Stock Analysis

- China

- /

- Electrical

- /

- SZSE:002851

Exploring Undervalued Stocks On Chinese Exchanges With Intrinsic Discounts Ranging From 24.5% To 46.3%

Reviewed by Simply Wall St

Amidst a complex global landscape marked by heightened U.S.-China trade tensions and mixed economic signals, Chinese equities have shown resilience, with certain sectors demonstrating potential for significant value. In this environment, identifying undervalued stocks on Chinese exchanges could offer investors intrinsic discounts ranging from 24.5% to 46.3%, presenting opportunities for those looking to invest in assets that may be poised for recovery or growth as market conditions evolve.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.06 | CN¥28.08 | 46.4% |

| Shanghai Baolong Automotive (SHSE:603197) | CN¥29.61 | CN¥56.20 | 47.3% |

| Anhui Anli Material Technology (SZSE:300218) | CN¥14.20 | CN¥26.58 | 46.6% |

| Beijing Kawin Technology Share-Holding (SHSE:688687) | CN¥24.12 | CN¥45.85 | 47.4% |

| Jiangsu Hualan New Pharmaceutical MaterialLtd (SZSE:301093) | CN¥17.26 | CN¥32.56 | 47% |

| Thunder Software TechnologyLtd (SZSE:300496) | CN¥42.90 | CN¥84.11 | 49% |

| Guangdong Shenling Environmental Systems (SZSE:301018) | CN¥20.66 | CN¥38.48 | 46.3% |

| China Film (SHSE:600977) | CN¥10.22 | CN¥20.27 | 49.6% |

| Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥9.79 | CN¥18.84 | 48% |

| MGI Tech (SHSE:688114) | CN¥42.03 | CN¥77.56 | 45.8% |

Let's review some notable picks from our screened stocks.

Asian Star Anchor Chain Jiangsu (SHSE:601890)

Overview: Asian Star Anchor Chain Co., Ltd. Jiangsu operates globally in the production and sale of anchor chains, marine mooring chains, and related accessories, with a market capitalization of approximately CN¥6.75 billion.

Operations: The company generates revenue primarily from the production and sale of anchor chains and marine mooring chains, along with associated accessories.

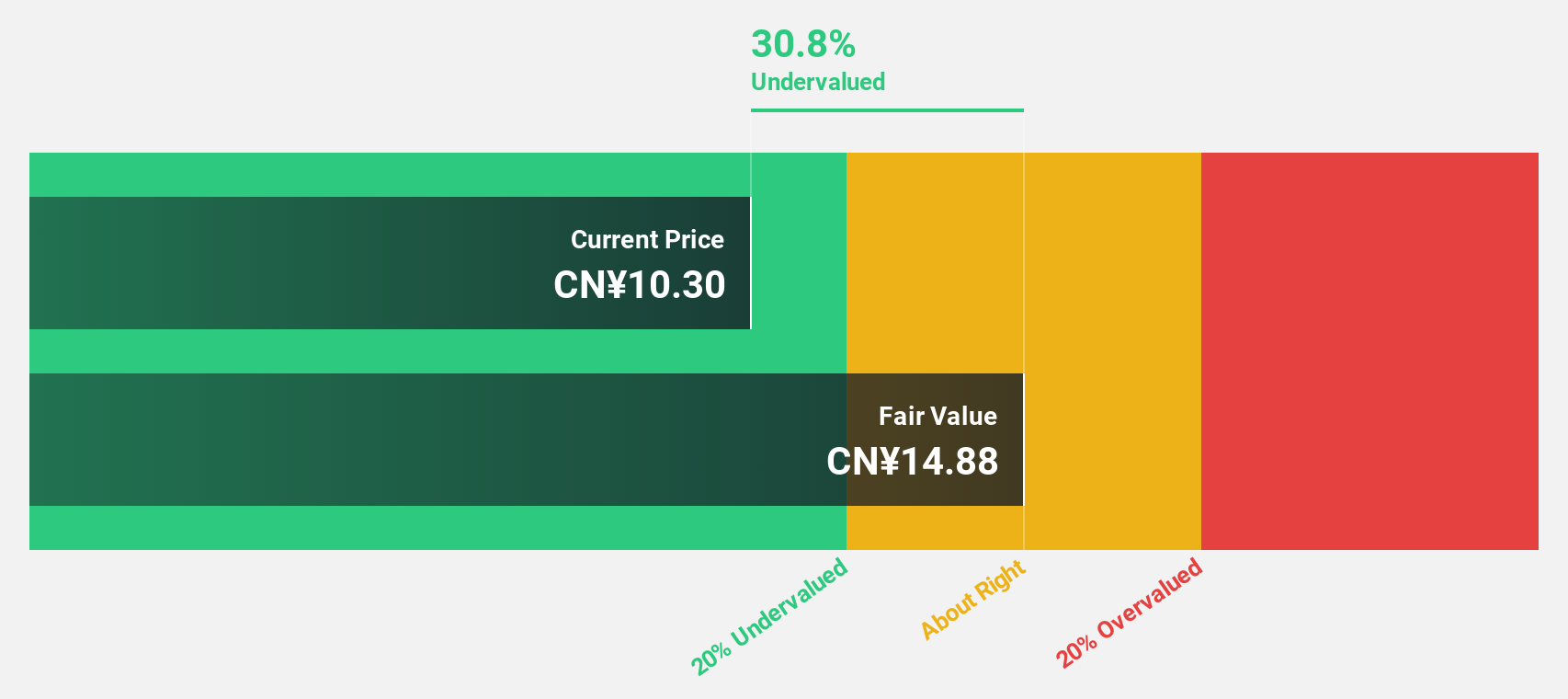

Estimated Discount To Fair Value: 24.5%

Asian Star Anchor Chain Jiangsu is currently trading at CN¥7.04, significantly below the estimated fair value of CN¥9.32, indicating a potential undervaluation of 24.5%. Despite a modest dividend yield of 1.49% not well covered by free cash flows, the company's earnings have increased by 35.3% over the past year and are expected to grow by 23.59% annually over the next three years, outpacing both its revenue growth and market averages in China.

- Insights from our recent growth report point to a promising forecast for Asian Star Anchor Chain Jiangsu's business outlook.

- Click to explore a detailed breakdown of our findings in Asian Star Anchor Chain Jiangsu's balance sheet health report.

Shenzhen Megmeet Electrical (SZSE:002851)

Overview: Shenzhen Megmeet Electrical Co., LTD, with a market cap of CN¥12.71 billion, specializes in the R&D, production, sales, and services of electrical automation solutions including hardware and software in China.

Operations: The company generates its revenue primarily from the development, production, and sale of electrical automation solutions involving both hardware and software.

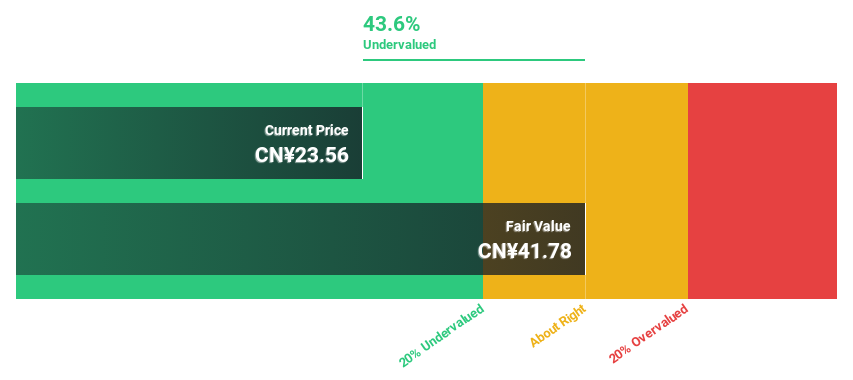

Estimated Discount To Fair Value: 29.9%

Shenzhen Megmeet Electrical, with a current trading price of CN¥25.42, appears undervalued against a fair value estimate of CN¥36.25, suggesting a potential discount exceeding 20%. Despite earnings growth of 8.3% last year and an expected annual increase of nearly 24%, the company's dividend yield at 0.86% is poorly supported by free cash flows. Recent consistent dividend payments highlight stability, yet the forecast for Return on Equity in three years remains modest at 16.7%.

- Our earnings growth report unveils the potential for significant increases in Shenzhen Megmeet Electrical's future results.

- Take a closer look at Shenzhen Megmeet Electrical's balance sheet health here in our report.

Guangdong Shenling Environmental Systems (SZSE:301018)

Overview: Guangdong Shenling Environmental Systems Co., Ltd. is a company specializing in the manufacturing of air conditioning systems with a market capitalization of approximately CN¥5.50 billion.

Operations: The revenue segments for the company are not specified in the provided text.

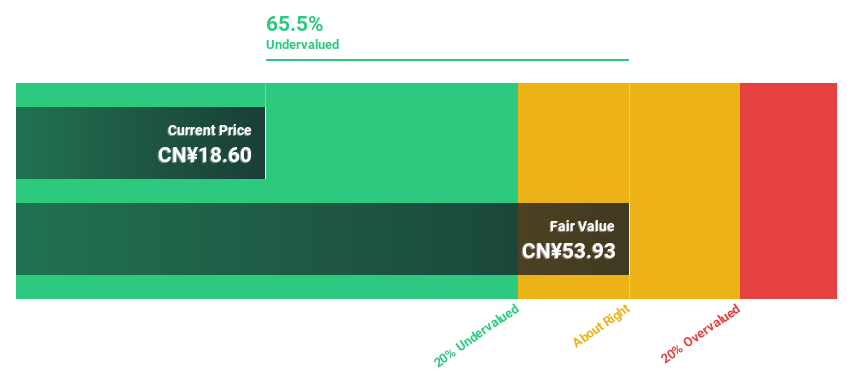

Estimated Discount To Fair Value: 46.3%

Guangdong Shenling Environmental Systems, priced at CN¥20.66, trades significantly below its estimated fair value of CN¥38.48, indicating a substantial undervaluation based on discounted cash flows. Although recent dividends have decreased to CNY 1.60 per 10 shares, earnings growth is robust at 45.18% annually, outpacing the Chinese market's 22.1%. However, with a low Return on Equity forecast of 13% and profit margins dropping from last year’s 7.6% to this year's 4.5%, financial efficiency concerns persist.

- Our comprehensive growth report raises the possibility that Guangdong Shenling Environmental Systems is poised for substantial financial growth.

- Navigate through the intricacies of Guangdong Shenling Environmental Systems with our comprehensive financial health report here.

Summing It All Up

- Navigate through the entire inventory of 99 Undervalued Chinese Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002851

Shenzhen Megmeet Electrical

Engages in the research and development, production, sales, and services of hardware, software, and system solutions for electrical automation in China.

Undervalued with high growth potential.