operations: I'm sorry, but the text you provided for the revenue segments is incomplete. If you can provide the missing information regarding the revenue segments, I'd be happy to help summarize it for you.

Insider Ownership: 31.2%

Revenue Growth Forecast: 32.5% p.a.

Beijing Relpow Technology is set for strong revenue growth at 32.5% annually, outpacing the CN market. Despite a current net loss of CNY 137.62 million and declining sales, the company is expected to become profitable within three years with earnings growth forecasted at over 100% per year. The recent completion of a share buyback totaling CNY 40.98 million underscores management's confidence amid low forecasted return on equity and an unsustainable dividend yield.

- Dive into the specifics of Beijing Relpow Technology here with our thorough growth forecast report.

- Our expertly prepared valuation report Beijing Relpow Technology implies its share price may be too high.

Turning Ideas Into Actions

- Explore the 1515 names from our Fast Growing Companies With High Insider Ownership screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Relpow Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300593

Beijing Relpow Technology

Manufactures and sells power supply products in China and internationally.

High growth potential with excellent balance sheet.