- China

- /

- Construction

- /

- SZSE:002822

Shenzhen Zhongzhuang Construction Group Co.,Ltd (SZSE:002822) Looks Inexpensive After Falling 29% But Perhaps Not Attractive Enough

To the annoyance of some shareholders, Shenzhen Zhongzhuang Construction Group Co.,Ltd (SZSE:002822) shares are down a considerable 29% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 71% loss during that time.

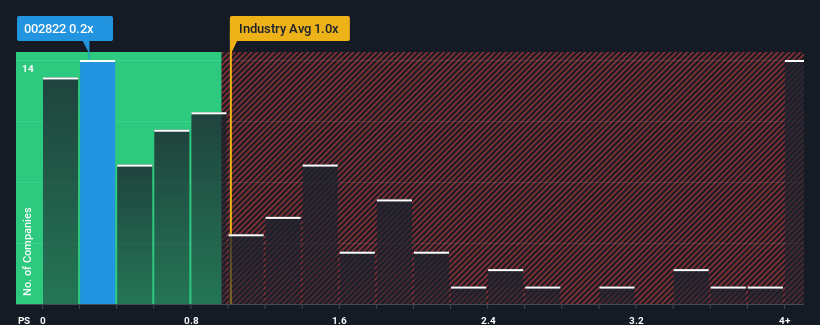

Since its price has dipped substantially, given about half the companies operating in China's Construction industry have price-to-sales ratios (or "P/S") above 1x, you may consider Shenzhen Zhongzhuang Construction GroupLtd as an attractive investment with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Shenzhen Zhongzhuang Construction GroupLtd

How Has Shenzhen Zhongzhuang Construction GroupLtd Performed Recently?

As an illustration, revenue has deteriorated at Shenzhen Zhongzhuang Construction GroupLtd over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shenzhen Zhongzhuang Construction GroupLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Shenzhen Zhongzhuang Construction GroupLtd's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 28%. The last three years don't look nice either as the company has shrunk revenue by 40% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 15% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that Shenzhen Zhongzhuang Construction GroupLtd is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Shenzhen Zhongzhuang Construction GroupLtd's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Shenzhen Zhongzhuang Construction GroupLtd revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Shenzhen Zhongzhuang Construction GroupLtd (2 can't be ignored!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002822

Shenzhen Zhongzhuang Construction GroupLtd

Engages in architectural decoration construction and design services in China.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives