As global markets continue to navigate mixed economic signals, Chinese equities have faced notable challenges, with key indices like the Shanghai Composite and CSI 300 experiencing declines. Despite these headwinds, small-cap stocks in China present intriguing opportunities for investors willing to explore beyond the well-trodden paths. In this context, identifying a good stock involves looking for companies with strong fundamentals, innovative business models, and growth potential that can weather broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Beijing Haohan Data TechnologyLtd | 0.68% | 9.58% | 15.38% | ★★★★★★ |

| Jiangsu JIXIN Wind Energy Technology | 4.12% | 0.51% | 12.27% | ★★★★★★ |

| Hangzhou Fortune Gas Cryogenic Group | 4.34% | 22.10% | 21.31% | ★★★★★★ |

| Zhejiang Kingland Pipeline and TechnologiesLtd | 6.90% | 4.67% | -4.50% | ★★★★★★ |

| Shanghai Xujiahui Commercial | NA | -34.49% | -34.61% | ★★★★★★ |

| Zhejiang Wellsun Intelligent TechnologyLtd | 2.48% | 30.08% | 34.66% | ★★★★★☆ |

| Xinjiang Torch Gas | 4.71% | 16.54% | 9.37% | ★★★★★☆ |

| Chongqing Changjiang River Moulding Material (Group) | 6.21% | -0.02% | 3.43% | ★★★★★☆ |

| Xinya Electronic | 75.53% | 35.77% | 6.22% | ★★★★☆☆ |

| Chongqing Gas Group | 23.23% | 9.54% | 1.00% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Qingdao Yunlu Advanced Materials Technology (SHSE:688190)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qingdao Yunlu Advanced Materials Technology Co., Ltd. (SHSE:688190) specializes in the development and production of advanced materials, with a market cap of CN¥7.94 billion.

Operations: The company generates revenue primarily from the sale of advanced materials. Its financial performance includes a notable net profit margin trend of 12.5% over the last fiscal year, reflecting its operational efficiency in managing costs and generating profits.

Qingdao Yunlu Advanced Materials Technology, a small-cap player in China's metals and mining sector, boasts a price-to-earnings ratio of 23.7x, undercutting the CN market average of 28.5x. Over the past year, earnings surged by 26.7%, outpacing the industry’s -0.4%. With levered free cash flow reaching ¥210M as of June 2023 and net profit margins at 15%, it seems well-positioned for continued growth with forecasts predicting an annual increase of 15.52%.

Beijing Tianma Intelligent Control Technology (SHSE:688570)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Tianma Intelligent Control Technology Co., Ltd. specializes in the development and manufacturing of intelligent control systems for construction machinery and equipment, with a market cap of CN¥8.33 billion.

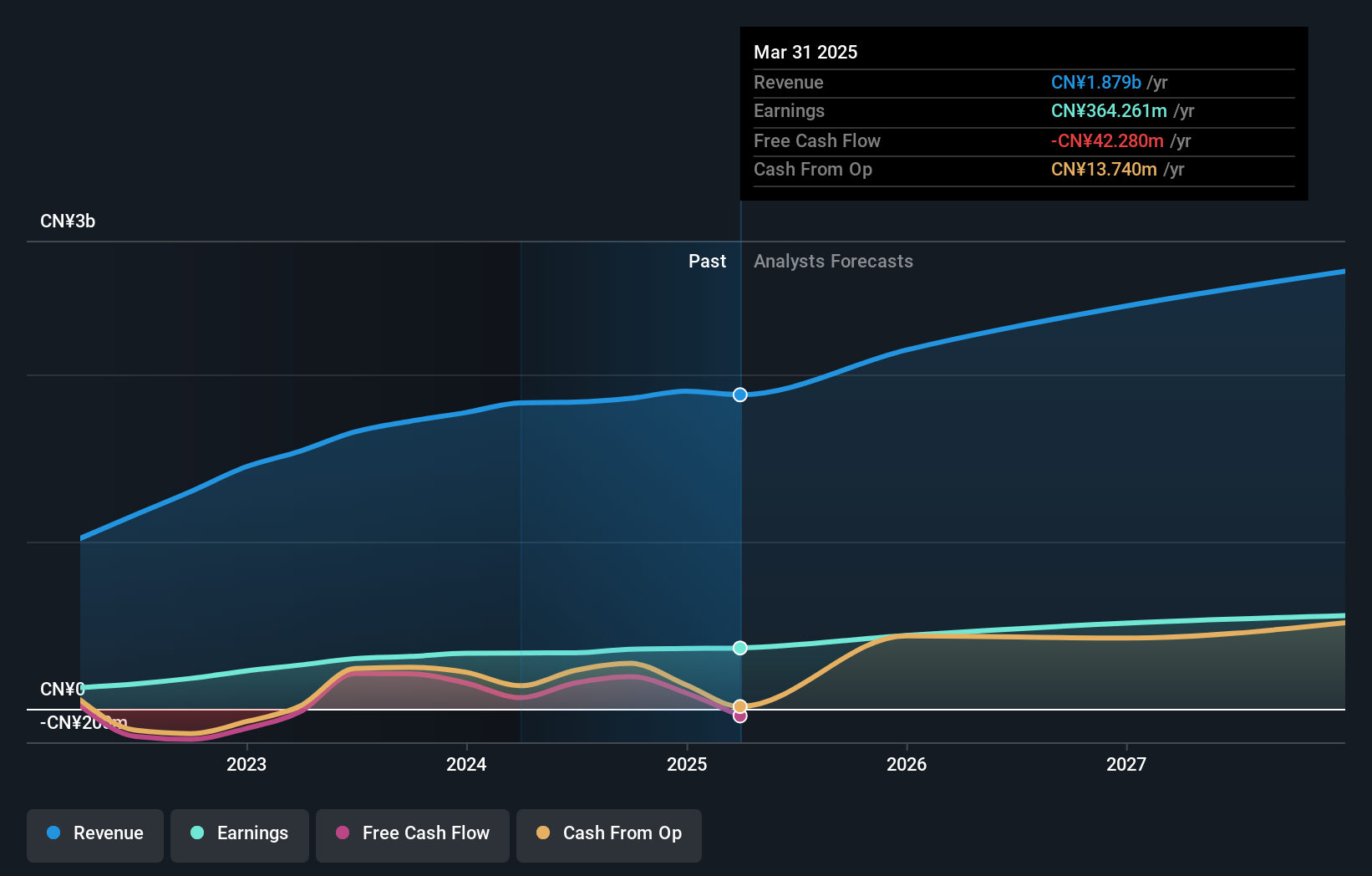

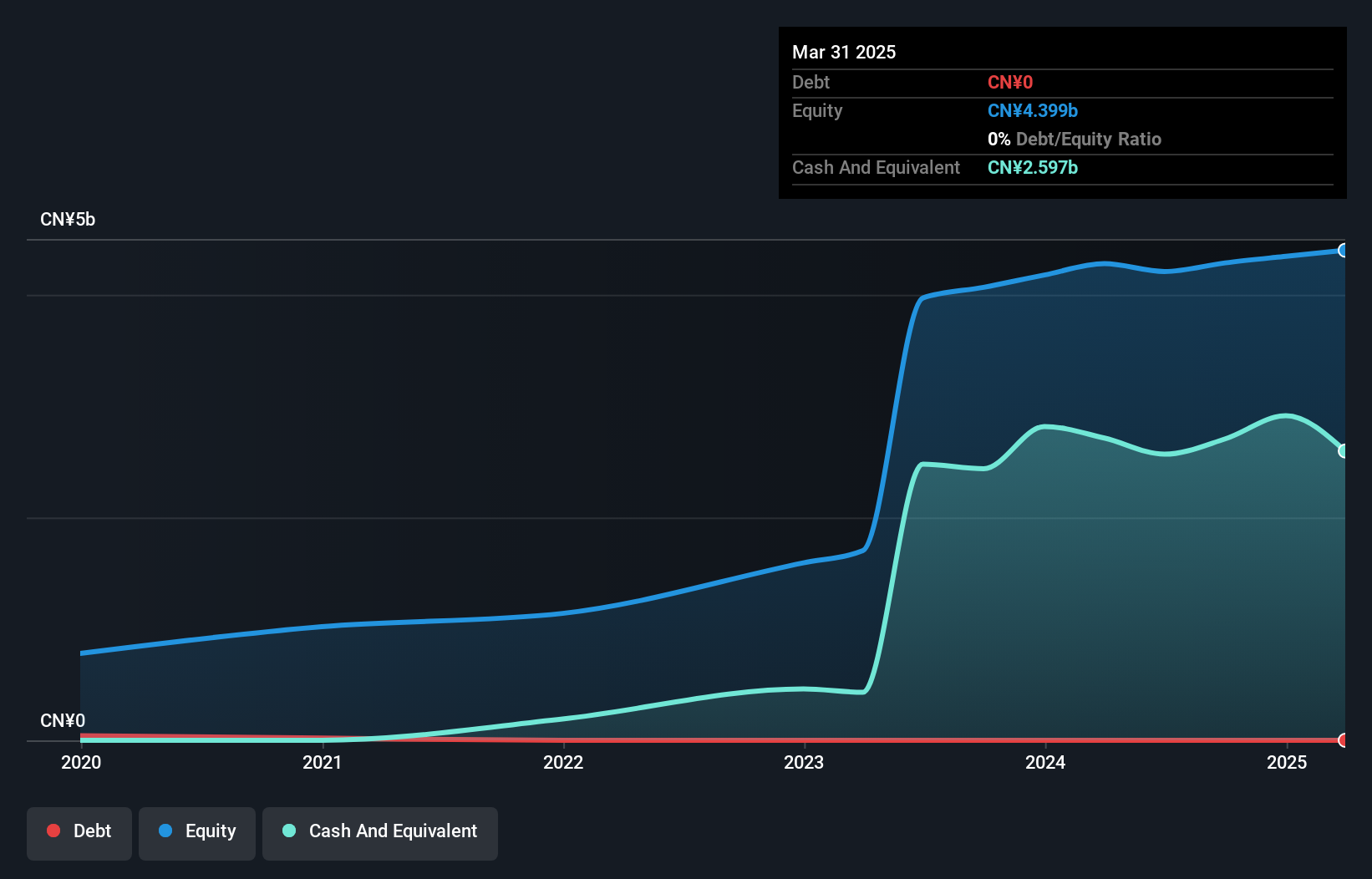

Operations: The company generates revenue primarily from its construction machinery and equipment segment, amounting to CN¥2.21 billion.

Beijing Tianma Intelligent Control Technology, a promising player in the machinery sector, has shown robust earnings growth of 6.7% over the past year, outpacing the industry average of 4.3%. The company boasts a price-to-earnings ratio of 19.2x, which is attractive compared to the CN market's 28.5x. With no debt and high-quality earnings, its financial health appears solid. Additionally, being added to major Shanghai Stock Exchange indices signals growing investor confidence and visibility in the market.

Shandong Oriental Ocean Sci-Tech (SZSE:002086)

