- China

- /

- Consumer Durables

- /

- SZSE:301383

3 Undiscovered Gems With Promising Potential On None Exchange

Reviewed by Simply Wall St

In the midst of a turbulent week for global markets, characterized by fluctuating indices and geopolitical uncertainties, small-cap stocks have faced their own set of challenges. As major economies grapple with interest rate decisions and inflation concerns, investors are increasingly on the lookout for undiscovered opportunities that might offer resilience and growth potential in such a dynamic environment. Identifying promising stocks often involves looking beyond immediate market noise to find companies with strong fundamentals or unique positioning within their industries, which can be particularly appealing during periods of economic uncertainty.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.78% | 27.31% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Damon Technology GroupLtd (SHSE:688360)

Simply Wall St Value Rating: ★★★★★☆

Overview: Damon Technology Group Co., Ltd. specializes in the research, development, manufacturing, sales, and servicing of automated logistics solutions both in China and internationally, with a market capitalization of approximately CN¥4.31 billion.

Operations: Damon Technology Group generates its revenue primarily from the high-end equipment manufacturing industry, amounting to CN¥1.57 billion.

Damon Technology Group, a nimble player in its sector, showcases impressive financial robustness with EBIT covering interest payments 187.8 times over. Its recent earnings surge of 54.8% outpaces the broader Machinery industry, which saw a contraction of 0.4%. However, the company's debt-to-equity ratio nudged up slightly from 17.1% to 18.9% over five years, indicating some leverage increase but still manageable given its cash position exceeding total debt levels. A notable event includes Zhu Guangkui's acquisition of a 5% stake for CN¥140 million at CN¥14 per share, reflecting market confidence in Damon's potential growth trajectory.

- Unlock comprehensive insights into our analysis of Damon Technology GroupLtd stock in this health report.

Gain insights into Damon Technology GroupLtd's past trends and performance with our Past report.

Zhejiang ZUCH Technology (SZSE:301280)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang ZUCH Technology Co., Ltd. specializes in providing electric connectors in China and has a market capitalization of CN¥4.56 billion.

Operations: Zhejiang ZUCH Technology generates revenue primarily from its electric connectors business in China. The company has a market capitalization of CN¥4.56 billion.

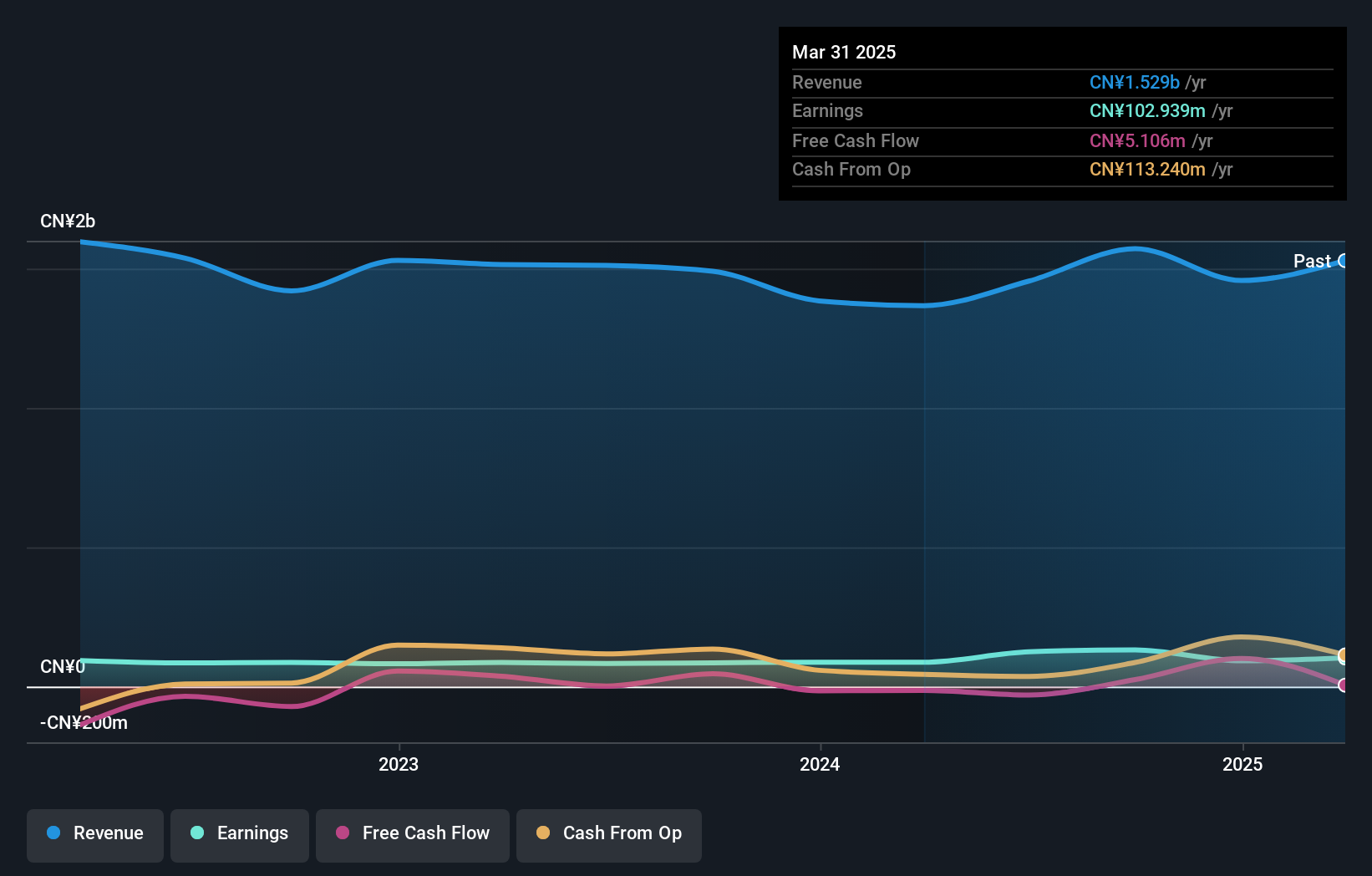

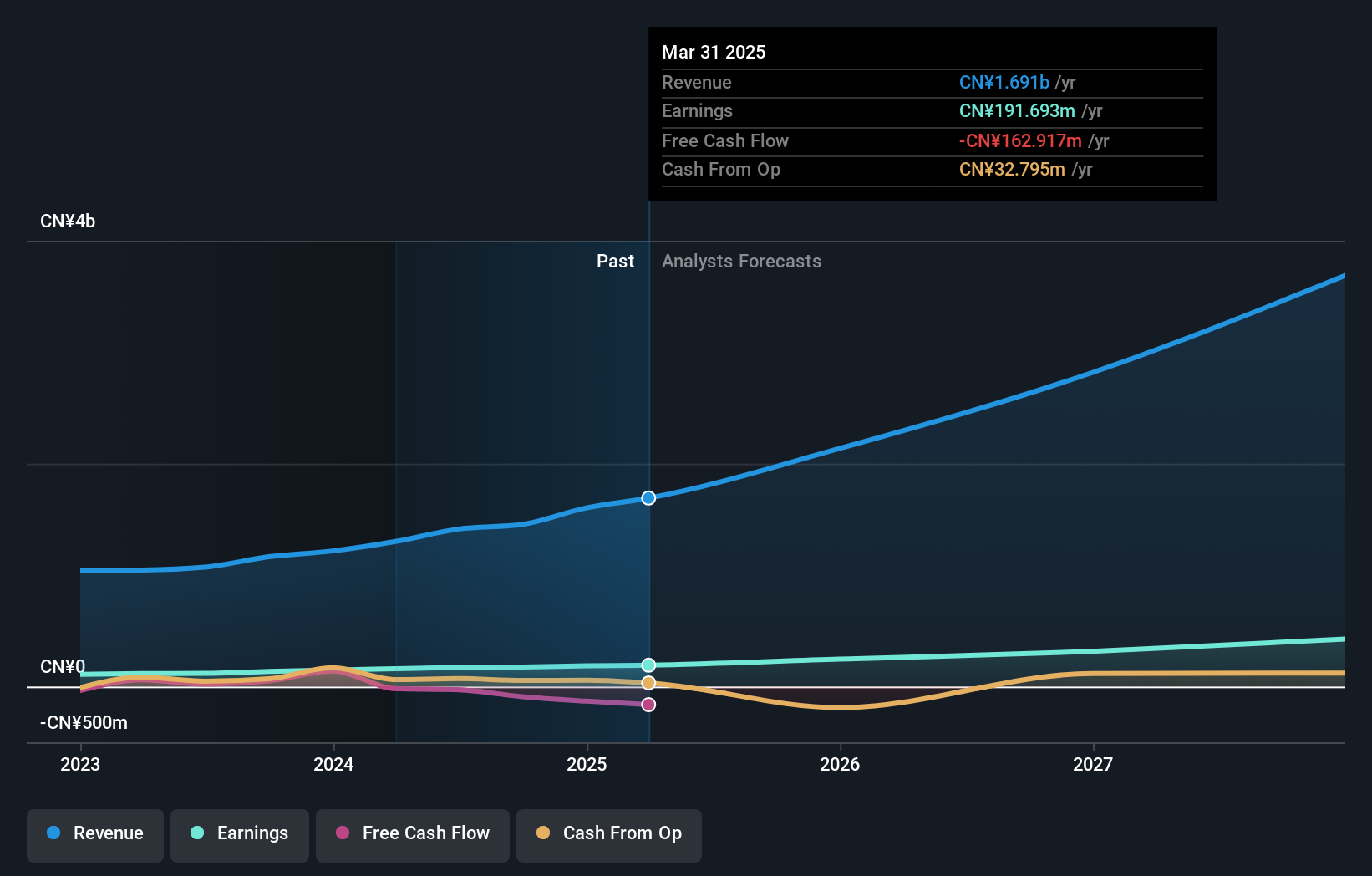

Zhejiang ZUCH Technology, a smaller player in the electronics sector, has seen impressive earnings growth of 28.5% over the past year, outpacing the industry average of 2.3%. Its debt-to-equity ratio has significantly improved from 35.4% to just 1.9% in five years, reflecting strong financial management and reduced leverage risk. Trading at a price-to-earnings ratio of 26.1x, it offers good value compared to peers and the broader CN market at 34.9x. Despite not being free cash flow positive recently, its high level of non-cash earnings suggests quality profits that could support future expansion plans discussed in upcoming meetings.

Minami Acoustics (SZSE:301383)

Simply Wall St Value Rating: ★★★★★★

Overview: Minami Acoustics Limited focuses on the research, development, production, and sale of electroacoustic components and accessories in China with a market capitalization of CN¥10.19 billion.

Operations: Minami Acoustics generates revenue primarily from its electronic component segment, which contributed CN¥2.14 billion. The company's financial performance is influenced by its net profit margin trends, reflecting the efficiency of operations and cost management strategies.

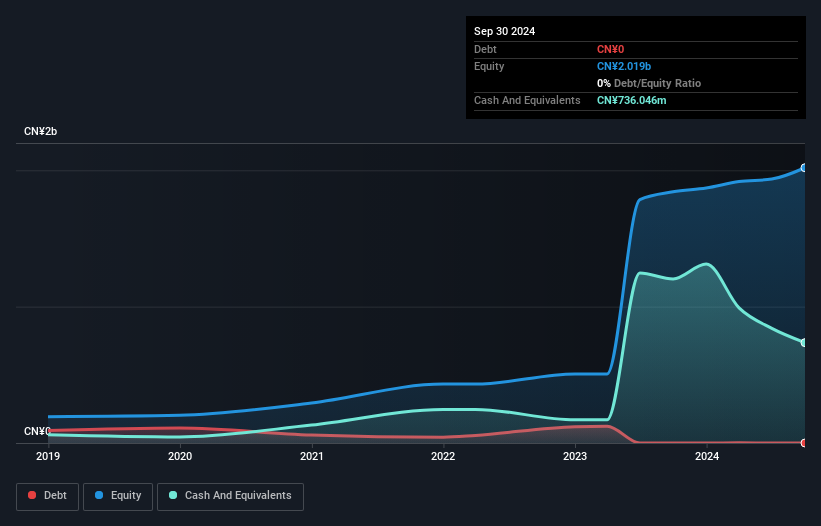

Minami Acoustics, a nimble player in the Consumer Durables sector, has demonstrated impressive earnings growth of 29.4% over the past year, outpacing the industry average of -1.9%. The company is debt-free, a significant improvement from five years ago when its debt-to-equity ratio stood at 52.7%, indicating robust financial health. Despite recent volatility in share price over three months, Minami remains profitable with positive free cash flow and high-quality non-cash earnings. Recent amendments to its articles and cash management system could streamline operations and potentially enhance future financial flexibility and growth prospects for this emerging entity.

Where To Now?

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4721 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301383

Minami Acoustics

Engages in the research, development, production, and sale of electroacoustic components and accessories in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives