In the midst of geopolitical tensions and consumer spending concerns, global markets have experienced a turbulent week with major indices declining after initial gains. As investors navigate these uncertainties, stocks with high insider ownership can offer a unique perspective on potential growth opportunities, as insiders often have deeper insights into their companies' prospects and confidence in their long-term strategies.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 30.2% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 133.7% |

We're going to check out a few of the best picks from our screener tool.

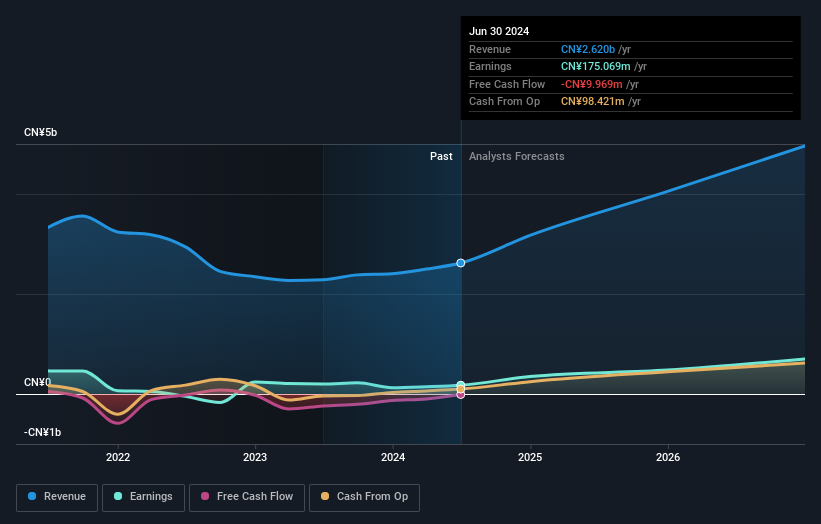

Weihai Guangtai Airport EquipmentLtd (SZSE:002111)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Weihai Guangtai Airport Equipment Co., Ltd manufactures and sells ground support and fire-fighting equipment in China and internationally, with a market cap of CN¥5.77 billion.

Operations: Weihai Guangtai Airport Equipment Co., Ltd generates revenue through its production and distribution of ground support and fire-fighting equipment both domestically and internationally.

Insider Ownership: 16.9%

Earnings Growth Forecast: 42.9% p.a.

Weihai Guangtai Airport Equipment Ltd. is poised for significant growth with earnings expected to rise 42.91% annually over the next three years, outpacing both its revenue growth of 24.3% and the broader Chinese market's performance. While its Return on Equity is forecasted to remain modest at 11.6%, the company's Price-To-Earnings ratio of 30.9x suggests it offers better value compared to the CN market average of 38.1x, despite lower profit margins this year and a dividend yield not fully covered by free cash flows.

- Get an in-depth perspective on Weihai Guangtai Airport EquipmentLtd's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Weihai Guangtai Airport EquipmentLtd is trading beyond its estimated value.

