- China

- /

- Electrical

- /

- SZSE:000682

3 Stocks Estimated To Be Undervalued By Up To 49.4%

Reviewed by Simply Wall St

In the wake of a significant rally in U.S. stocks, driven by expectations of favorable economic policies following a Republican electoral victory, investors are keenly observing potential opportunities within the market. As major indices like the S&P 500 and Nasdaq Composite reach record highs, identifying undervalued stocks becomes crucial for those looking to capitalize on potential market inefficiencies. In this context, understanding what constitutes an undervalued stock—typically characterized by strong fundamentals yet trading below intrinsic value—can be particularly advantageous amidst current economic shifts and policy changes.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro-Star International (TWSE:2377) | NT$184.50 | NT$368.99 | 50% |

| Anhui Huaheng Biotechnology (SHSE:688639) | CN¥36.00 | CN¥71.65 | 49.8% |

| Jetpak Top Holding (OM:JETPAK) | SEK106.00 | SEK211.81 | 50% |

| Dynavox Group (OM:DYVOX) | SEK66.50 | SEK132.84 | 49.9% |

| Redcentric (AIM:RCN) | £1.1625 | £2.32 | 50% |

| Proficient Auto Logistics (NasdaqGS:PAL) | US$10.00 | US$19.92 | 49.8% |

| Royal Plus (SET:PLUS) | THB5.45 | THB10.88 | 49.9% |

| Dometic Group (OM:DOM) | SEK61.15 | SEK121.72 | 49.8% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.14 | €16.25 | 49.9% |

| St. James's Place (LSE:STJ) | £8.275 | £16.46 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

