Global Penny Stocks Spotlight: NanJi E-Commerce And Two Other Picks

Reviewed by Simply Wall St

As global markets react to U.S. inflation data and interest rate cut speculation, investors are keeping a close watch on economic indicators that could influence future monetary policy decisions. In this climate, penny stocks—often smaller or newer companies—remain an intriguing area for those willing to look beyond the well-known names. While the term "penny stocks" might seem outdated, these investments can still offer compelling opportunities when backed by strong financial health and balance sheet resilience.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Cloudpoint Technology Berhad (KLSE:CLOUDPT) | MYR0.70 | MYR372.12M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.63 | HK$1.01B | ✅ 4 ⚠️ 1 View Analysis > |

| GTN (ASX:GTN) | A$0.39 | A$75.31M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.61 | HK$2.21B | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.625 | SGD253.31M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.83 | SGD11.14B | ✅ 5 ⚠️ 1 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR0.875 | MYR6.73B | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.17 | £185.96M | ✅ 4 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.946 | €31.9M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,780 stocks from our Global Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

NanJi E-Commerce (SZSE:002127)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NanJi E-Commerce Co., LTD operates in China, offering brand licensing and comprehensive mobile Internet marketing services, with a market cap of CN¥8.79 billion.

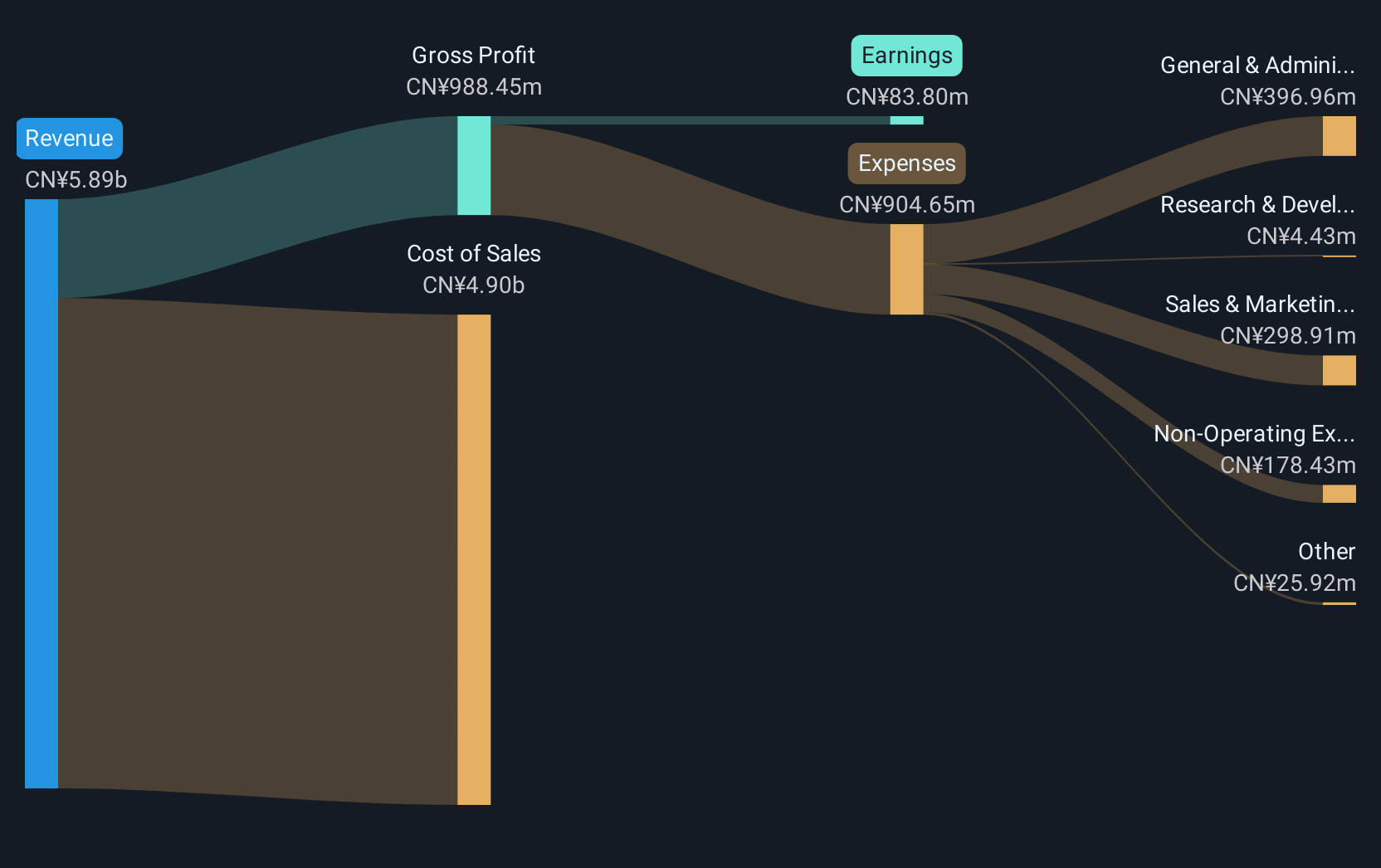

Operations: The company generates revenue of CN¥3.37 billion from its operations in China.