Simply Wall St Value Rating: ★★★★☆☆

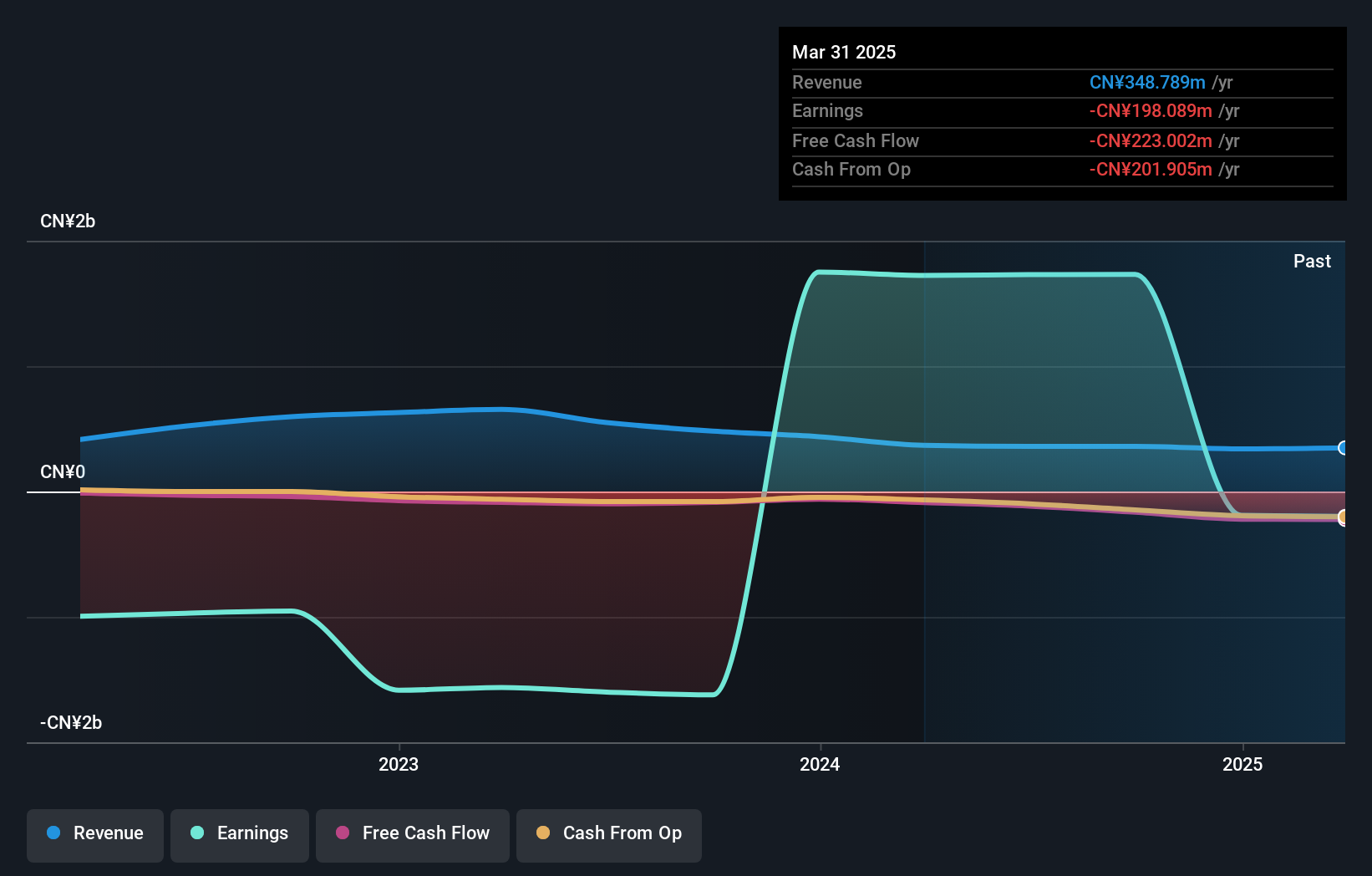

Overview: Shandong Oriental Ocean Sci-Tech Co., Ltd. operates in seawater seedling breeding, aquaculture, aquatic product processing, biotechnology, bonded warehousing, and logistics sectors both domestically and internationally with a market cap of CN¥4.11 billion.

Operations: Shandong Oriental Ocean Sci-Tech Co., Ltd. generates revenue primarily from its aquaculture, aquatic product processing, and biotechnology segments. The company has a market cap of CN¥4.11 billion.

Shandong Oriental Ocean Sci-Tech has seen significant changes recently, including the election of new non-independent directors Liu Hongtao, Zhang Le, and Wang Yuchi. The company turned profitable this year, making comparisons to the Food industry (6.6%) challenging. Its debt-to-equity ratio improved from 34.2% to 23.3% over five years, and it boasts a low Price-To-Earnings ratio of 2.4x compared to the CN market's 28.5x average. However, shareholders faced substantial dilution in the past year.

Seize The Opportunity

- Discover the full array of 990 Chinese Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002086

Shandong Oriental Ocean Sci-Tech

Engages in the seawater seedling breeding, aquaculture, aquatic product processing, biotechnology, bonded warehousing, and logistics businesses in China and internationally.

Proven track record with adequate balance sheet.