As global markets navigate through mixed signals, with the U.S. and China reaching a temporary trade truce and Japan's stock markets hitting record highs, investor attention is increasingly turning towards Asia's growth potential. In such an environment, companies with high insider ownership can offer unique insights into potential growth trajectories, as insiders often have a deeper understanding of their company's prospects and are more aligned with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 30% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31.2% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.8% |

Underneath we present a selection of stocks filtered out by our screen.

SolaX Power Network Technology (Zhejiang) (SHSE:688717)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SolaX Power Network Technology (Zhejiang) Co., Ltd. (ticker: SHSE:688717) operates in the renewable energy sector, focusing on the development and manufacturing of solar power products, with a market cap of CN¥12.58 billion.

Operations: SolaX Power Network Technology generates revenue primarily from its Electronic Components & Parts segment, amounting to CN¥3.69 billion.

Insider Ownership: 36%

Revenue Growth Forecast: 28.2% p.a.

SolaX Power Network Technology (Zhejiang) shows promising growth potential with forecasted revenue and earnings growth rates significantly outpacing the Chinese market. Despite recent volatility in its share price, the company's strategic partnership with Solerus Energy enhances its product offerings and market reach. However, net income has slightly declined year-over-year, and dividends are not well-covered by earnings or free cash flows. High insider ownership aligns management interests with shareholders but lacks recent insider trading data.

- Click to explore a detailed breakdown of our findings in SolaX Power Network Technology (Zhejiang)'s earnings growth report.

- The analysis detailed in our SolaX Power Network Technology (Zhejiang) valuation report hints at an inflated share price compared to its estimated value.

Anhui Estone Materials TechnologyLtd (SHSE:688733)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anhui Estone Materials Technology Co., Ltd specializes in lithium battery coatings, electronic communication functional fillings, and low-smoke halogen-free flame-retardant materials in China, with a market capitalization of CN¥6.73 billion.

Operations: The company's revenue is derived from its offerings in lithium battery coatings, electronic communication functional fillings, and low-smoke halogen-free flame-retardant materials.

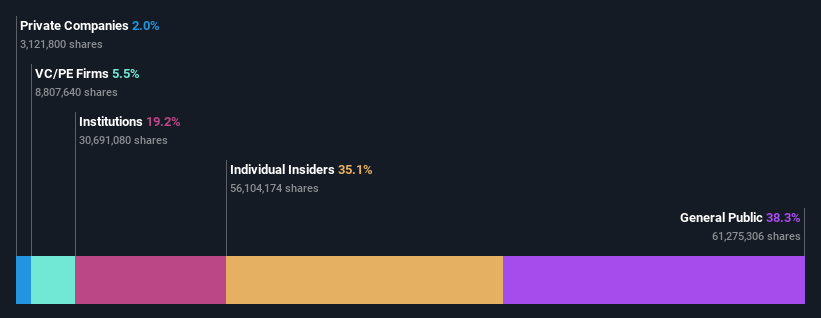

Insider Ownership: 32.5%

Revenue Growth Forecast: 24.1% p.a.

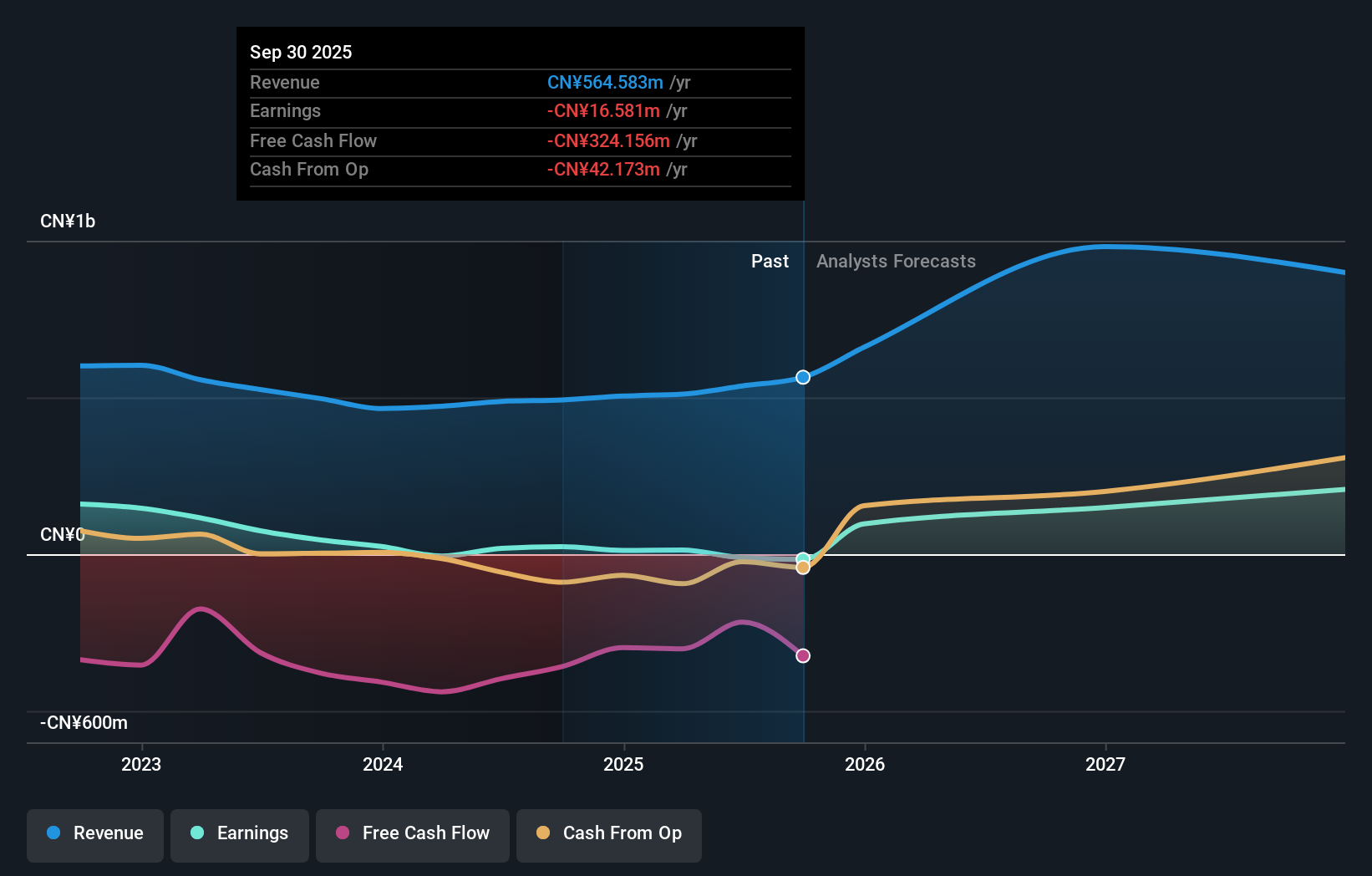

Anhui Estone Materials Technology is poised for significant growth, with revenue expected to increase by 24.1% annually, outpacing the Chinese market. Despite recent volatility in its share price and a net loss of CNY 13.83 million for the first nine months of 2025, the company anticipates becoming profitable within three years. A recently announced share repurchase program worth up to CNY 55 million aims to support employee incentives, indicating confidence in future prospects despite current challenges.

- Unlock comprehensive insights into our analysis of Anhui Estone Materials TechnologyLtd stock in this growth report.

- Our valuation report here indicates Anhui Estone Materials TechnologyLtd may be overvalued.

Kehua Data (SZSE:002335)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kehua Data Co., Ltd. offers integrated solutions for power protection and energy conservation both in China and internationally, with a market cap of CN¥29.71 billion.

Operations: Kehua Data generates revenue through its provision of integrated power protection and energy conservation solutions both domestically and internationally.

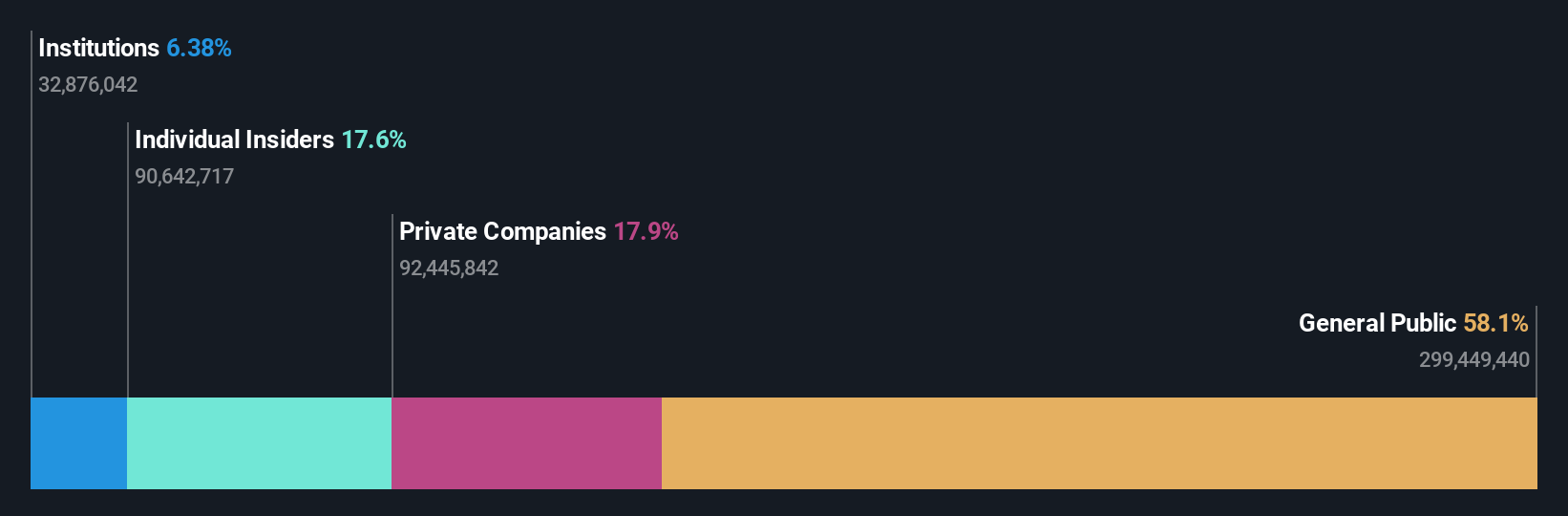

Insider Ownership: 17.6%

Revenue Growth Forecast: 23.6% p.a.

Kehua Data demonstrates strong growth potential, with earnings forecasted to rise significantly by 48.4% annually, surpassing the broader Chinese market's growth rate. Despite a volatile share price, recent earnings reports show improvement, with net income reaching CNY 344.5 million for the first nine months of 2025 compared to CNY 238.07 million a year ago. Revenue is also set to grow at an impressive rate of 23.6% per year, indicating robust business momentum without substantial insider trading activity recently noted.

- Click here to discover the nuances of Kehua Data with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Kehua Data's current price could be inflated.

Summing It All Up

- Delve into our full catalog of 623 Fast Growing Asian Companies With High Insider Ownership here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688733

Anhui Estone Materials TechnologyLtd

Provides lithium battery coating, electronic communication functional filling, and low-smoke halogen-free flame-retardant materials in China.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives