- China

- /

- Auto Components

- /

- SZSE:002662

Undiscovered Gems These 3 Small Caps Show Strong Potential

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, small-cap stocks have demonstrated resilience, holding up better than their large-cap counterparts amidst broader market fluctuations. As investors navigate these uncertain times, identifying promising small-cap opportunities can be crucial, especially those that exhibit strong fundamentals and potential for growth despite the prevailing economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al Wathba National Insurance Company PJSC | 14.56% | 13.48% | 31.31% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Beijing WKW Automotive PartsLtd (SZSE:002662)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing WKW Automotive Parts Co., Ltd. specializes in the production and sale of automotive interior and exterior trim systems within China, with a market capitalization of CN¥5.18 billion.

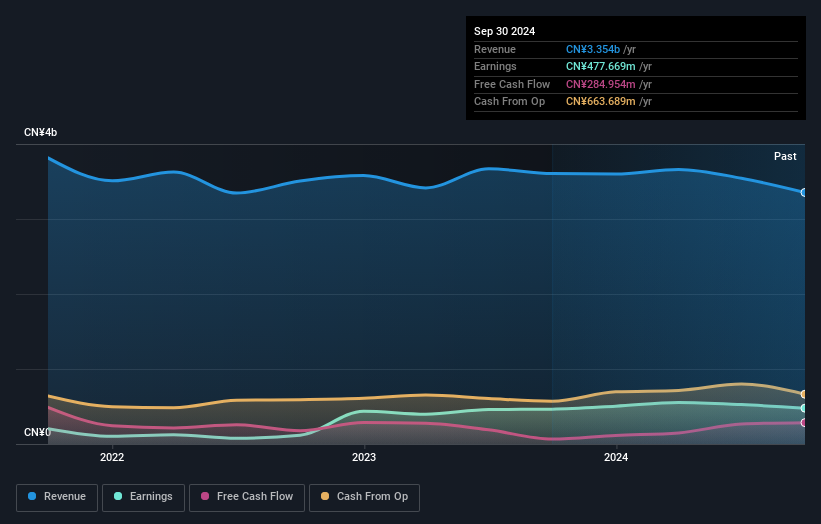

Operations: The company generates revenue primarily from the sale of automotive interior and exterior trim systems. It experienced a net profit margin fluctuation, with figures ranging between 3% and 5% over recent periods.

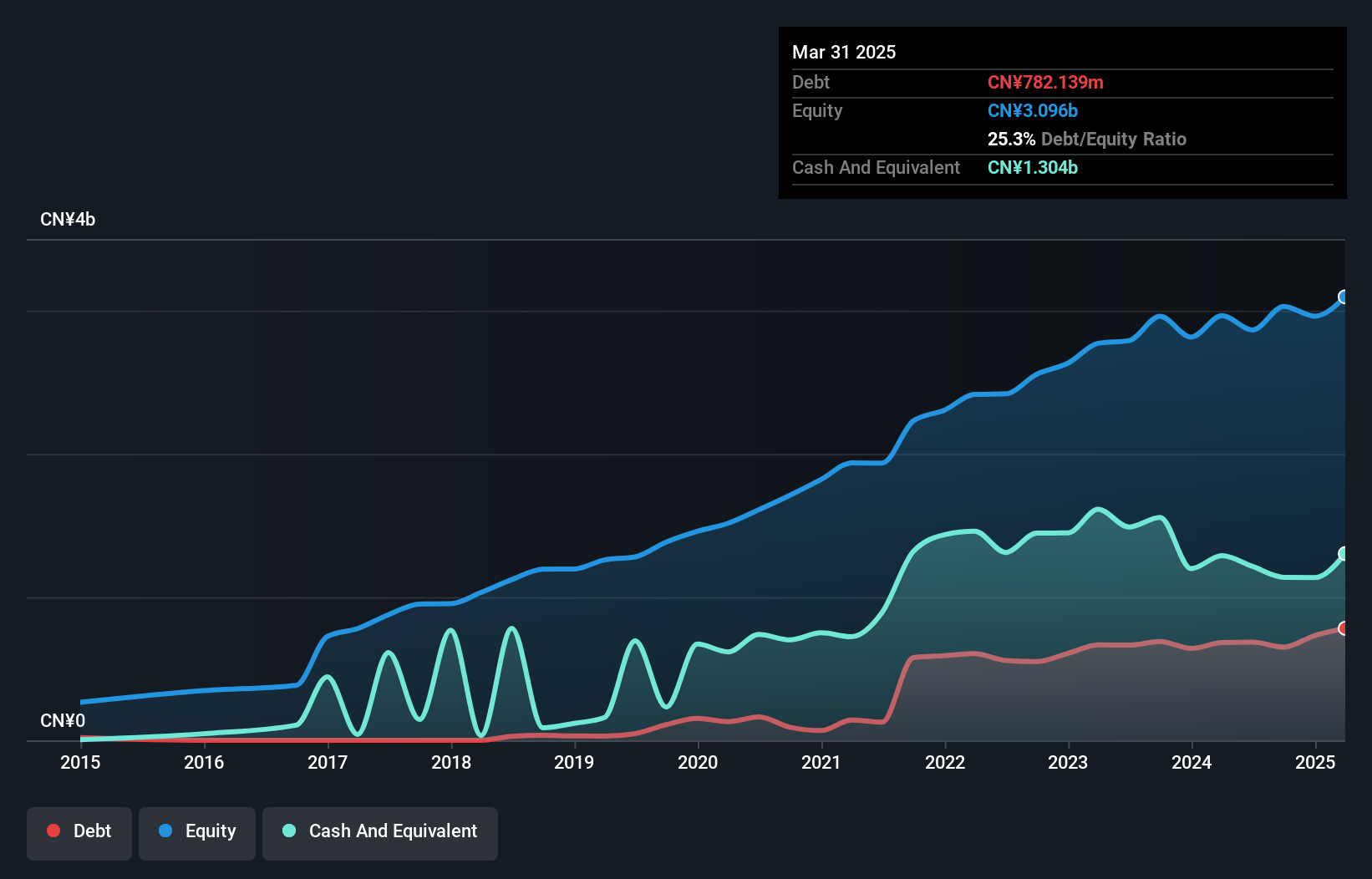

Beijing WKW Automotive Parts, a smaller player in the auto parts industry, has shown resilience despite some recent challenges. Its earnings have grown an impressive 72.9% annually over the past five years, indicating robust performance. The company's debt-to-equity ratio has improved significantly from 32.3% to 14%, reflecting prudent financial management. However, recent earnings for the nine months ended September 2024 saw sales of CNY 2.37 billion compared to CNY 2.62 billion a year ago, with net income at CNY 322 million down from CNY 348 million last year. Despite these figures, it trades at about 28% below its estimated fair value and maintains high-quality earnings with interest comfortably covered by profits.

Guangzhou KDT MachineryLtd (SZSE:002833)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangzhou KDT Machinery Co., Ltd. specializes in the production and sale of special equipment for furniture machinery primarily in China, with a market capitalization of CN¥7.51 billion.

Operations: KDT Machinery generates revenue primarily from the sale of special equipment for furniture machinery in China. The company's net profit margin has shown variability, reflecting changes in cost structures and pricing strategies over time.

Guangzhou KDT Machinery, a smaller player in the machinery sector, shows a mixed financial landscape. Over the past year, earnings grew by 3.4%, outpacing the industry average of -0.4%. The company's debt to equity ratio has risen from 7.9% to 21.5% over five years, yet it holds more cash than total debt, indicating manageable leverage levels. Trading at a price-to-earnings ratio of 13x suggests good value compared to China's market average of 34x. Recent earnings for nine months ending September show sales at CNY 2.17 billion but net income slightly decreased to CNY 455 million from CNY 479 million last year, reflecting stable yet cautious growth dynamics amidst dividend reductions and strategic adjustments in convertible bonds pricing.

- Click here and access our complete health analysis report to understand the dynamics of Guangzhou KDT MachineryLtd.

Understand Guangzhou KDT MachineryLtd's track record by examining our Past report.

Bunka Shutter (TSE:5930)

Simply Wall St Value Rating: ★★★★★★

Overview: Bunka Shutter Co., Ltd. is a Japanese company that specializes in the manufacturing and sale of shutters and construction materials, with a market capitalization of ¥135.72 billion.

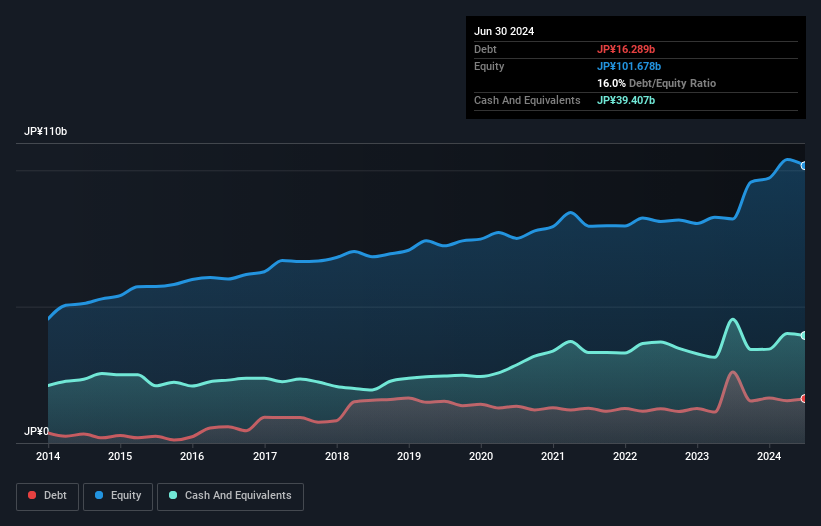

Operations: Bunka Shutter generates revenue primarily from its Shutter Business and Construction-Related Materials Business, contributing ¥96.93 billion and ¥87.30 billion, respectively. The Service Business adds an additional ¥30.43 billion in revenue, while the Refurbishment Business contributes ¥6.04 billion.

Bunka Shutter, a small player in the building industry, is making waves with its impressive financial performance. The company boasts high-quality earnings and trades at 38.1% below its estimated fair value, presenting an attractive valuation for investors. Over the past year, earnings surged by 28.8%, outpacing the industry's growth of 16%. With interest payments well-covered by EBIT at a robust 217x and a debt-to-equity ratio reduced from 21% to 16% over five years, Bunka Shutter's financial health seems solid. Despite shareholder dilution last year, profitability ensures that cash runway concerns are minimal for this promising entity.

Make It Happen

- Click this link to deep-dive into the 4731 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing WKW Automotive PartsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002662

Beijing WKW Automotive PartsLtd

Manufactures and sells automotive interior and exterior trim systems in China.

Flawless balance sheet, good value and pays a dividend.