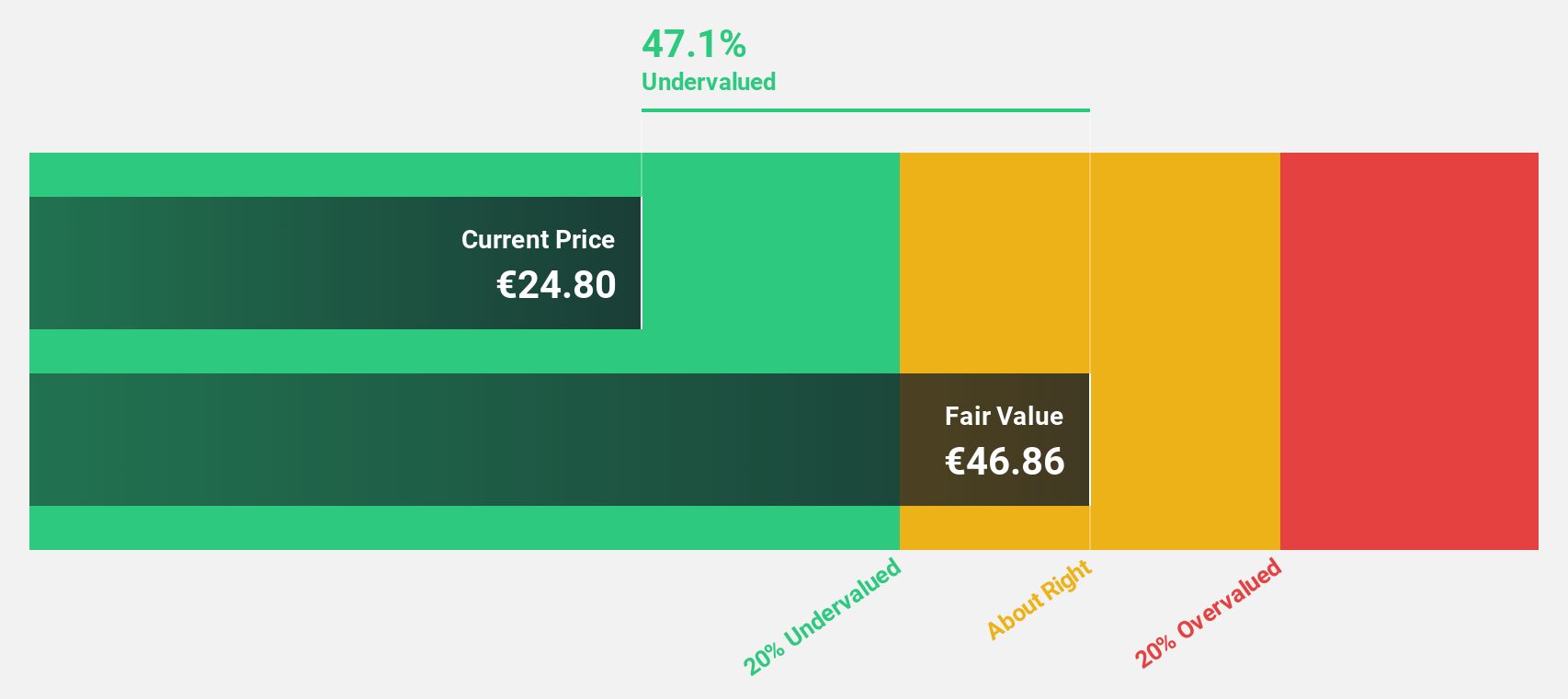

Lectra (ENXTPA:LSS)

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €1.02 billion.

Operations: The company's revenue segments are distributed as follows: €172.19 million from the Americas and €124.33 million from the Asia-Pacific region.

Estimated Discount To Fair Value: 43.4%

Lectra is trading at €26.8, significantly below its estimated fair value of €47.37, representing a 43.4% undervaluation based on discounted cash flow analysis. Despite recent earnings showing a decline in net income to €22.77 million for the first nine months of 2024, the company's earnings are forecast to grow substantially at 35.85% annually, outpacing both revenue growth and market averages in France.

- According our earnings growth report, there's an indication that Lectra might be ready to expand.

- Navigate through the intricacies of Lectra with our comprehensive financial health report here.

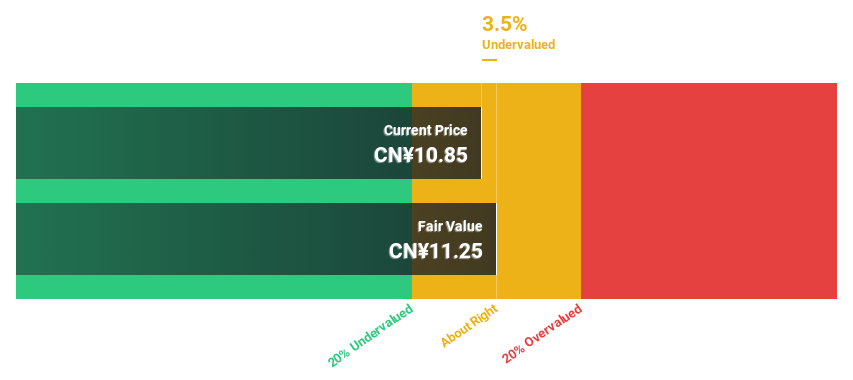

Dongfang Electronics (SZSE:000682)

Overview: Dongfang Electronics Co., Ltd. specializes in the research, development, manufacturing, operation, system integration, and technical servicing of energy management system solutions across various regions including China and internationally, with a market cap of CN¥15.70 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 44.9%

Dongfang Electronics is trading at CN¥11.71, significantly below its estimated fair value of CN¥21.25, indicating a 44.9% undervaluation based on discounted cash flow analysis. Despite an unstable dividend history, the company reported strong revenue growth to CN¥4.63 billion for the first nine months of 2024, up from CN¥4.10 billion last year, with net income rising to CN¥421.19 million from CN¥344.5 million, highlighting robust cash flow potential amidst forecasted revenue growth of 22.5% annually.

- The growth report we've compiled suggests that Dongfang Electronics' future prospects could be on the up.

- Dive into the specifics of Dongfang Electronics here with our thorough financial health report.

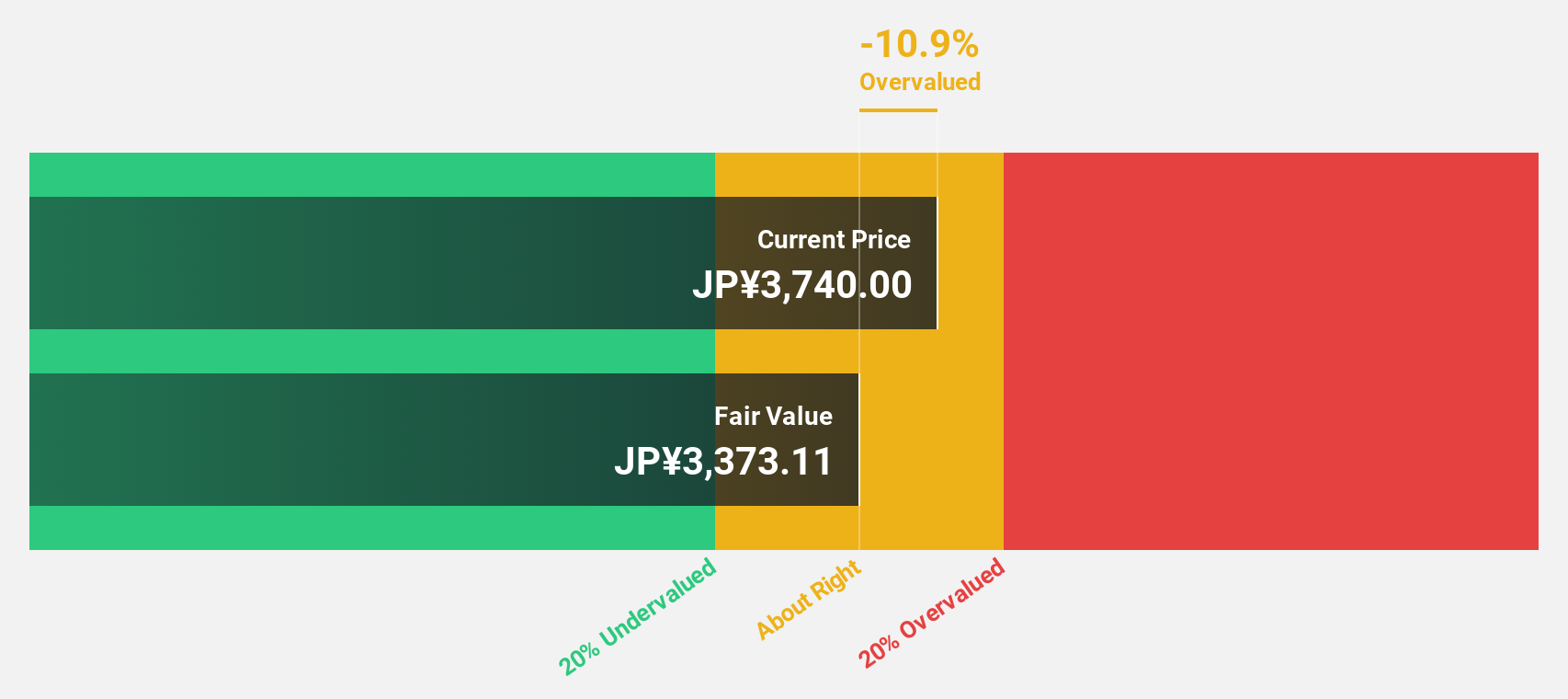

freee K.K (TSE:4478)

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market cap of ¥175.62 billion.

Operations: The company generates revenue from its Platform Business segment, which amounted to ¥25.43 billion.

Estimated Discount To Fair Value: 49.4%

freee K.K. is trading at ¥2,986, significantly below its estimated fair value of ¥5,900.63, suggesting it is undervalued based on discounted cash flow analysis by over 49%. The company forecasts an annual revenue growth of 18.2%, surpassing the JP market average. Although freee K.K.'s share price has been highly volatile recently, it is expected to become profitable within three years and achieve above-average market profit growth.

- The analysis detailed in our freee K.K growth report hints at robust future financial performance.

- Click here to discover the nuances of freee K.K with our detailed financial health report.

Key Takeaways

- Unlock our comprehensive list of 899 Undervalued Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000682

Dongfang Electronics

Engages in the research, development, manufacturing, operation, system integration, and technical servicing of energy management system solutions in China, South Asia, Southeast Asia, Africa, South America, Europe and internationally.

Solid track record with excellent balance sheet and pays a dividend.