- China

- /

- Electrical

- /

- SZSE:300286

AcrelLtd (SZSE:300286) Ticks All The Boxes When It Comes To Earnings Growth

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like AcrelLtd (SZSE:300286), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide AcrelLtd with the means to add long-term value to shareholders.

View our latest analysis for AcrelLtd

How Quickly Is AcrelLtd Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years AcrelLtd grew its EPS by 13% per year. That's a pretty good rate, if the company can sustain it.

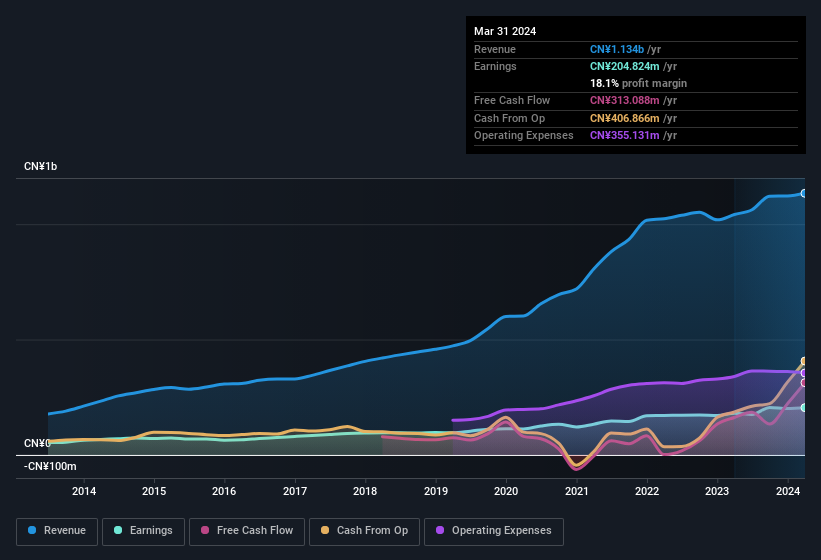

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note AcrelLtd achieved similar EBIT margins to last year, revenue grew by a solid 8.8% to CN¥1.1b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for AcrelLtd's future profits.

Are AcrelLtd Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So as you can imagine, the fact that AcrelLtd insiders own a significant number of shares certainly is appealing. In fact, they own 40% of the shares, making insiders a very influential shareholder group. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. at the current share price. That level of investment from insiders is nothing to sneeze at.

Should You Add AcrelLtd To Your Watchlist?

As previously touched on, AcrelLtd is a growing business, which is encouraging. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination definitely favoured by investors so consider keeping the company on a watchlist. Still, you should learn about the 1 warning sign we've spotted with AcrelLtd.

Although AcrelLtd certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300286

AcrelLtd

Researches, develops, produces, and sells equipment and systems required for energy efficiency management of medium and low voltage for enterprise microgrids in China.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives