Stock Analysis

- China

- /

- Electrical

- /

- SZSE:300407

Investors who have held Tianjin Keyvia ElectricLtd (SZSE:300407) over the last year have watched its earnings decline along with their investment

Tianjin Keyvia Electric Co.,Ltd (SZSE:300407) shareholders should be happy to see the share price up 13% in the last week. In contrast, the stock is down for the year. But on the bright side, its return of 10%, is better than the market, which is down 0.1642116277.

On a more encouraging note the company has added CN¥302m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

See our latest analysis for Tianjin Keyvia ElectricLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

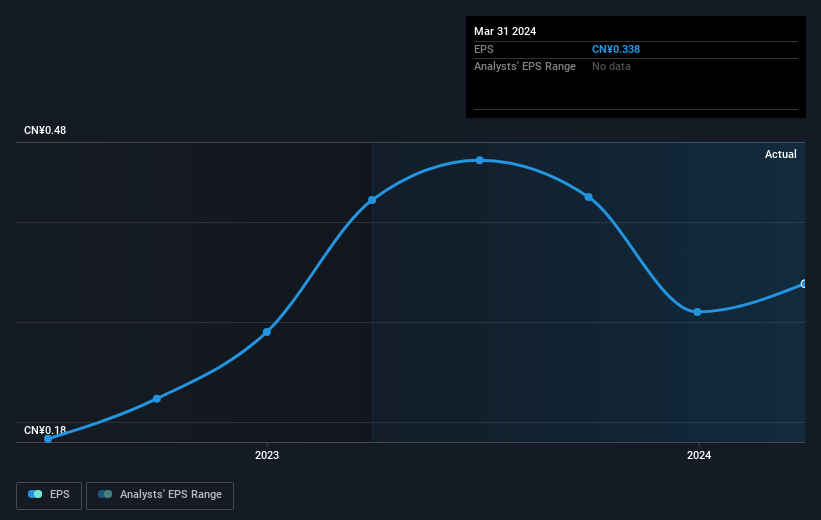

Unhappily, Tianjin Keyvia ElectricLtd had to report a 20% decline in EPS over the last year. This fall in the EPS is significantly worse than the 12% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Tianjin Keyvia ElectricLtd's key metrics by checking this interactive graph of Tianjin Keyvia ElectricLtd's earnings, revenue and cash flow.

A Different Perspective

Although it hurts that Tianjin Keyvia ElectricLtd returned a loss of 10% in the last twelve months, the broader market was actually worse, returning a loss of 16%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 0.1% over the last half decade. Whilst Baron Rothschild does tell the investor "buy when there's blood in the streets, even if the blood is your own", buyers would need to examine the data carefully to be comfortable that the business itself is sound. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Tianjin Keyvia ElectricLtd that you should be aware of before investing here.

We will like Tianjin Keyvia ElectricLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Tianjin Keyvia ElectricLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Tianjin Keyvia ElectricLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300407

Tianjin Keyvia ElectricLtd

Engages in the research and development, production, and sales of electrified railway and urban rail transit traction power supply systems in China.

Flawless balance sheet and good value.