Stock Analysis

- China

- /

- Electrical

- /

- SZSE:300001

Shareholders in Qingdao TGOOD Electric (SZSE:300001) are in the red if they invested three years ago

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Qingdao TGOOD Electric Co., Ltd. (SZSE:300001) shareholders have had that experience, with the share price dropping 32% in three years, versus a market decline of about 25%.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Qingdao TGOOD Electric

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate three years of share price decline, Qingdao TGOOD Electric actually saw its earnings per share (EPS) improve by 21% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

The modest 0.5% dividend yield is unlikely to be guiding the market view of the stock. We note that, in three years, revenue has actually grown at a 22% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Qingdao TGOOD Electric more closely, as sometimes stocks fall unfairly. This could present an opportunity.

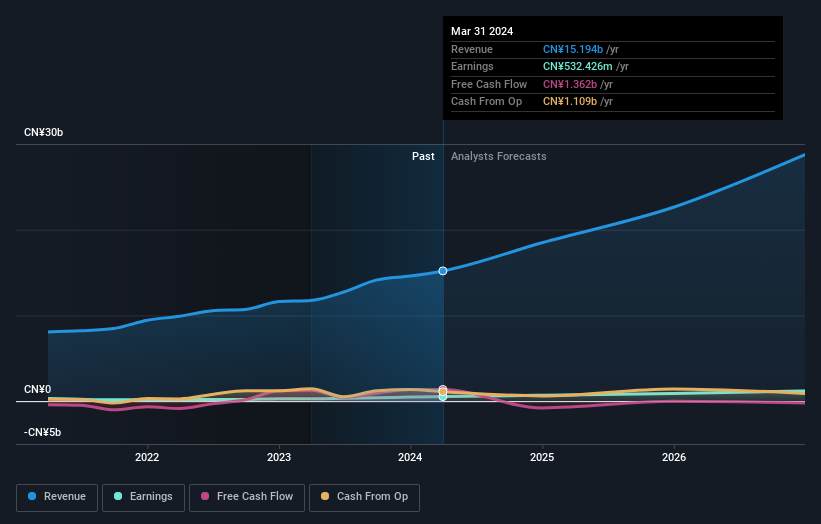

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Qingdao TGOOD Electric is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

While it's certainly disappointing to see that Qingdao TGOOD Electric shares lost 2.5% throughout the year, that wasn't as bad as the market loss of 16%. Given the total loss of 0.5% per year over five years, it seems returns have deteriorated in the last twelve months. Whilst Baron Rothschild does tell the investor "buy when there's blood in the streets, even if the blood is your own", buyers would need to examine the data carefully to be comfortable that the business itself is sound. Before deciding if you like the current share price, check how Qingdao TGOOD Electric scores on these 3 valuation metrics.

But note: Qingdao TGOOD Electric may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Qingdao TGOOD Electric is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Qingdao TGOOD Electric is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300001

Qingdao TGOOD Electric

Provides the electrical transmission and distribution solutions in China and internationally.

Flawless balance sheet with high growth potential.