Stock Analysis

- China

- /

- Basic Materials

- /

- SZSE:002271

Exploring Top Dividend Stocks In China For May 2024

Reviewed by Simply Wall St

As of May 2024, Chinese stocks have shown signs of recovery, buoyed by positive holiday spending and a robust trade surplus. This upward trend in the market sets an optimistic backdrop for investors looking into dividend-paying stocks in China. In this context, a good dividend stock typically offers not only a reliable income stream but also stands to benefit from the broader economic resilience and consumer confidence apparent in these recent market activities.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Shandong Wit Dyne HealthLtd (SZSE:000915) | 5.97% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.03% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.33% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.32% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.44% | ★★★★★★ |

| Jiangsu Yanghe Brewery (SZSE:002304) | 4.85% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.45% | ★★★★★★ |

| Shenzhen Fuanna Bedding and FurnishingLtd (SZSE:002327) | 5.36% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.29% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.67% | ★★★★★★ |

Click here to see the full list of 179 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Shenzhen Tagen Group (SZSE:000090)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shenzhen Tagen Group Co., Ltd. focuses on urban construction, comprehensive development, and urban services in China, with a market capitalization of approximately CN¥8.76 billion.

Operations: Shenzhen Tagen Group Co., Ltd. generates its revenue from activities related to urban construction, comprehensive development, and urban services across China.

Dividend Yield: 5.3%

Shenzhen Tagen Group's recent financials show a decline, with Q1 2024 sales at CNY 2.75 billion and net income at CNY 97.36 million, both down from the previous year. Despite a top-tier dividend yield of 5.33%, the company's dividend track record is unstable and payments have been volatile over the last decade. However, dividends are well-supported by earnings with a low payout ratio of 36.6% and an even lower cash payout ratio of 9.9%, suggesting sustainability from cash flow perspectives despite high debt levels.

- Take a closer look at Shenzhen Tagen Group's potential here in our dividend report.

- Our valuation report unveils the possibility Shenzhen Tagen Group's shares may be trading at a discount.

Beijing Oriental Yuhong Waterproof Technology (SZSE:002271)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing Oriental Yuhong Waterproof Technology Co., Ltd. focuses on the research, development, production, and sale of waterproof materials primarily in China, with a market capitalization of approximately CN¥40.80 billion.

Operations: Beijing Oriental Yuhong Waterproof Technology Co., Ltd. generates its revenue primarily from the sale of waterproof materials in China.

