- China

- /

- Auto Components

- /

- SHSE:603376

3 Undiscovered Gems In Asia With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape of interest rate adjustments and geopolitical developments, the Asian market has shown resilience amid mixed performances in key indices. While major economies like Japan experience record highs, attention is turning to smaller-cap companies that may offer unique opportunities for growth. In this environment, identifying stocks with strong fundamentals and potential for expansion can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Otec | 9.34% | 5.51% | 13.05% | ★★★★★★ |

| DoshishaLtd | NA | 3.17% | 3.20% | ★★★★★★ |

| Soft-World International | NA | -1.48% | 5.58% | ★★★★★★ |

| Taisun Enterprise | 0.03% | 5.34% | 7.18% | ★★★★★★ |

| Hangzhou Hirisun Technology | NA | -9.43% | -21.49% | ★★★★★★ |

| GDEP ADVANCEInc | NA | 27.84% | 19.61% | ★★★★★★ |

| Guangzhou Ruili Kormee Automotive Electronic | 13.53% | 14.73% | 7.72% | ★★★★★☆ |

| CHANGE HoldingsInc | 63.47% | 29.29% | 14.76% | ★★★★★☆ |

| Changjiu Holdings | 50.46% | 54.90% | 14.57% | ★★★★☆☆ |

| Pizu Group Holdings | 41.45% | -2.37% | -15.01% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Daming ElectronicsLtd (SHSE:603376)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Daming Electronics Co., Ltd. specializes in producing automobile air-conditioning and acoustic systems, with a market cap of CN¥5.02 billion.

Operations: Daming Electronics generates revenue primarily from its Automotive Body Electronic and Electrical Control Systems segment, which reported CN¥2.73 billion.

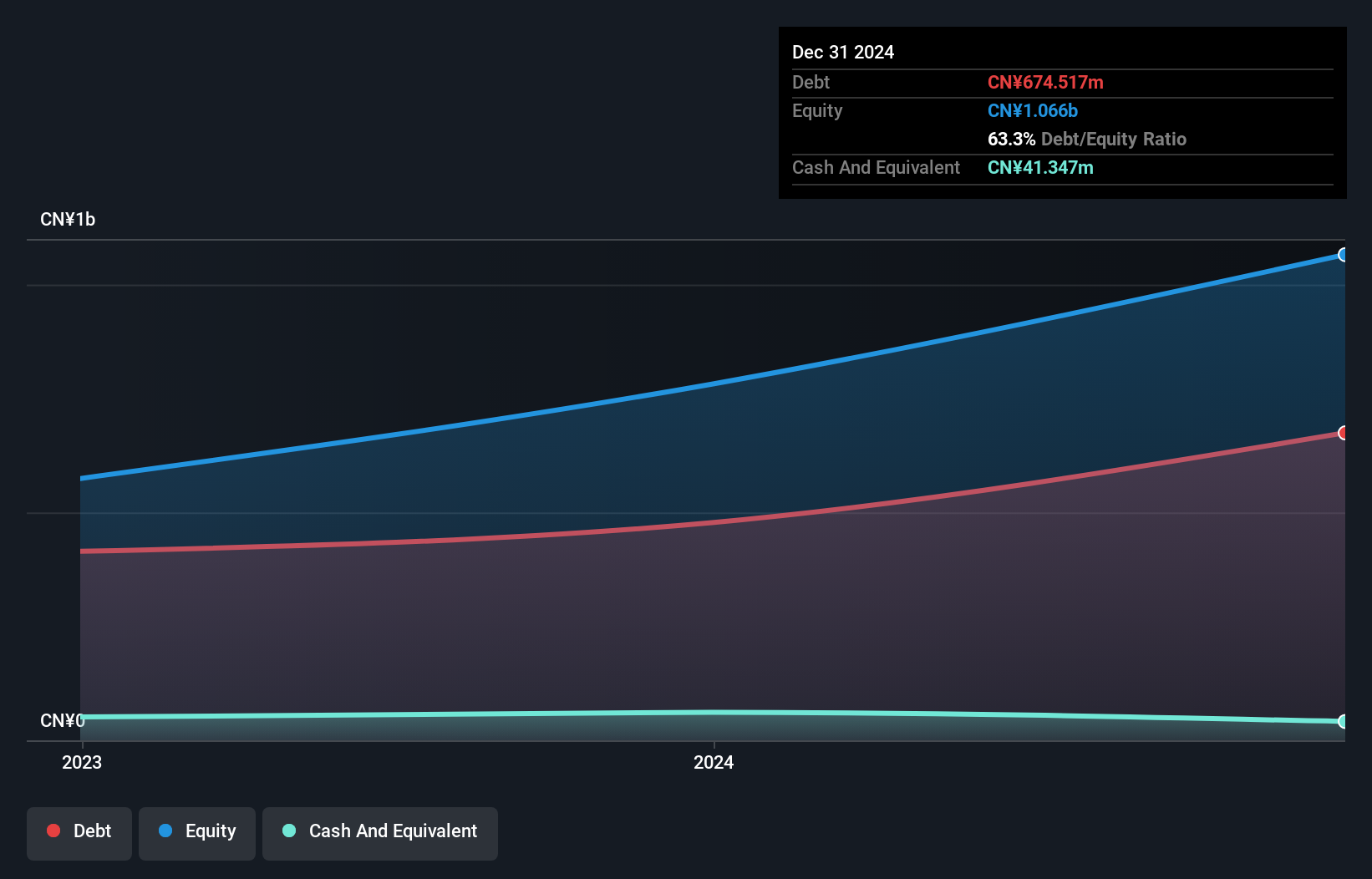

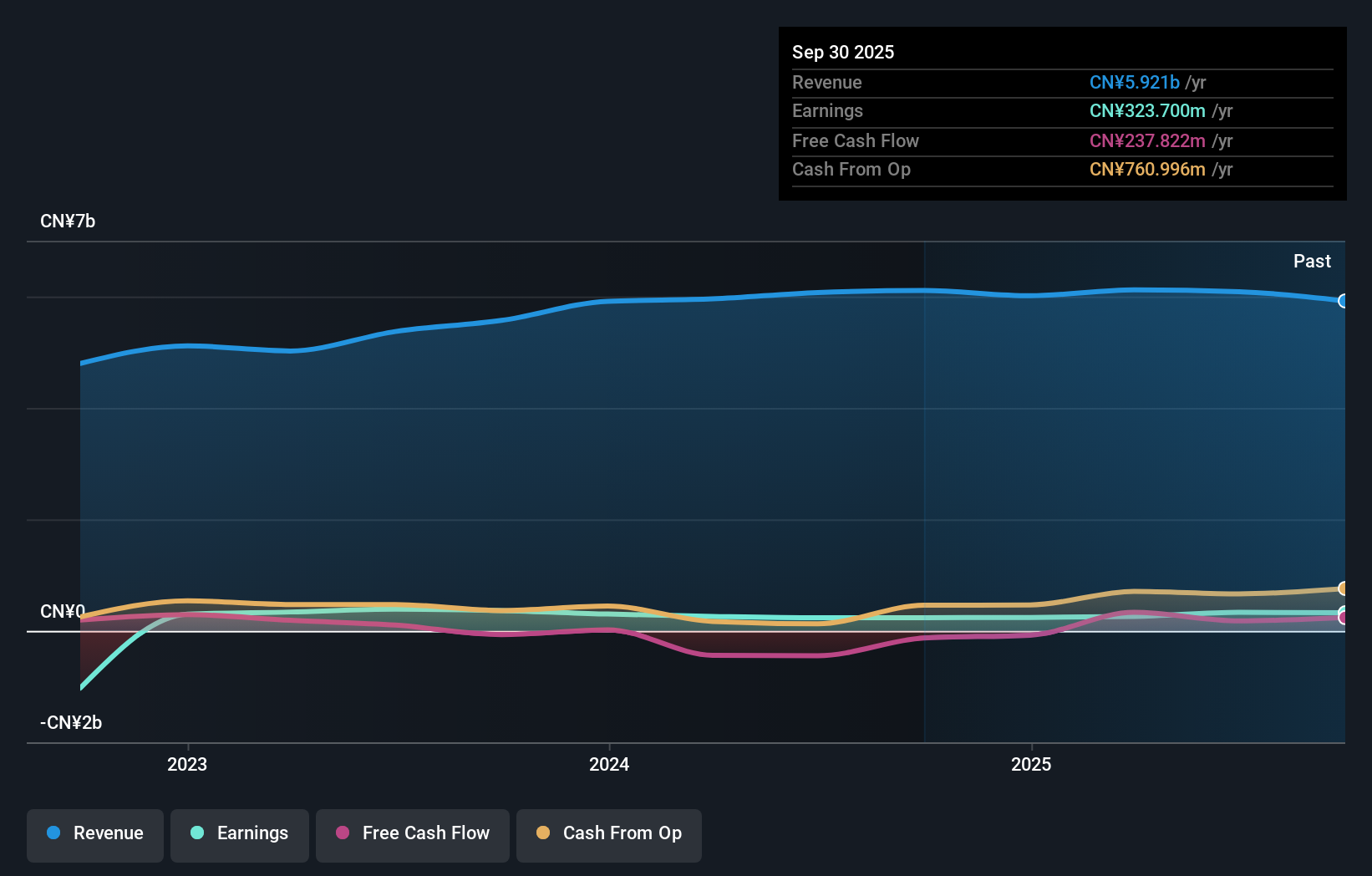

Daming Electronics, a relatively smaller player in the electronics sector, recently completed an IPO raising CNY 502.01 million, reflecting investor interest. For the nine months ending September 2025, sales reached CNY 2.07 billion with net income at CNY 192.84 million and earnings per share of CNY 0.54. Despite a high net debt to equity ratio of 59%, its interest payments are well covered by EBIT at a multiple of 14.8x, indicating solid financial management amidst growth challenges. Notably, earnings surged by 37% over the past year, surpassing industry averages and showcasing strong performance potential despite liquidity constraints.

- Click here and access our complete health analysis report to understand the dynamics of Daming ElectronicsLtd.

Understand Daming ElectronicsLtd's track record by examining our Past report.

Zhejiang Wanliyang (SZSE:002434)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Wanliyang Co., Ltd. focuses on the research, development, production, and sale of automotive transmissions and transmission/drive system products for new energy vehicles both in China and internationally, with a market cap of CN¥12.82 billion.

Operations: The company generates revenue through the sale of automotive transmissions and transmission/drive system products for new energy vehicles. It operates in both domestic and international markets, with a market capitalization of CN¥12.82 billion.

Zhejiang Wanliyang, a notable player in the machinery sector, showcases impressive growth dynamics. Over the past year, earnings surged by 36.8%, outpacing the industry's 6.4% growth rate, highlighting its robust performance. The company's net debt to equity ratio stands at a satisfactory 9.6%, ensuring financial stability while maintaining high-quality earnings. Trading at 59% below estimated fair value suggests potential undervaluation opportunities for investors. Recent reports reveal a net income increase to CNY 340 million from CNY 257 million last year, with basic earnings per share rising to CNY 0.26 from CNY 0.2, underscoring its profitability trajectory amidst slightly lower sales figures of CNY 4,201 million compared to last year's CNY 4,293 million.

Chengdu Guibao Science & TechnologyLtd (SZSE:300019)

Simply Wall St Value Rating: ★★★★★★

Overview: Chengdu Guibao Science & Technology Co., Ltd. operates in the field of silicone sealants and adhesives, with a market capitalization of CN¥9.23 billion.

Operations: Guibao generates revenue primarily from its silicone sealants and adhesives business. The company has shown a net profit margin trend that provides insight into its profitability.

Chengdu Guibao Science & Technology, with a focus on the chemicals sector, has shown robust performance. Over the past year, earnings surged by 23.3%, significantly outpacing the industry average of 6.2%. The company's debt-to-equity ratio impressively dropped from 33.7% to 10.9% over five years, indicating prudent financial management. Recent results highlight a net income increase to CNY 229 million for nine months ending September 2025 from CNY 158 million last year, with sales reaching CNY 2.65 billion compared to CNY 2.13 billion previously, reflecting strong growth momentum and operational efficiency in its niche market space.

Turning Ideas Into Actions

- Access the full spectrum of 2406 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603376

Daming ElectronicsLtd

Engages in the production of automobile air-conditioning and acoustic systems.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives