- Hong Kong

- /

- Professional Services

- /

- SEHK:2225

Jinhai Medical Technology Leads These 3 Global Penny Stocks

Reviewed by Simply Wall St

Global markets have shown resilience, with U.S. stocks posting solid gains despite a government shutdown and European indices reaching record levels on the back of technology rallies. Amid this backdrop, investors are increasingly turning their attention to smaller companies that might offer hidden value and growth potential. While the term "penny stock" may seem outdated, it still represents an intriguing investment area where strong financials can lead to significant opportunities for those willing to explore beyond traditional market leaders.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.51 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.75 | A$437.26M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.645 | MYR327.97M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.71 | HK$2.27B | ✅ 4 ⚠️ 1 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.22 | A$236.18M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.37 | MYR550.13M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.35 | SGD13.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.5225 | $303.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.185 | £188.66M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,566 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Jinhai Medical Technology (SEHK:2225)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jinhai Medical Technology Limited is an investment holding company offering minimally invasive surgery solutions, medical products, and related services in China and Singapore, with a market cap of HK$4.97 billion.

Operations: The company's revenue is derived from its operations in Singapore, contributing SGD 14.82 million, and the People's Republic of China, generating SGD 19.83 million.

Market Cap: HK$4.97B

Jinhai Medical Technology Limited, with a market cap of HK$4.97 billion, operates in China and Singapore, generating revenues of SGD 19.83 million and SGD 14.82 million respectively. Despite a seasoned board and management team, the company remains unprofitable with increasing losses over the past five years at an annual rate of 83.8%. Recent earnings results show a net loss of SGD 10.25 million for the half year ended June 2025, reflecting decreased revenue from its core operations in minimally invasive surgery solutions and medical products. The company has raised additional capital through a follow-on equity offering worth HKD 162 million to bolster its cash runway amidst high share price volatility and increased debt levels over time.

- Take a closer look at Jinhai Medical Technology's potential here in our financial health report.

- Gain insights into Jinhai Medical Technology's past trends and performance with our report on the company's historical track record.

PropNex (SGX:OYY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PropNex Limited is an investment holding company offering real estate services in Singapore with a market capitalization of SGD1.73 billion.

Operations: The company's revenue is primarily derived from Agency Services at SGD830.49 million and Project Marketing Services at SGD352.77 million, with additional contributions from Training Services and Administrative Support Services totaling SGD6.60 million.

Market Cap: SGD1.73B

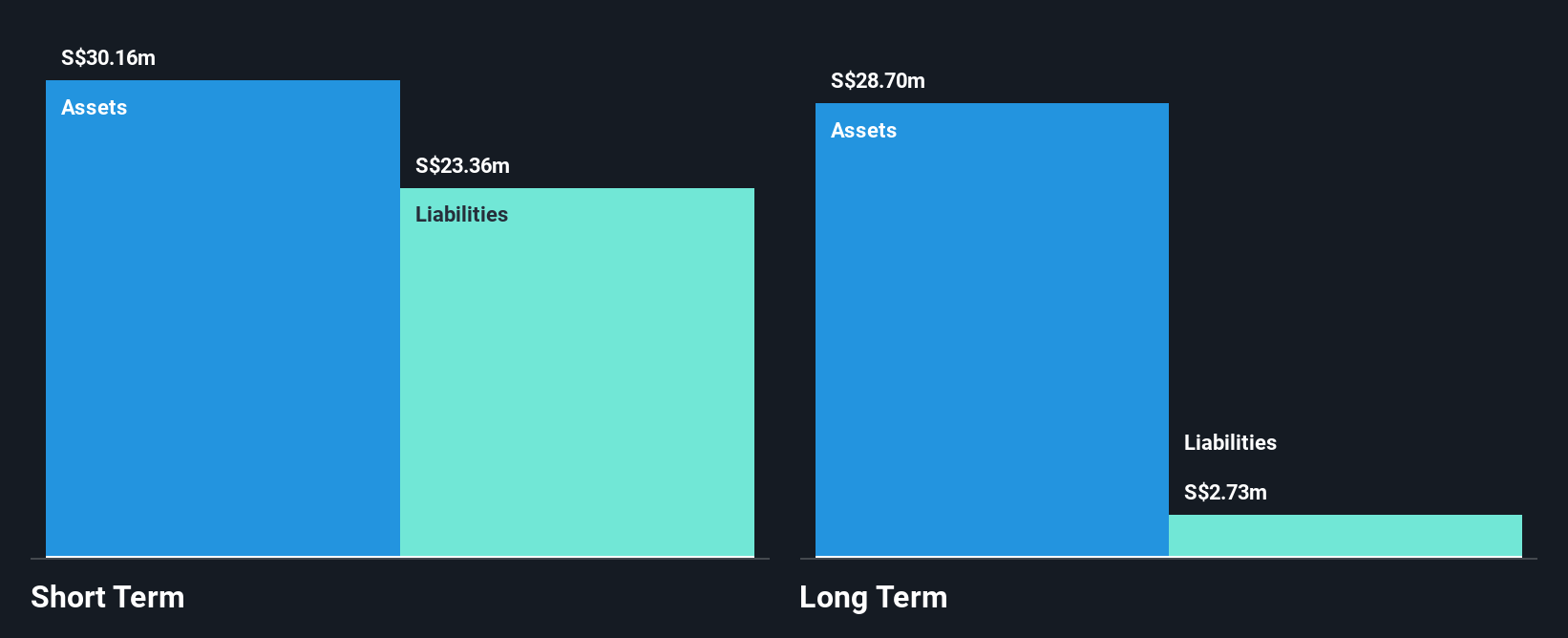

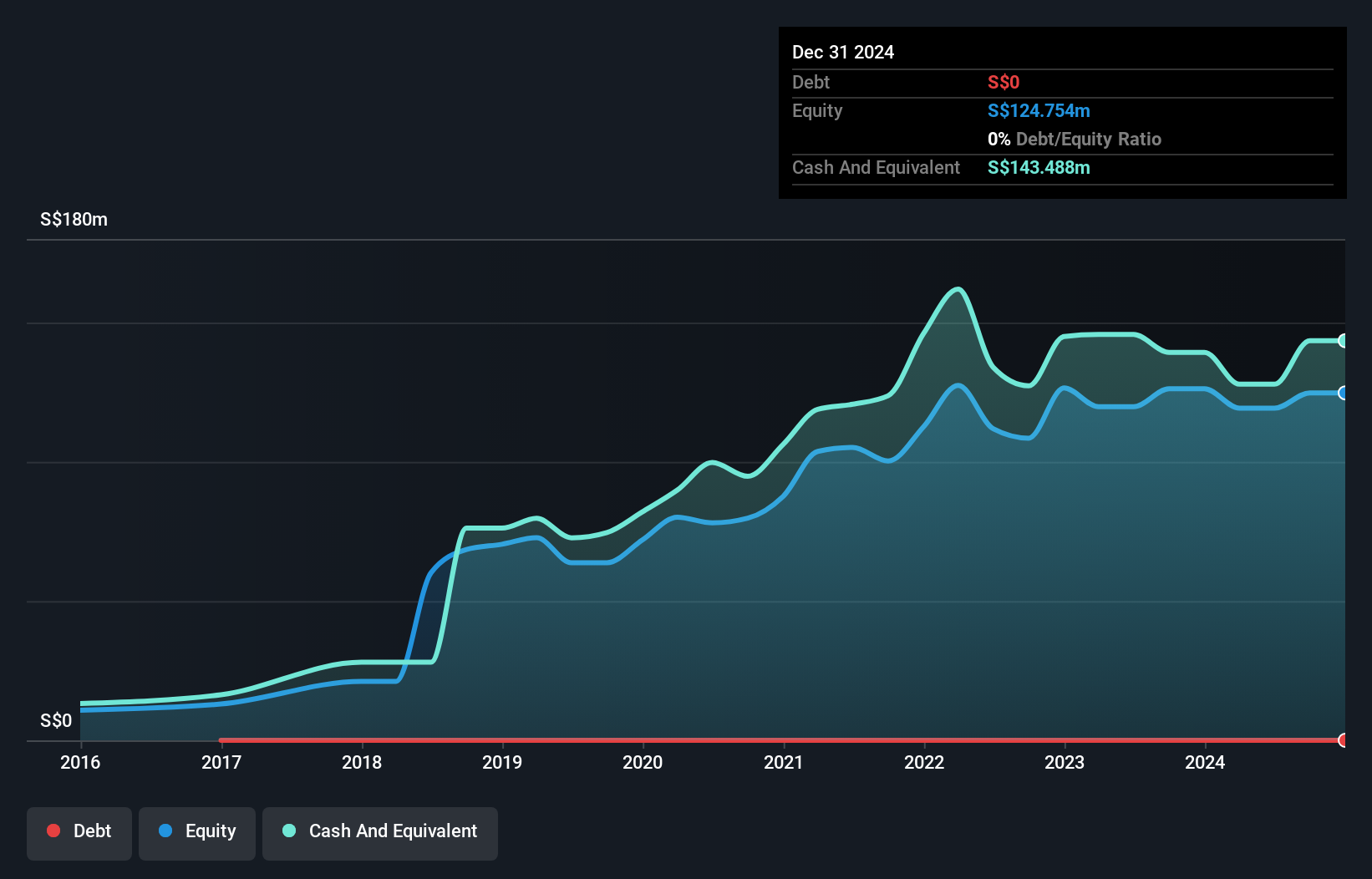

PropNex Limited, with a market cap of SGD1.73 billion, has demonstrated robust financial performance, reporting half-year sales of SGD598.95 million and net income of SGD42.26 million as of June 2025. The company's earnings growth rate over the past year significantly outpaced the industry average, while its return on equity stands at an impressive 52.8%. PropNex is debt-free and maintains strong short-term asset coverage over liabilities. Despite these strengths, its dividend yield is not well covered by earnings, and management's relatively short tenure may suggest potential challenges in leadership stability following recent executive changes.

- Click here to discover the nuances of PropNex with our detailed analytical financial health report.

- Learn about PropNex's future growth trajectory here.

HuBei NengTer TechnologyLtd (SZSE:002102)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: HuBei NengTer Technology Co., Ltd operates an ecommerce platform focused on the supply chain of plastic raw materials in China, with a market cap of CN¥9.41 billion.

Operations: The company's revenue is primarily derived from its operations in China, generating CN¥11.09 billion, with an additional CN¥191.08 million from international markets.

Market Cap: CN¥9.41B

