Wuxi Huadong Heavy Machinery (SZSE:002685) delivers shareholders notable 24% CAGR over 3 years, surging 5.5% in the last week alone

Wuxi Huadong Heavy Machinery Co., Ltd. (SZSE:002685) shareholders have seen the share price descend 23% over the month. But that shouldn't obscure the pleasing returns achieved by shareholders over the last three years. After all, the share price is up a market-beating 90% in that time.

Since the stock has added CN¥373m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Wuxi Huadong Heavy Machinery

Wuxi Huadong Heavy Machinery wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

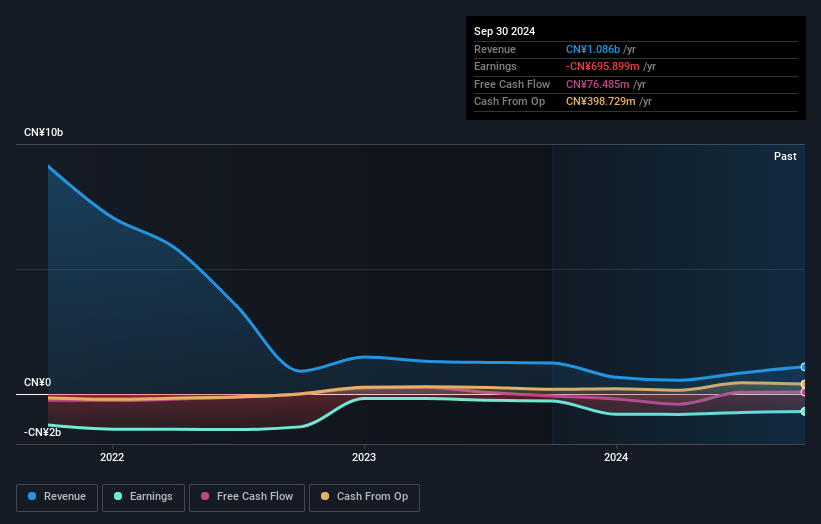

Wuxi Huadong Heavy Machinery actually saw its revenue drop by 89% per year over three years. Despite the lack of revenue growth, the stock has returned 24%, compound, over three years. Unless the company is going to make profits soon, we would be pretty cautious about it.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Wuxi Huadong Heavy Machinery's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Wuxi Huadong Heavy Machinery shareholders have received a total shareholder return of 90% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 0.4% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Wuxi Huadong Heavy Machinery you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Huadong Heavy Machinery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002685

Wuxi Huadong Heavy Machinery

Manufactures and sells container handling equipment and intelligent CNC machine tools in the People's Republic of China.

Flawless balance sheet and fair value.