- China

- /

- Electronic Equipment and Components

- /

- SHSE:600552

High Growth Tech And 2 More Stocks With Promising Growth

Reviewed by Simply Wall St

As global markets experience broad-based gains with smaller-cap indexes outperforming large-caps, investors are keeping a keen eye on sectors poised for growth amid positive economic indicators like strong labor market and home sales reports. In this context, identifying high-growth tech stocks can be particularly promising, as they often thrive in environments where innovation drives demand and market sentiment is buoyed by robust economic data.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Triumph Science & TechnologyLtd (SHSE:600552)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Triumph Science & Technology Co., Ltd is involved in the development, production, and sale of electronic information display and new materials both in China and internationally, with a market cap of CN¥11.54 billion.

Operations: Triumph Science & Technology Co., Ltd focuses on electronic information display and new materials, serving both domestic and international markets. The company operates with a market capitalization of CN¥11.54 billion.

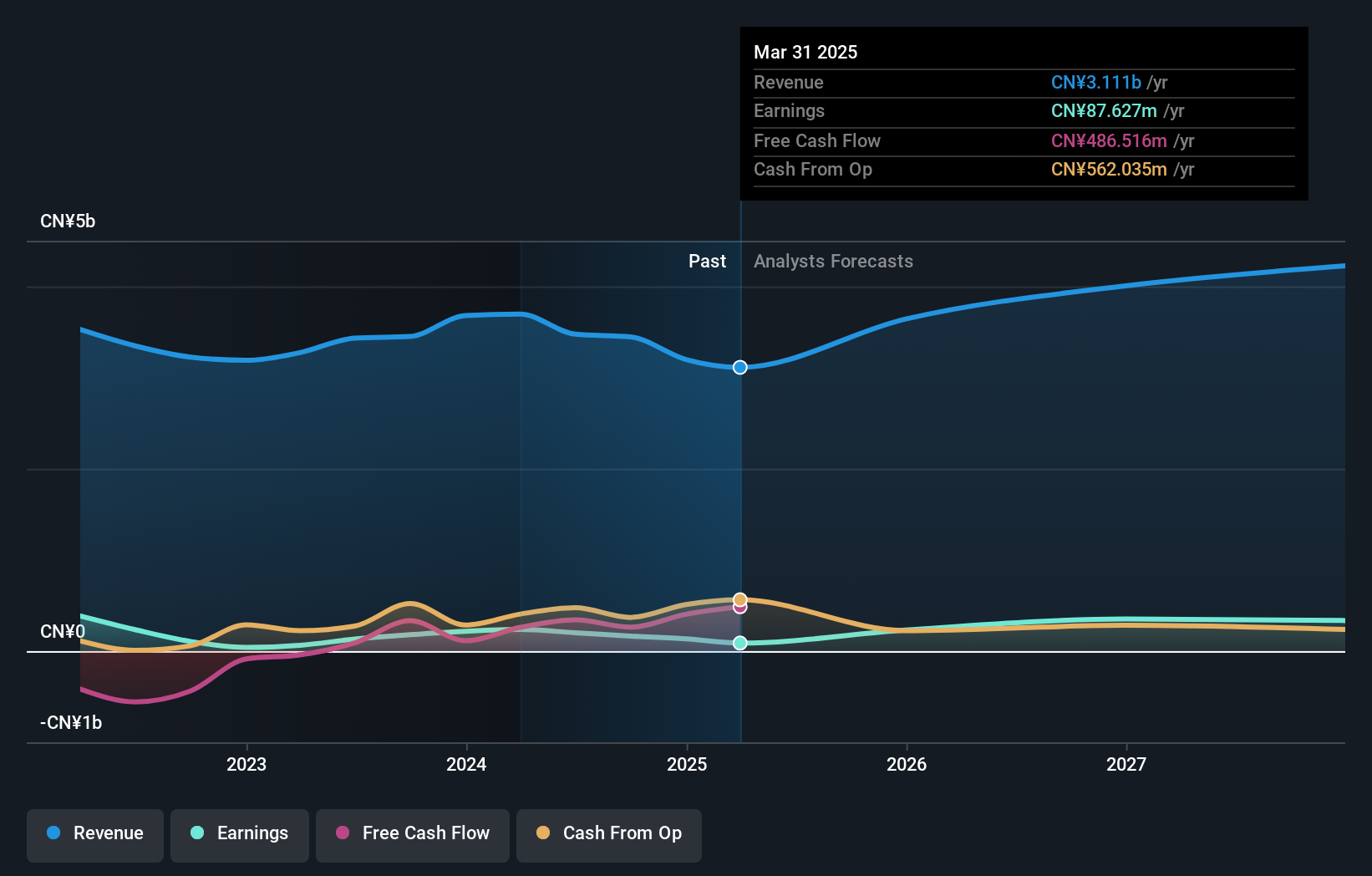

Triumph Science & TechnologyLtd's recent financial performance reveals a nuanced picture of growth and challenges. Despite a slight dip in revenue to CNY 3.57 billion from last year's CNY 3.78 billion, the company managed an increase in net income to CNY 111.84 million, up from CNY 96.07 million, indicating improved profitability and effective cost management strategies. The firm's commitment to innovation is underscored by its R&D efforts which are crucial for maintaining competitiveness in the fast-evolving tech landscape; however, specific figures on R&D spending were not disclosed this period. Looking ahead, Triumph is expected to see earnings grow by an impressive 42.2% annually over the next three years, outpacing both its past performance and broader market trends significantly, suggesting robust future prospects if it continues on this trajectory of enhancing operational efficiency and investing in technological advancements.

Shenzhen Fastprint Circuit TechLtd (SZSE:002436)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Fastprint Circuit Tech Co., Ltd. manufactures and sells printed circuit boards (PCBs) both in China and internationally, with a market capitalization of CN¥19.93 billion.

Operations: Fastprint Circuit Tech specializes in the production and distribution of printed circuit boards (PCBs) across domestic and international markets. The company's revenue is primarily derived from its PCB manufacturing operations, with a focus on both local and global clientele.

