Stock Analysis

3 High Insider Ownership Growth Companies On Chinese Exchange With Revenues Increasing By At Least 14%

Reviewed by Simply Wall St

As global markets navigate through varying economic signals, Chinese stocks have shown mixed responses, influenced by recent economic data that includes a decline in home prices and an uptick in retail sales. In this context, examining growth companies with high insider ownership on Chinese exchanges becomes particularly relevant, as these firms often demonstrate strong confidence from those most familiar with the company's prospects and challenges.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.5% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 39.1% |

| Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

| UTour Group (SZSE:002707) | 24% | 33.1% |

| Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

We'll examine a selection from our screener results.

Darbond Technology (SHSE:688035)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Darbond Technology Co., Ltd specializes in the research, development, production, and sale of polymer engineering and interface materials in China, with a market capitalization of approximately CN¥4.93 billion.

Operations: The company generates its revenue through the research, development, production, and sales of polymer engineering and interface materials in China.

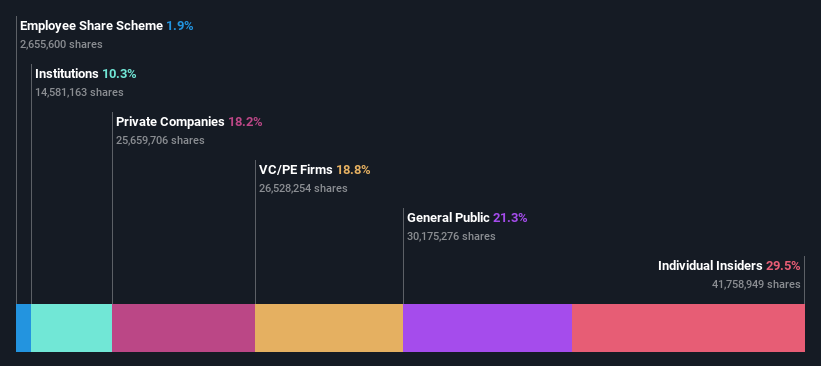

Insider Ownership: 29.5%

Revenue Growth Forecast: 18.9% p.a.

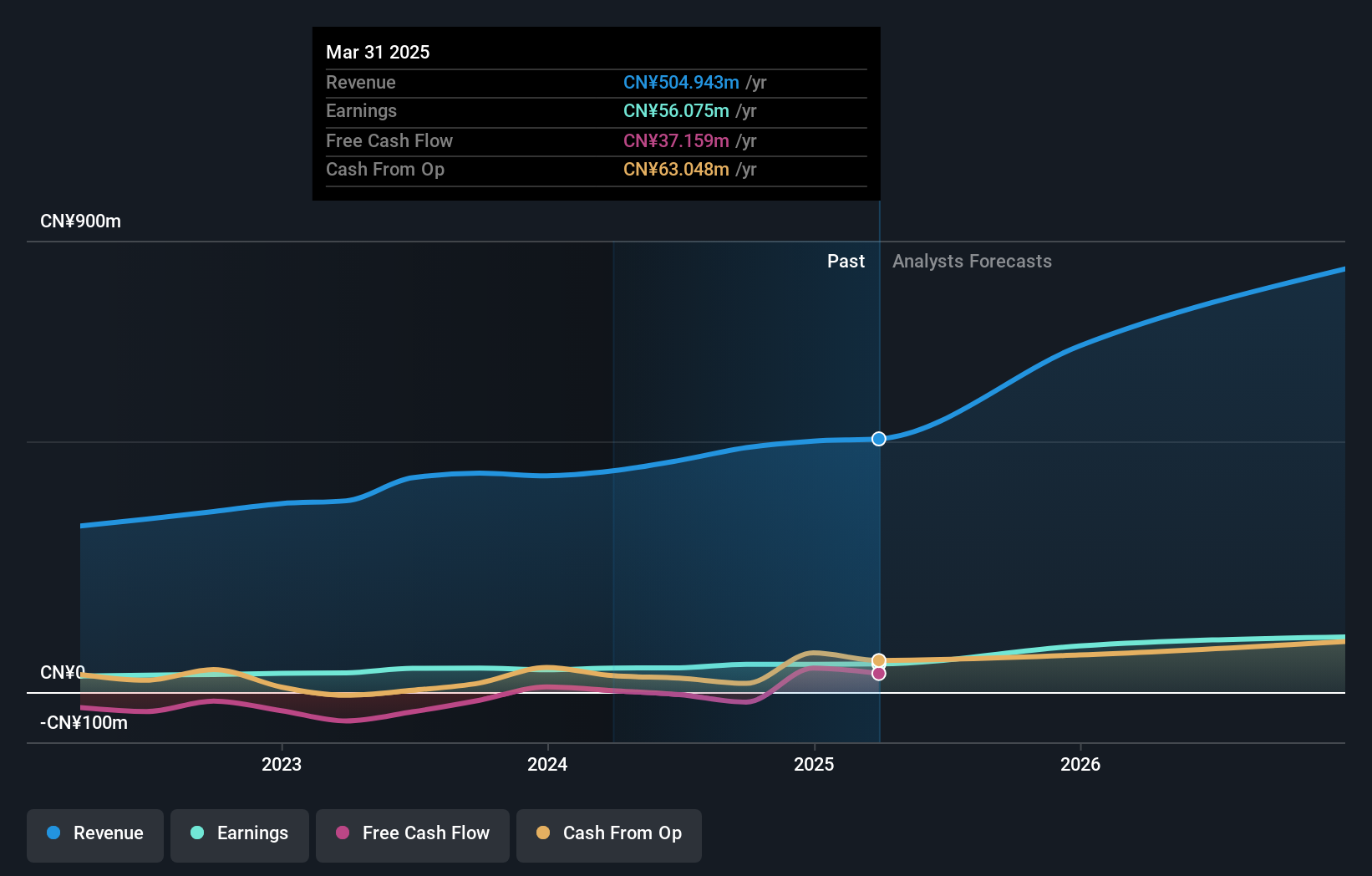

Darbond Technology, a growth-oriented firm with significant insider ownership, reported a decline in Q1 2024 net income to CNY 13.78 million from CNY 24.06 million year-over-year, despite increased revenues of CNY 203.14 million. The company actively repurchased shares worth CNY 41.64 million, signaling confidence by management. However, concerns arise as its dividend coverage remains weak and profit margins have dropped to 9.6%. Analysts anticipate robust earnings growth of approximately 41% annually over the next three years, outpacing broader market expectations.

- Delve into the full analysis future growth report here for a deeper understanding of Darbond Technology.

- In light of our recent valuation report, it seems possible that Darbond Technology is trading beyond its estimated value.

Chongqing Mas Sci.&Tech.Co.Ltd (SZSE:300275)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chongqing Mas Sci.&Tech.Co.,Ltd. specializes in providing safety technology equipment and safety information services in China, with a market capitalization of approximately CN¥3.13 billion.

Operations: The firm operates primarily in the provision of technology solutions and services for safety applications across various industries in China.

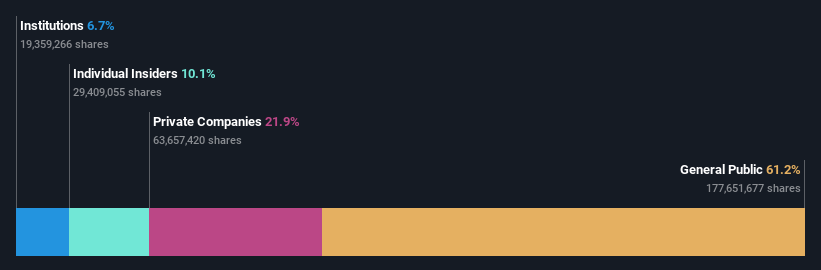

Insider Ownership: 21.9%

Revenue Growth Forecast: 27.7% p.a.

Chongqing Mas Sci.&Tech.Co.,Ltd. has demonstrated solid growth with a 24.6% increase in earnings over the past year, and revenues are expected to rise by 27.7% annually, outpacing the Chinese market forecast of 13.9%. Despite recent dividend reductions, the company's robust revenue and profit forecasts suggest strong future performance. However, its projected Return on Equity is relatively low at 12.1%, which could be a concern for potential growth sustainability.

- Unlock comprehensive insights into our analysis of Chongqing Mas Sci.&Tech.Co.Ltd stock in this growth report.

- The valuation report we've compiled suggests that Chongqing Mas Sci.&Tech.Co.Ltd's current price could be inflated.

GuoChuang SoftwareLtd (SZSE:300520)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GuoChuang Software Co., Ltd. is a global software company based in China, with a market capitalization of approximately CN¥5.12 billion.

Operations: The revenue segments for the company are not specified in the provided text.

Insider Ownership: 10.1%

Revenue Growth Forecast: 15% p.a.

GuoChuang Software Co.,Ltd. saw its Q1 earnings increase significantly, with net income rising to CNY 5.89 million from CNY 2.38 million year-over-year, despite a substantial drop in revenue to CNY 307.84 million from CNY 537.87 million. The company is expected to become profitable within three years, with earnings forecasted to grow by a very large percentage annually and revenue projected to grow at 15% per year, slightly above the market average of 13.9%. However, concerns include a low forecasted Return on Equity of only 5.3% and recent shareholder dilution.

- Navigate through the intricacies of GuoChuang SoftwareLtd with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that GuoChuang SoftwareLtd's share price might be on the expensive side.

Taking Advantage

- Click this link to deep-dive into the 363 companies within our Fast Growing Chinese Companies With High Insider Ownership screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Chongqing Mas Sci.&Tech.Co.Ltd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300275

Chongqing Mas Sci.&Tech.Co.Ltd

Provides safety technology equipment and safety information services in China.

High growth potential with proven track record.