- China

- /

- Aerospace & Defense

- /

- SZSE:002338

Why Investors Shouldn't Be Surprised By Changchun UP Optotech Co.,Ltd.'s (SZSE:002338) 30% Share Price Surge

Those holding Changchun UP Optotech Co.,Ltd. (SZSE:002338) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Taking a wider view, although not as strong as the last month, the full year gain of 16% is also fairly reasonable.

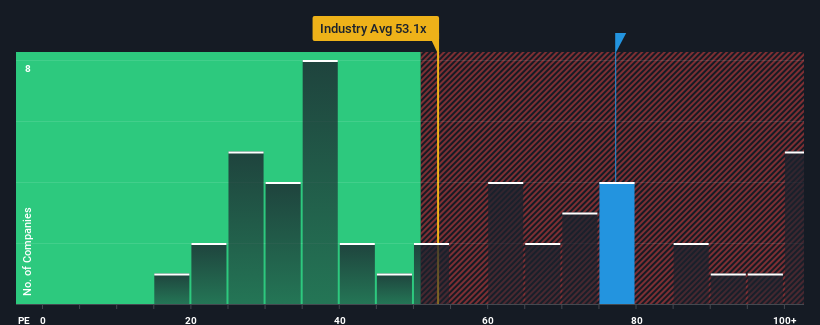

Following the firm bounce in price, Changchun UP OptotechLtd's price-to-earnings (or "P/E") ratio of 77.1x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 29x and even P/E's below 18x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Changchun UP OptotechLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Changchun UP OptotechLtd

Is There Enough Growth For Changchun UP OptotechLtd?

The only time you'd be truly comfortable seeing a P/E as steep as Changchun UP OptotechLtd's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 15%. This was backed up an excellent period prior to see EPS up by 96% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 99% as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

With this information, we can see why Changchun UP OptotechLtd is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Changchun UP OptotechLtd's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Changchun UP OptotechLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Changchun UP OptotechLtd with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Changchun UP OptotechLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002338

Changchun UP OptotechLtd

Engages in the research, development, production, and sale of photoelectric measurement and control equipment, new medical equipment, optical materials, grating encoders, carbon fiber composites, and other products in China.

High growth potential with proven track record.

Market Insights

Community Narratives