Market Cap: CN¥8.79B

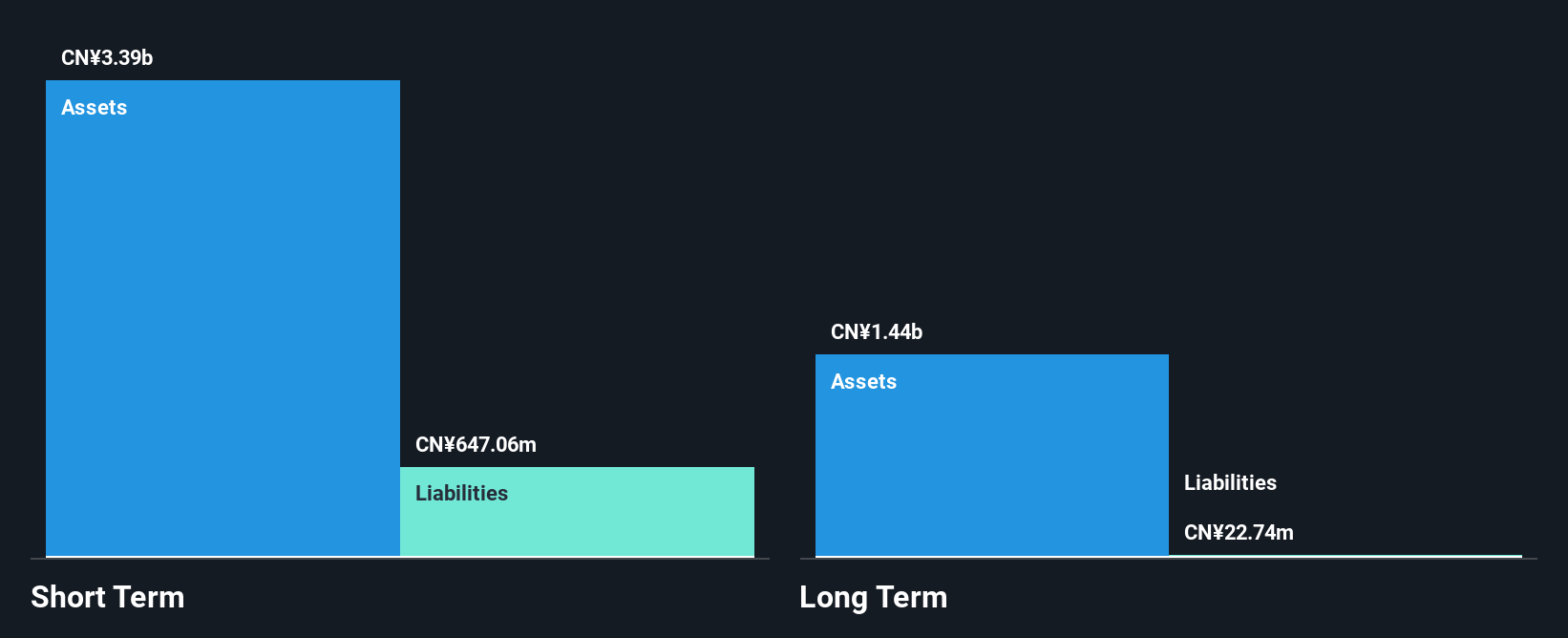

NanJi E-Commerce Co., LTD, with a market cap of CN¥8.79 billion and revenue of CN¥3.37 billion, operates without debt, which is advantageous for financial stability. The company’s short-term assets significantly exceed both its short and long-term liabilities, indicating solid liquidity management. However, it remains unprofitable with increasing losses over the past five years and a negative return on equity of -7.18%. Despite this, earnings are forecast to grow substantially at 74.54% annually. Recent amendments to the company's articles suggest strategic shifts while dividends remain inadequately covered by earnings or free cash flows.

- Click to explore a detailed breakdown of our findings in NanJi E-Commerce's financial health report.

- Review our growth performance report to gain insights into NanJi E-Commerce's future.

Guizhou Xinbang Pharmaceutical (SZSE:002390)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guizhou Xinbang Pharmaceutical Co., Ltd. is engaged in the research, development, manufacturing, and sale of Chinese herbal medicines and other pharmaceutical products both domestically and internationally, with a market cap of CN¥7.13 billion.

Operations: No specific revenue segments have been reported for the company.

Market Cap: CN¥7.13B

Guizhou Xinbang Pharmaceutical, with a market cap of CN¥7.13 billion, shows financial resilience despite challenges. The company has experienced negative earnings growth over the past year and five years, impacted by a significant one-off loss of CN¥65.5 million. However, it maintains strong liquidity with short-term assets exceeding both short and long-term liabilities and more cash than debt. The management team is seasoned with an average tenure of 10.3 years, although the board lacks experience at 1.9 years on average. Trading below estimated fair value offers potential appeal despite low return on equity and declining profit margins.

