Zhejiang Fenglong Electric (SZSE:002931 investor three-year losses grow to 33% as the stock sheds CN¥377m this past week

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Zhejiang Fenglong Electric Co., Ltd. (SZSE:002931) shareholders, since the share price is down 34% in the last three years, falling well short of the market decline of around 22%. Shareholders have had an even rougher run lately, with the share price down 32% in the last 90 days.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Zhejiang Fenglong Electric

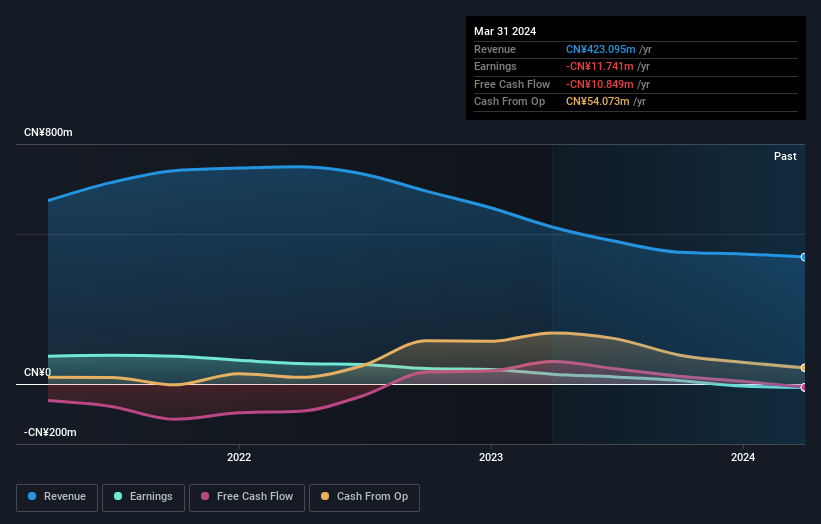

Given that Zhejiang Fenglong Electric didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last three years, Zhejiang Fenglong Electric's revenue dropped 17% per year. That means its revenue trend is very weak compared to other loss making companies. On the face of it we'd posit the share price fall of 10% compound, over three years is well justified by the fundamental deterioration. It would probably be worth asking whether the company can fund itself to profitability. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While it's never nice to take a loss, Zhejiang Fenglong Electric shareholders can take comfort that their trailing twelve month loss of 2.7% wasn't as bad as the market loss of around 10%. What is more upsetting is the 3% per annum loss investors have suffered over the last half decade. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 2 warning signs we've spotted with Zhejiang Fenglong Electric (including 1 which is potentially serious) .

We will like Zhejiang Fenglong Electric better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Fenglong Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002931

Zhejiang Fenglong Electric

Engages in the research and development, production, and sale of garden machinery engines and electric machines, hydraulic control systems, and auto parts.

Adequate balance sheet very low.