Shenzhen Fastprint Circuit TechLtd's recent financial performance highlights significant volatility, with a shift from a net income of CNY 190.46 million to a net loss of CNY 31.6 million year-over-year. Despite this setback, the company's revenue has grown to CNY 4,351.49 million, marking an increase from the previous year and outpacing average market growth rates by 17.5%. This suggests resilience in generating sales amidst challenges. The firm is navigating through its financial difficulties with strategic R&D investments aimed at future profitability; however, specifics on R&D spending remain under wraps within this period's reporting framework. As Shenzhen Fastprint aims for recovery and growth in a competitive tech landscape, its ability to innovate and adapt will be crucial for turning recent losses into long-term gains.

- Get an in-depth perspective on Shenzhen Fastprint Circuit TechLtd's performance by reading our health report here.

Understand Shenzhen Fastprint Circuit TechLtd's track record by examining our Past report.

Wuhan Raycus Fiber Laser TechnologiesLtd (SZSE:300747)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuhan Raycus Fiber Laser Technologies Co., Ltd. specializes in the development and production of fiber laser technologies, with a market cap of CN¥11.63 billion.

Operations: Raycus focuses on producing fiber laser technologies, generating revenue primarily from the sale of these laser products. The company's financial metrics indicate a notable trend in its gross profit margin, which has shown variability across recent periods.

Wuhan Raycus Fiber Laser Technologies Co., Ltd. has demonstrated a robust growth trajectory with its revenue forecast to expand by 19.3% annually, outpacing the CN market average of 13.8%. This performance is underpinned by significant R&D investments, which are crucial for maintaining technological leadership and competitiveness in the fiber laser sector. Notably, the company's earnings are expected to surge by 53.9% per year, reflecting its effective strategy and innovation focus despite recent dips in net income from CNY 172.25 million to CNY 120.01 million over the last nine months. These financial dynamics underscore Wuhan Raycus's potential in navigating market challenges while bolstering its position as a key player in high-tech laser technologies.

Seize The Opportunity

- Investigate our full lineup of 1289 High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triumph Science & TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600552

Triumph Science & TechnologyLtd

Engages in the development, production, and sale of electronic information display and new materials in China and internationally.

Reasonable growth potential with proven track record.