- Navigate through the intricacies of Guizhou Xinbang Pharmaceutical with our comprehensive balance sheet health report here.

- Understand Guizhou Xinbang Pharmaceutical's track record by examining our performance history report.

Dongguan Kingsun OptoelectronicLtd (SZSE:002638)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Kingsun Optoelectronic Co., Ltd. manufactures and sells LED lighting products both in China and internationally, with a market cap of CN¥3.37 billion.

Operations: The company generates revenue primarily from its Semiconductor Lighting segment, totaling CN¥412.79 million.

Market Cap: CN¥3.37B

Dongguan Kingsun Optoelectronic Co., Ltd., with a market cap of CN¥3.37 billion, shows financial stability despite being unprofitable. The company benefits from a robust cash position, supporting operations for over three years without additional funding. Short-term assets of CN¥1.4 billion comfortably cover both short and long-term liabilities, indicating strong liquidity management. Although the board is relatively new with an average tenure of 2.2 years, the management team brings experience at 3.2 years on average. Shareholders have not faced significant dilution recently, and the company remains debt-free while reducing losses by 15% annually over five years.

- Click here and access our complete financial health analysis report to understand the dynamics of Dongguan Kingsun OptoelectronicLtd.

- Review our historical performance report to gain insights into Dongguan Kingsun OptoelectronicLtd's track record.

Make It Happen

- Jump into our full catalog of 3,780 Global Penny Stocks here.

- Ready For A Different Approach? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002390

Guizhou Xinbang Pharmaceutical

Researches, develops, manufactures, and sells Chinese herbal medicines and other pharmaceutical products in China and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives