As global markets continue to reach new heights, with the Russell 2000 Index hitting record intraday highs, small-cap stocks are capturing attention amid a backdrop of robust consumer spending and geopolitical developments. In this dynamic environment, identifying stocks with strong fundamentals becomes crucial for investors seeking opportunities that may not yet be widely recognized.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.72% | -3.47% | -13.16% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Hsino Tower Group (SHSE:601096)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hsino Tower Group Co., Ltd. is involved in construction engineering design activities and has a market capitalization of CN¥12.28 billion.

Operations: Hsino Tower primarily generates revenue from its heavy construction segment, amounting to CN¥10.29 billion.

Hsino Tower Group, a noteworthy player in its sector, has demonstrated strong financial performance with earnings growing by 70% over the past year. Trading at 37% below estimated fair value, it offers potential value for investors. The company reported sales of CNY 7.58 billion for the first nine months of 2024, up from CNY 6.58 billion last year, and net income rose to CNY 178 million from CNY 89 million. With EBIT covering interest payments by an impressive factor of 107x and having more cash than total debt, Hsino Tower seems well-positioned financially despite a historical decline in earnings over five years.

Damon Technology GroupLtd (SHSE:688360)

Simply Wall St Value Rating: ★★★★★☆

Overview: Damon Technology Group Ltd. engages in the research, development, manufacturing, sales, and servicing of automated logistics solutions both in China and internationally, with a market capitalization of approximately CN¥3.57 billion.

Operations: Damon Technology Group Ltd. generates revenue primarily from the high-end equipment manufacturing industry, amounting to CN¥1.57 billion.

