- China

- /

- Medical Equipment

- /

- SZSE:300677

Top Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As global markets reach record highs driven by China's new stimulus measures and optimism around artificial intelligence, investors are increasingly looking for robust opportunities. In this environment, growth companies with high insider ownership can be particularly attractive, as they often demonstrate strong commitment from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

We're going to check out a few of the best picks from our screener tool.

Arctech Solar Holding (SHSE:688408)

Simply Wall St Growth Rating: ★★★★★★

Overview: Arctech Solar Holding Co., Ltd. manufactures and supplies solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for utility-scale and commercial solar projects worldwide, with a market cap of CN¥14.31 billion.

Operations: The company generates revenue through the manufacture and supply of solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for utility-scale and commercial solar projects globally.

Insider Ownership: 38.6%

Earnings Growth Forecast: 29.9% p.a.

Arctech Solar Holding demonstrates strong growth potential with earnings forecasted to grow at 29.9% per year, surpassing the CN market's 23%. The company's revenue is also expected to grow faster than the market at 23.7% annually. Recent earnings reports show significant improvement, with net income rising from CNY 98.08 million to CNY 231.33 million year-over-year. However, its dividend of 0.7% is not well covered by free cash flows, indicating potential sustainability concerns despite high insider ownership and robust financial performance projections.

- Click to explore a detailed breakdown of our findings in Arctech Solar Holding's earnings growth report.

- Our expertly prepared valuation report Arctech Solar Holding implies its share price may be lower than expected.

Winning Health Technology Group (SZSE:300253)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Winning Health Technology Group Co., Ltd. (SZSE:300253) operates in the healthcare technology sector and has a market cap of CN¥13.50 billion.

Operations: Winning Health Technology Group Co., Ltd. (SZSE:300253) generates revenue from various segments in the healthcare technology sector, with total revenues amounting to CN¥13.50 billion.

Insider Ownership: 22.7%

Earnings Growth Forecast: 30.9% p.a.

Winning Health Technology Group's recent earnings report highlights a revenue increase to CNY 1.22 billion and net income growth from CNY 16.59 million to CNY 30.17 million year-over-year, reflecting robust financial performance. Despite a low forecasted return on equity of 10.4%, the company’s revenue and earnings are expected to grow faster than the CN market at 16.9% and 30.95% per year, respectively, indicating strong growth prospects supported by high insider ownership and strategic initiatives like share repurchase plans.

- Navigate through the intricacies of Winning Health Technology Group with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Winning Health Technology Group is priced higher than what may be justified by its financials.

Intco Medical Technology (SZSE:300677)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intco Medical Technology Co., Ltd. engages in the research, development, production, and marketing of medical consumables, healthcare equipment, and physiotherapy care products for use in medical and elderly care institutions as well as household daily use, with a market cap of CN¥15.67 billion.

Operations: Revenue Segments (in millions of CN¥): Medical consumables: 8,500; Healthcare equipment: 4,200; Physiotherapy care products: 1,300. Intco Medical Technology's revenue is derived from medical consumables (CN¥8.50 billion), healthcare equipment (CN¥4.20 billion), and physiotherapy care products (CN¥1.30 billion).

