Damon Technology Group Co.,Ltd.'s (SHSE:688360) Share Price Is Matching Sentiment Around Its Earnings

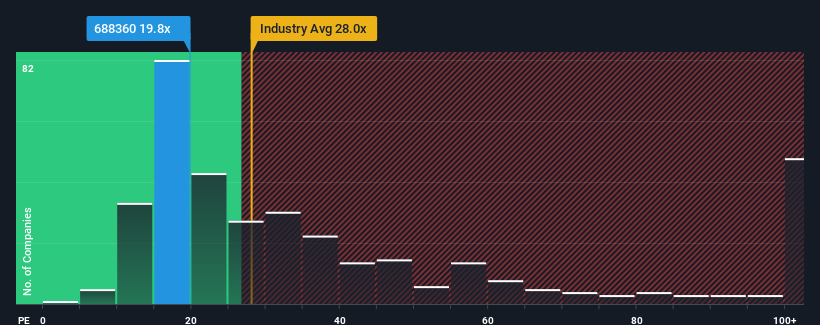

Damon Technology Group Co.,Ltd.'s (SHSE:688360) price-to-earnings (or "P/E") ratio of 19.8x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 29x and even P/E's above 54x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's exceedingly strong of late, Damon Technology GroupLtd has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Damon Technology GroupLtd

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Damon Technology GroupLtd would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 41% gain to the company's bottom line. EPS has also lifted 9.5% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 36% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Damon Technology GroupLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Damon Technology GroupLtd's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Damon Technology GroupLtd maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 3 warning signs for Damon Technology GroupLtd that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688360

Damon Technology GroupLtd

Research, develops, manufactures, sells, and services automated logistics solutions in China and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives