- China

- /

- Electrical

- /

- SZSE:002892

These 4 Measures Indicate That Keli Motor Group (SZSE:002892) Is Using Debt Reasonably Well

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Keli Motor Group Co., Ltd. (SZSE:002892) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Keli Motor Group

How Much Debt Does Keli Motor Group Carry?

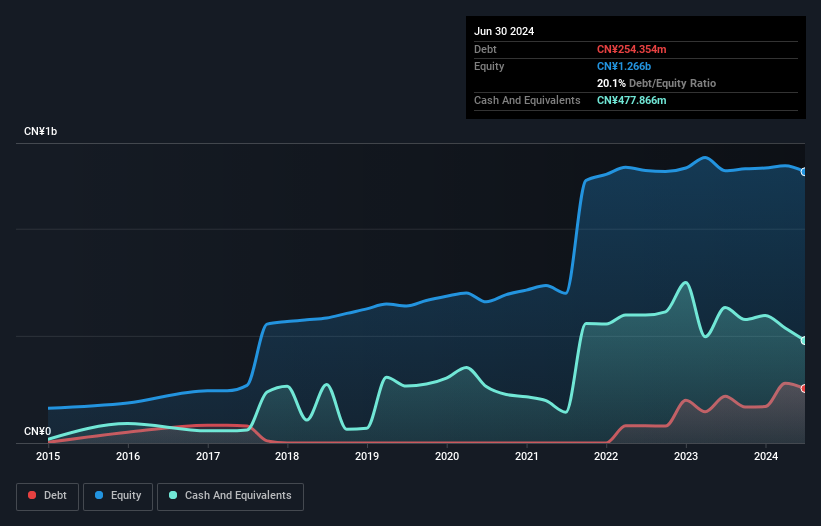

As you can see below, at the end of June 2024, Keli Motor Group had CN¥254.4m of debt, up from CN¥218.0m a year ago. Click the image for more detail. But it also has CN¥477.9m in cash to offset that, meaning it has CN¥223.5m net cash.

A Look At Keli Motor Group's Liabilities

Zooming in on the latest balance sheet data, we can see that Keli Motor Group had liabilities of CN¥611.6m due within 12 months and liabilities of CN¥228.6m due beyond that. On the other hand, it had cash of CN¥477.9m and CN¥478.9m worth of receivables due within a year. So it can boast CN¥116.6m more liquid assets than total liabilities.

Having regard to Keli Motor Group's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the CN¥6.92b company is struggling for cash, we still think it's worth monitoring its balance sheet. Succinctly put, Keli Motor Group boasts net cash, so it's fair to say it does not have a heavy debt load!

It is well worth noting that Keli Motor Group's EBIT shot up like bamboo after rain, gaining 54% in the last twelve months. That'll make it easier to manage its debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Keli Motor Group will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Keli Motor Group has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Keli Motor Group saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Keli Motor Group has net cash of CN¥223.5m, as well as more liquid assets than liabilities. And we liked the look of last year's 54% year-on-year EBIT growth. So we are not troubled with Keli Motor Group's debt use. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Keli Motor Group is showing 3 warning signs in our investment analysis , and 2 of those don't sit too well with us...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Keli Motor Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002892

Keli Motor Group

Engages in the research and development, manufacture, and sale of micro motors in China.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Industrialist of the Skies – Scaling with "Automotive DNA

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026