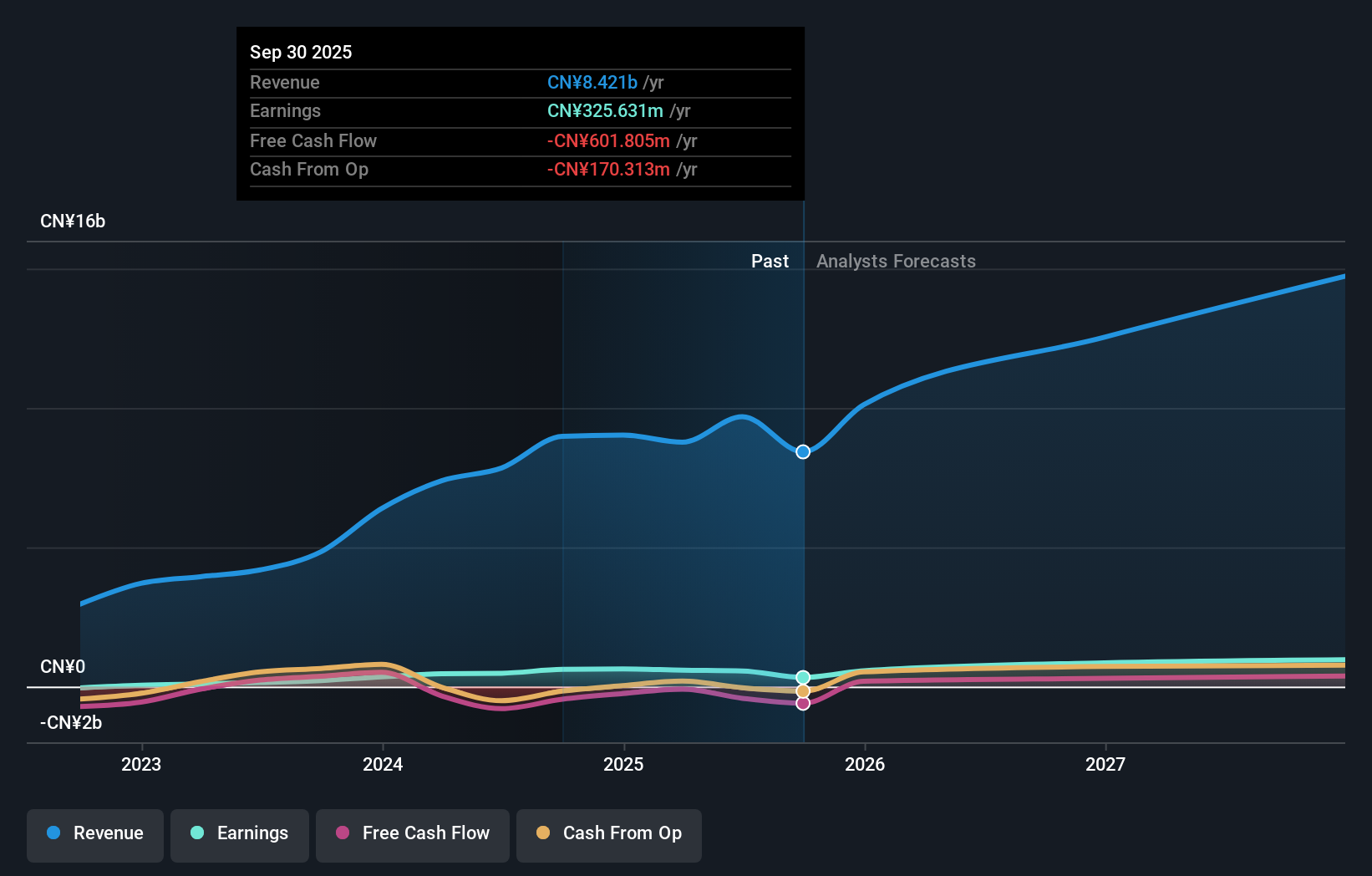

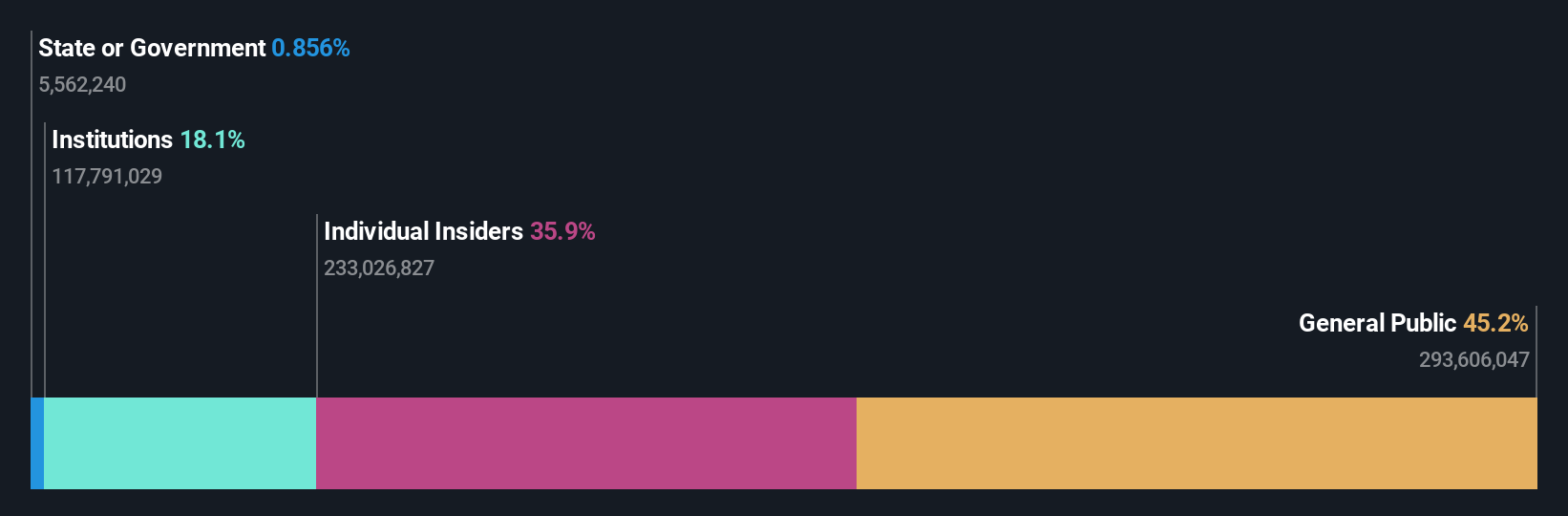

Insider Ownership: 36%

Earnings Growth Forecast: 34.2% p.a.

Intco Medical Technology's earnings are forecast to grow 34.2% annually, outpacing the CN market. Despite a low return on equity forecast of 8.9%, the company trades at a favorable P/E ratio of 26.8x compared to the CN market's 30x. Recent financials show revenue up from CNY 3.29 billion to CNY 4.51 billion year-over-year, with net income rising from CNY 293 million to CNY 587 million, reflecting strong growth supported by insider ownership and strategic share repurchase plans worth up to CNY 120 million.

- Take a closer look at Intco Medical Technology's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Intco Medical Technology's current price could be quite moderate.

Summing It All Up

- Embark on your investment journey to our 1526 Fast Growing Companies With High Insider Ownership selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300677

Intco Medical Technology

Engages in the research and development, production, and marketing of medical consumables, health care equipment, and physiotherapy care products that are used in medical and elderly care institutions, household daily use, and other related industries in China and internationally.

Reasonable growth potential with adequate balance sheet.