- China

- /

- Electrical

- /

- SZSE:002635

Investors more bullish on Suzhou Anjie Technology (SZSE:002635) this week as stock lifts 4.7%, despite earnings trending downwards over past five years

Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses is one path to excess returns. For example, long term Suzhou Anjie Technology Co., Ltd. (SZSE:002635) shareholders have enjoyed a 22% share price rise over the last half decade, well in excess of the market return of around 15% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 8.9% in the last year, including dividends.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Suzhou Anjie Technology

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Suzhou Anjie Technology's earnings per share are down 9.2% per year, despite strong share price performance over five years.

The strong decline in earnings per share suggests the market isn't using EPS to judge the company. The falling EPS doesn't correlate with the climbing share price, so it's worth taking a look at other metrics.

The modest 2.0% dividend yield is unlikely to be propping up the share price. On the other hand, Suzhou Anjie Technology's revenue is growing nicely, at a compound rate of 8.2% over the last five years. In that case, the company may be sacrificing current earnings per share to drive growth.

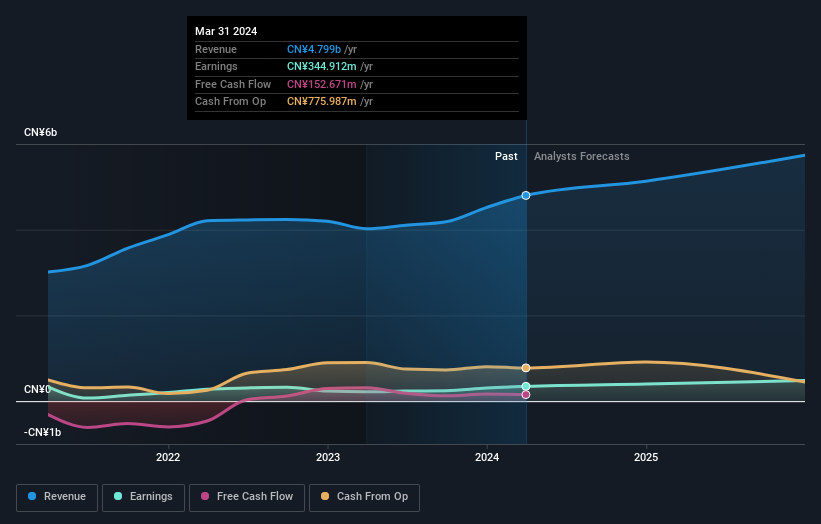

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Suzhou Anjie Technology has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Suzhou Anjie Technology in this interactive graph of future profit estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Suzhou Anjie Technology the TSR over the last 5 years was 27%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Suzhou Anjie Technology shareholders have received a total shareholder return of 8.9% over one year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 5% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Suzhou Anjie Technology has 1 warning sign we think you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002635

Suzhou Anjie Technology

Engages in the research, development, production, and sale of intelligent terminal components in China and internationally.

Solid track record with excellent balance sheet.