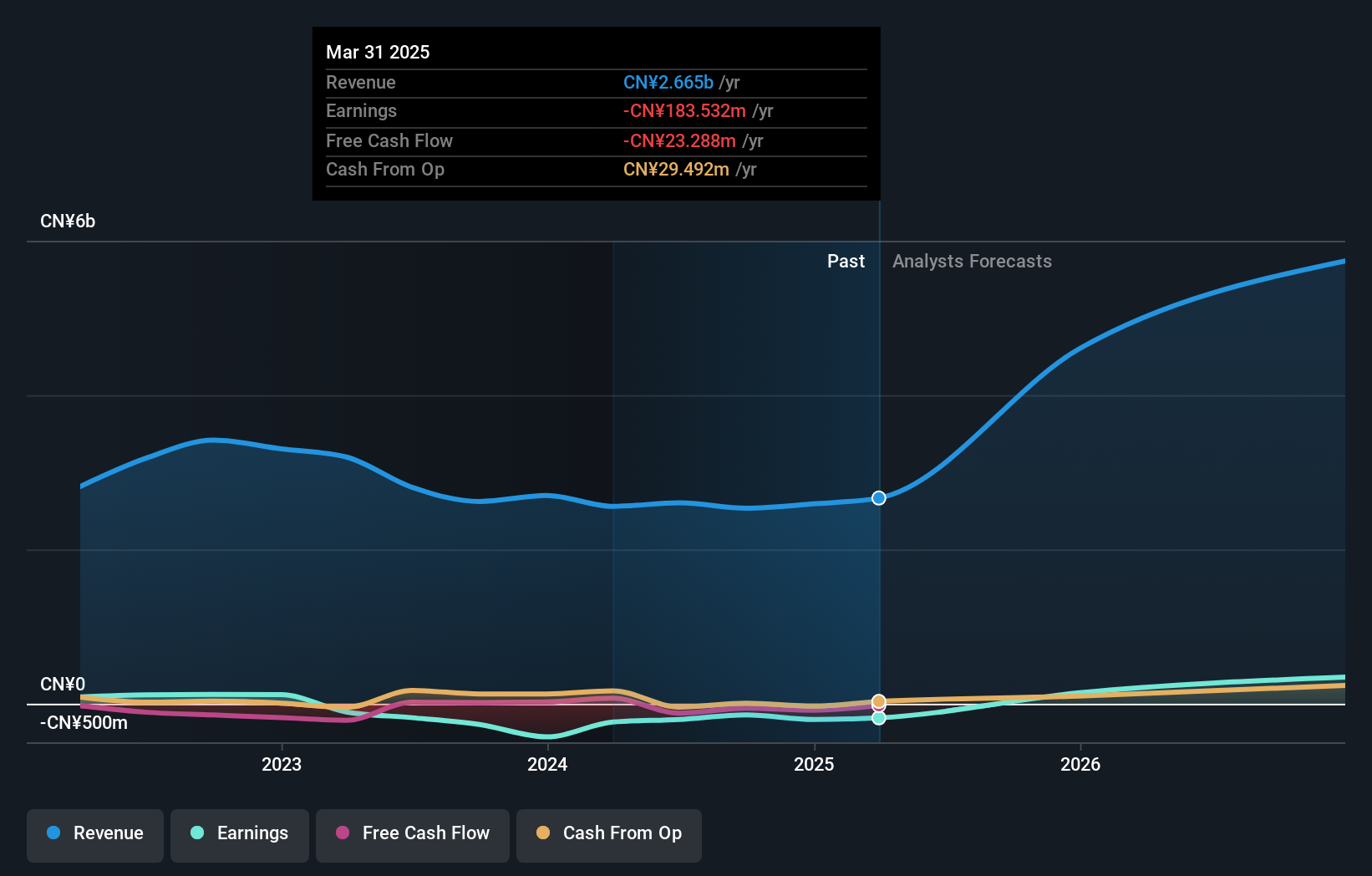

Guangdong Guanghua Sci-Tech (SZSE:002741)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Guanghua Sci-Tech Co., Ltd. operates in China producing and selling electronic chemicals, chemical reagents, and new energy materials with a market cap of CN¥8.03 billion.

Operations: The company's revenue from the chemical industry segment amounts to CN¥2.53 billion.

Insider Ownership: 38%

Earnings Growth Forecast: 122.2% p.a.

Guangdong Guanghua Sci-Tech is positioned for robust growth with earnings projected to increase by 122.17% annually, significantly outpacing the Chinese market's average. Revenue is expected to grow at 31% per year, surpassing the market's 13.4%. Despite this growth potential, the company faces challenges such as high volatility in share price and recent shareholder dilution. Additionally, its debt coverage by operating cash flow is inadequate and Return on Equity forecasts are modest at 16.4%.

- Click here to discover the nuances of Guangdong Guanghua Sci-Tech with our detailed analytical future growth report.

- According our valuation report, there's an indication that Guangdong Guanghua Sci-Tech's share price might be on the expensive side.

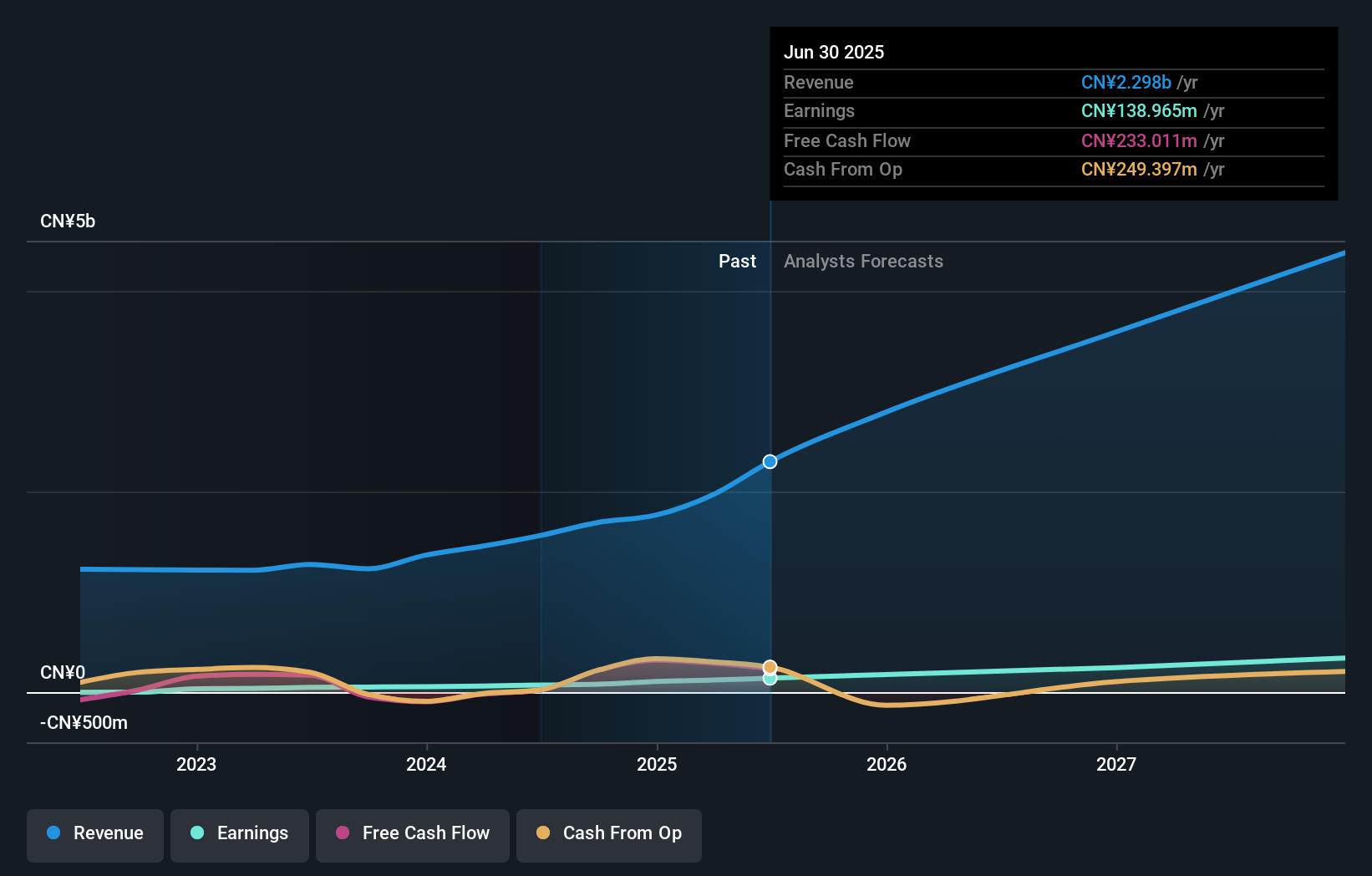

Guangzhou Ruoyuchen TechnologyLtd (SZSE:003010)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Ruoyuchen Technology Co., Ltd. offers brand integrated marketing solutions in China and has a market cap of CN¥4.94 billion.

Operations: The company's revenue from the E-Commerce Service Industry is CN¥1.69 billion.

Insider Ownership: 37.2%

Earnings Growth Forecast: 34.6% p.a.

Guangzhou Ruoyuchen Technology is poised for significant growth, with earnings forecasted to rise by 34.61% annually, outpacing the Chinese market. Revenue is also expected to grow at 24.9% per year. Despite high share price volatility and a modest Return on Equity forecast of 12%, the company has initiated a substantial share repurchase program worth up to CNY 200 million, potentially enhancing shareholder value through equity incentives or employee stock plans.

- Click here and access our complete growth analysis report to understand the dynamics of Guangzhou Ruoyuchen TechnologyLtd.

- Insights from our recent valuation report point to the potential overvaluation of Guangzhou Ruoyuchen TechnologyLtd shares in the market.

Turning Ideas Into Actions

- Delve into our full catalog of 1450 Fast Growing Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Weihai Guangtai Airport EquipmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002111

Weihai Guangtai Airport EquipmentLtd

Engages in manufacture and sale of ground support equipment and fire-fighting equipment in China and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives