- China

- /

- Construction

- /

- SZSE:002811

Shenzhen Cheng Chung Design Co., Ltd. (SZSE:002811) Shares May Have Slumped 30% But Getting In Cheap Is Still Unlikely

To the annoyance of some shareholders, Shenzhen Cheng Chung Design Co., Ltd. (SZSE:002811) shares are down a considerable 30% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 26% in that time.

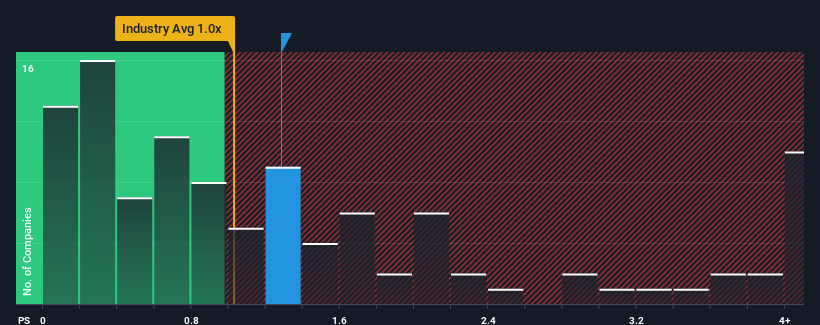

In spite of the heavy fall in price, it's still not a stretch to say that Shenzhen Cheng Chung Design's price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" compared to the Construction industry in China, where the median P/S ratio is around 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Shenzhen Cheng Chung Design

How Shenzhen Cheng Chung Design Has Been Performing

For instance, Shenzhen Cheng Chung Design's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Shenzhen Cheng Chung Design, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Shenzhen Cheng Chung Design's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 7.7% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 47% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 15% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's somewhat alarming that Shenzhen Cheng Chung Design's P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Shenzhen Cheng Chung Design's P/S

Following Shenzhen Cheng Chung Design's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We find it unexpected that Shenzhen Cheng Chung Design trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Shenzhen Cheng Chung Design (1 doesn't sit too well with us) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002811

Shenzhen Cheng Chung Design

Provides decoration design, consulting, and construction services in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success