Dividend Yield: 3.6%

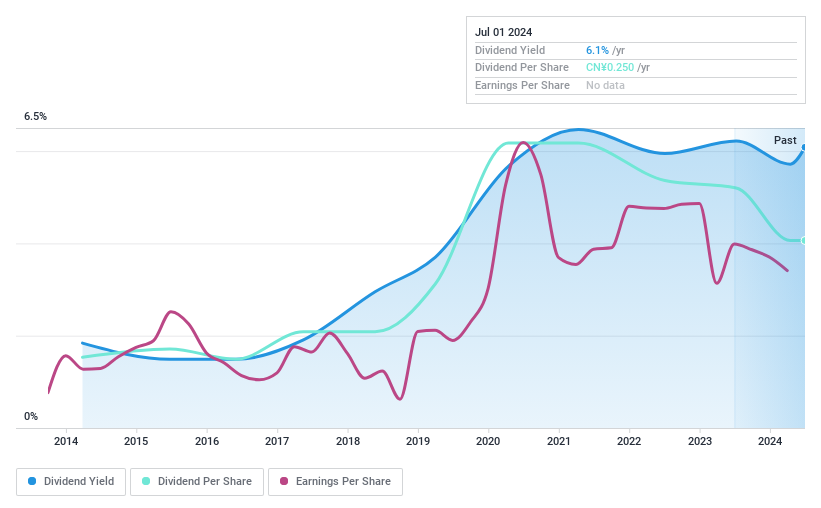

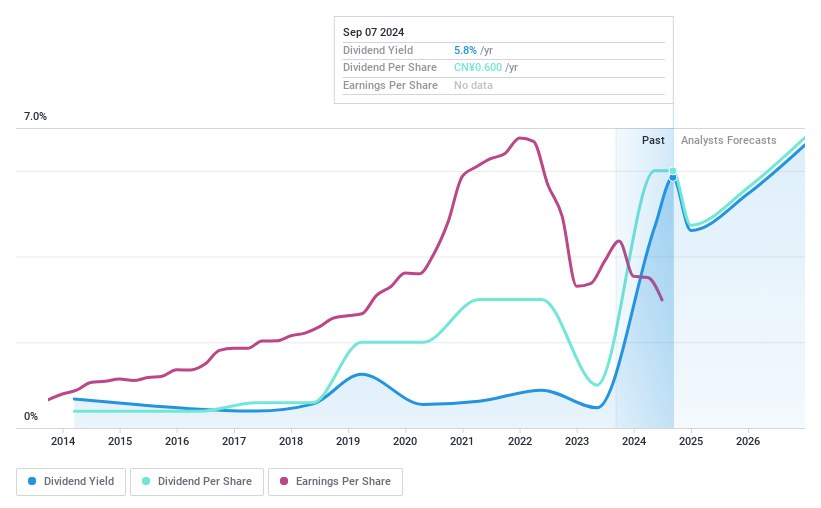

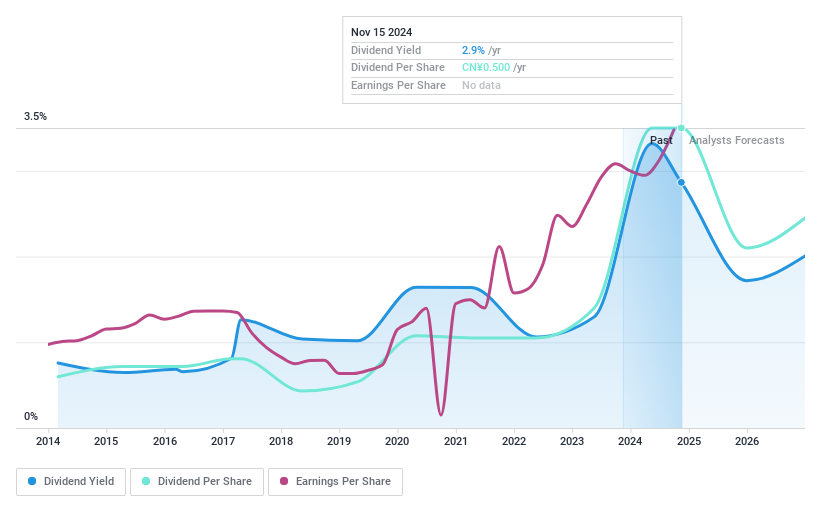

Beijing Oriental Yuhong Waterproof Technology Co., Ltd. recently declared a dividend of CNY 6 per 10 shares, with a record date of 21 May 2024. Despite experiencing a slight decline in quarterly and annual earnings, the company maintains a reasonable payout ratio of 66.5% and cash payout ratio of 58.8%, supporting its dividend sustainability. Over ten years, dividends have increased but shown volatility and unreliability in growth patterns. Trading at a P/E ratio well below the market average suggests relative value, yet the inconsistent dividend history may concern investors seeking stability.

- Click to explore a detailed breakdown of our findings in Beijing Oriental Yuhong Waterproof Technology's dividend report.

- Our comprehensive valuation report raises the possibility that Beijing Oriental Yuhong Waterproof Technology is priced lower than what may be justified by its financials.

Hangzhou Sunrise TechnologyLtd (SZSE:300360)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hangzhou Sunrise Technology Co., Ltd. specializes in the design, development, manufacturing, and sale of electricity energy meters and power information collection systems in China, with a market capitalization of approximately CN¥8.20 billion.

Operations: Hangzhou Sunrise Technology Co., Ltd. generates its revenue primarily from the design, development, manufacturing, and sales of electricity energy meters and power information collection systems within China.

Dividend Yield: 3.1%

Hangzhou Sunrise Technology Co., Ltd. recently increased its dividend to CNY 5 per 10 shares, reflecting a commitment to shareholder returns despite a slight dip in quarterly net income from CNY 120.21 million to CNY 112.05 million. The firm's annual earnings rose significantly, supporting a sustainable payout ratio of 42.4% and cash payout ratio of 61.3%. However, its dividend history over the past decade has been marked by volatility and unreliability, posing potential concerns for those seeking consistent income streams.

- Unlock comprehensive insights into our analysis of Hangzhou Sunrise TechnologyLtd stock in this dividend report.

- Our valuation report here indicates Hangzhou Sunrise TechnologyLtd may be undervalued.

Seize The Opportunity

- Dive into all 179 of the Top Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Beijing Oriental Yuhong Waterproof Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002271

Beijing Oriental Yuhong Waterproof Technology

Engages in research and development, production, and sale of waterproof materials primarily in China.

Flawless balance sheet established dividend payer.