While shareholders of Baota Industry (SZSE:000595) are in the black over 3 years, those who bought a week ago aren't so fortunate

Baota Industry Co., Ltd. (SZSE:000595) shareholders might be concerned after seeing the share price drop 19% in the last quarter. But over three years, the returns would have left most investors smiling In the last three years the share price is up, 50%: better than the market.

Since the long term performance has been good but there's been a recent pullback of 12%, let's check if the fundamentals match the share price.

See our latest analysis for Baota Industry

Given that Baota Industry didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Baota Industry's revenue trended up 16% each year over three years. That's pretty nice growth. While the share price has done well, compounding at 15% yearly, over three years, that move doesn't seem over the top. If that's the case, then it could be well worth while to research the growth trajectory. Keep in mind that the strength of the balance sheet impacts the options open to the company.

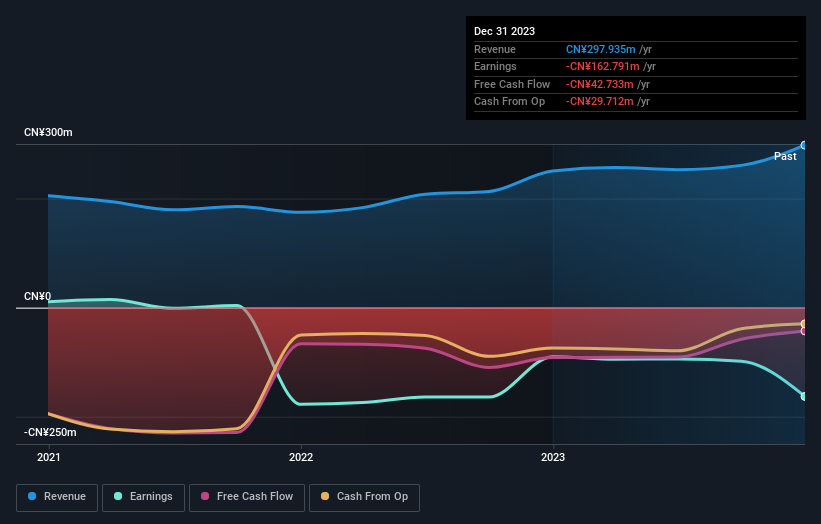

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Baota Industry's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Baota Industry shareholders are down 30% for the year. Unfortunately, that's worse than the broader market decline of 9.7%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 7%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Baota Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000595

Flawless balance sheet minimal.