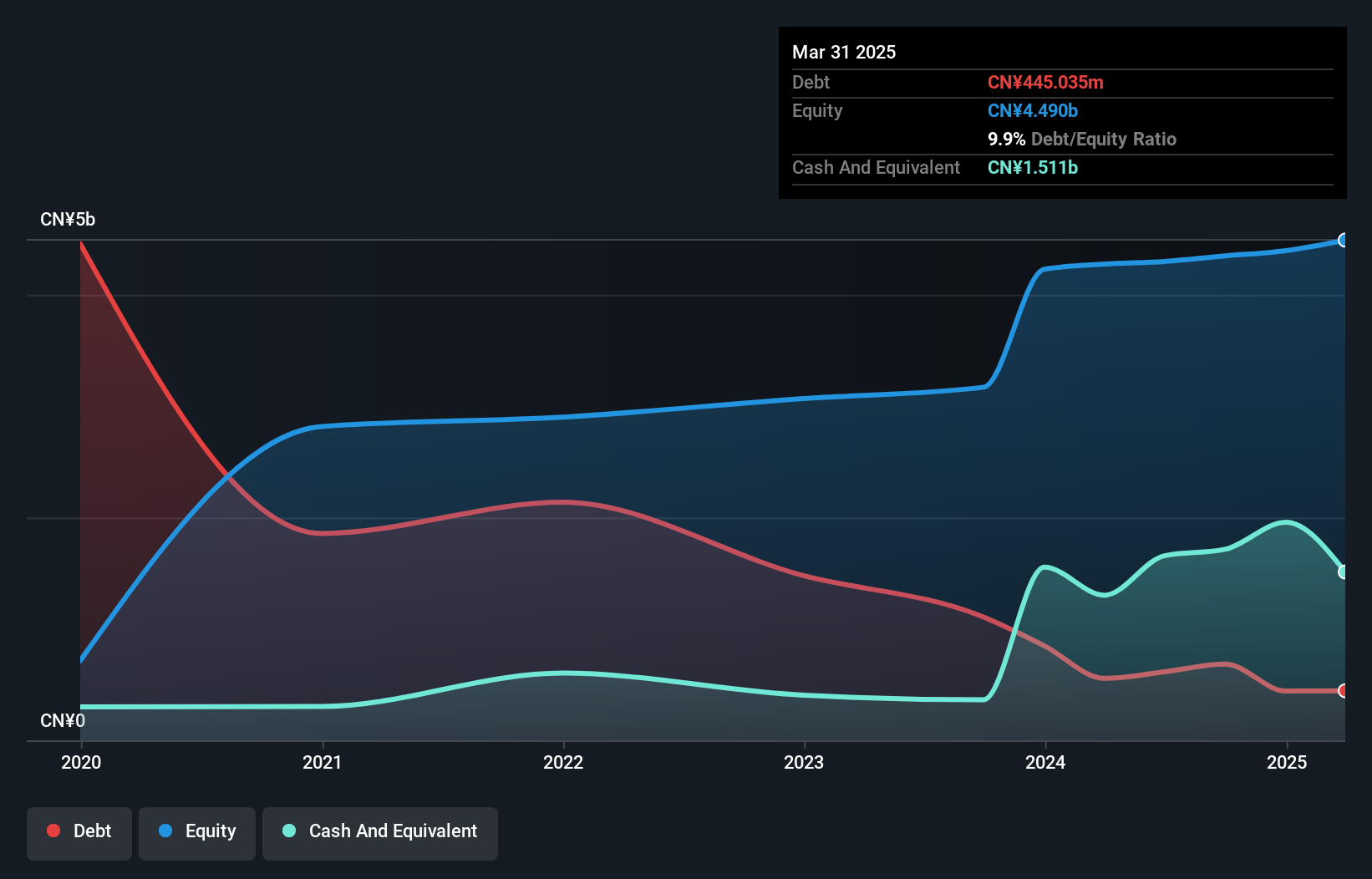

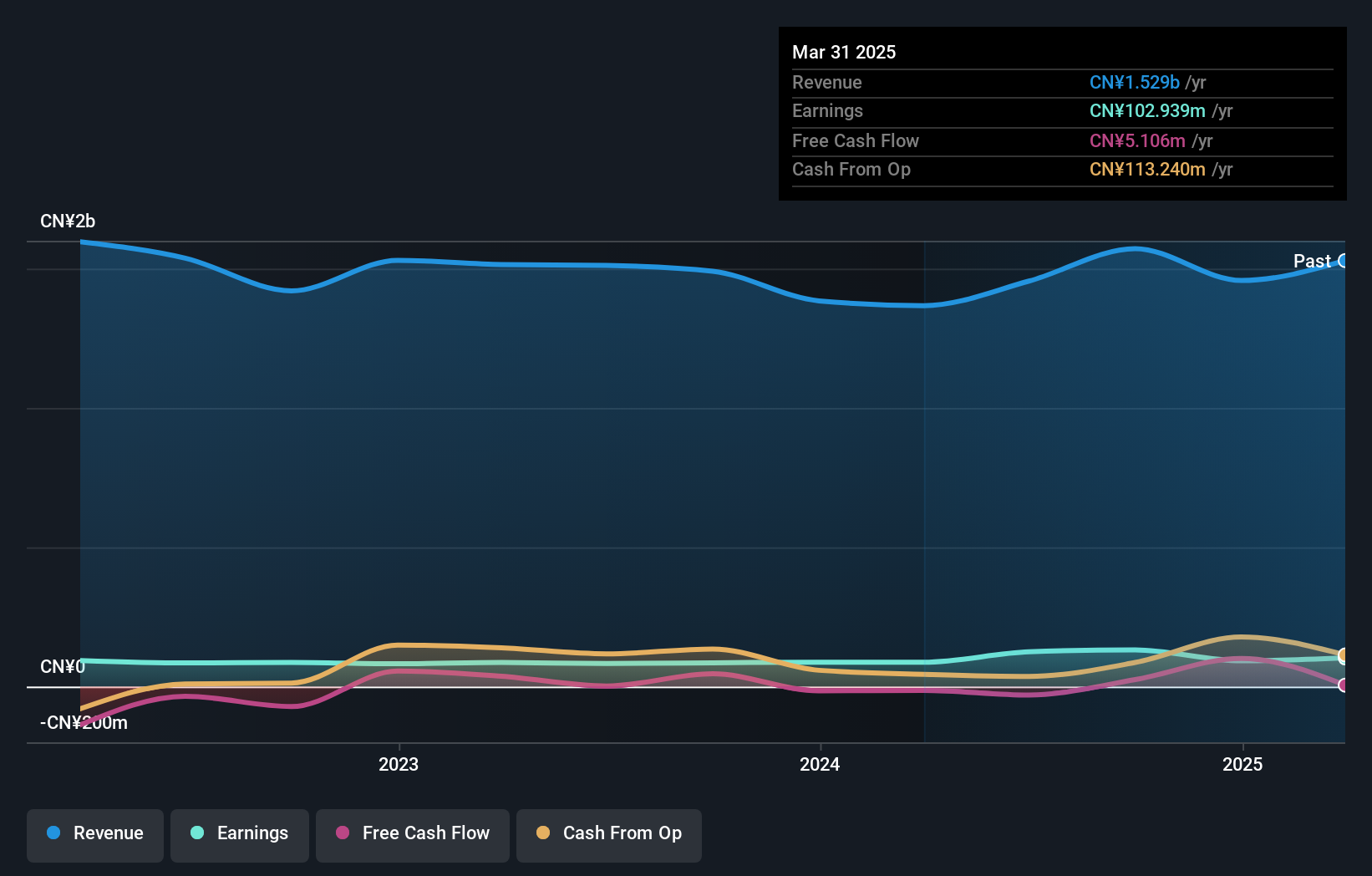

Damon Technology Group, a nimble player in its sector, reported impressive earnings growth of 54.8% over the past year, outperforming the broader Machinery industry. With a price-to-earnings ratio of 27.1x, it presents better value compared to the CN market average of 36.9x. Despite a rise in its debt-to-equity ratio from 17.1% to 18.9% over five years, Damon boasts more cash than total debt and strong interest coverage at 187.8x EBIT, indicating robust financial health. The recent results include a one-off gain of CN¥38M impacting financials but still reflect solid underlying performance with net income hitting CN¥116M for nine months ending September 2024.

Xinlei Compressor (SZSE:301317)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xinlei Compressor Co., Ltd. is involved in the research, development, manufacture, and sale of air compressors and blowers in China with a market cap of CN¥3.55 billion.

Operations: Xinlei Compressor generates revenue primarily from the Machinery & Industrial Equipment segment, amounting to CN¥1.01 billion.

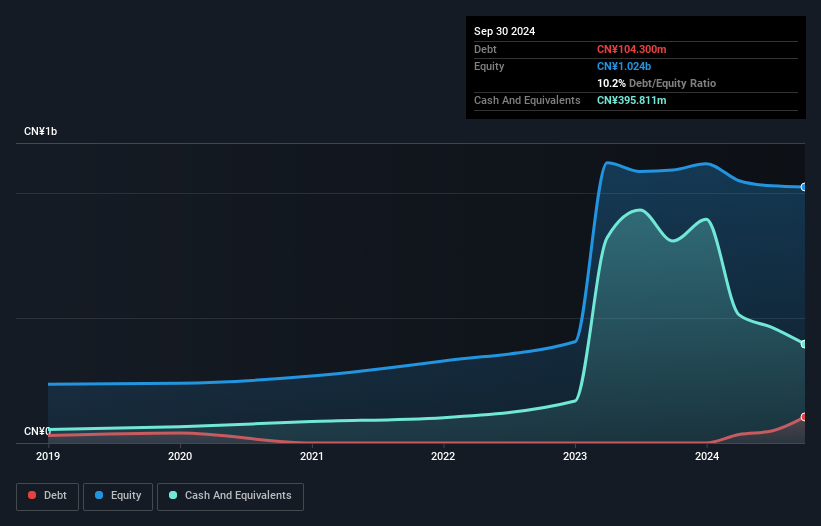

Xinlei Compressor, a notable player in the machinery sector, has shown promising growth with earnings increasing by 12.2% over the past year, outpacing the industry average of -0.4%. Despite this progress, its net profit margin dipped to 6.1% from last year's 9%. The company boasts a healthy balance sheet with more cash than total debt and has successfully reduced its debt-to-equity ratio from 15.8% to 10.2% over five years. Recent results reveal sales of CNY 660 million for nine months ending September 2024, up from CNY 425 million year-on-year, though net income remained stable at CNY 35.69 million.

- Get an in-depth perspective on Xinlei Compressor's performance by reading our health report here.

Examine Xinlei Compressor's past performance report to understand how it has performed in the past.

Make It Happen

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4642 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688360

Damon Technology GroupLtd

Research, develops, manufactures, sells, and services automated logistics solutions in China and internationally.

Excellent balance sheet with proven track record.