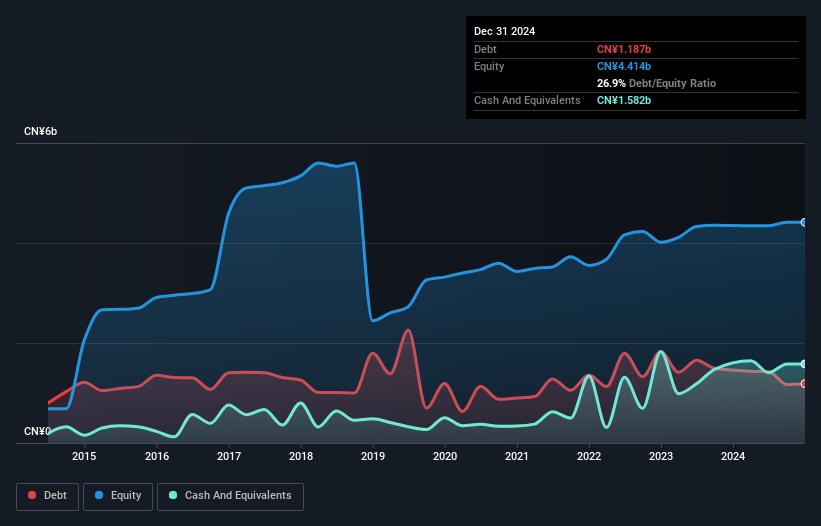

HuBei NengTer Technology Ltd, with a market cap of CN¥9.41 billion, operates in China's plastic raw materials supply chain and has shown mixed financial performance. Despite being unprofitable, the company reported improved net income of CN¥339.22 million for the half year ending June 2025, compared to CN¥56.88 million a year ago. Its short-term assets exceed liabilities, providing financial stability despite increased debt levels over five years. The company announced a share buyback program worth up to CN¥50 million to reduce registered capital, reflecting confidence in its long-term prospects while maintaining sufficient cash runway for over three years.

- Unlock comprehensive insights into our analysis of HuBei NengTer TechnologyLtd stock in this financial health report.

- Understand HuBei NengTer TechnologyLtd's earnings outlook by examining our growth report.

Summing It All Up

- Embark on your investment journey to our 3,566 Global Penny Stocks selection here.

- Ready To Venture Into Other Investment Styles? These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2225

Jinhai Medical Technology

An investment holding company, provides minimally invasive surgery solutions, medical products, and related services in the People's Republic of China and Singapore.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives