Further Upside For Zhuzhou Huarui Precision Cutting Tools Co.,Ltd. (SHSE:688059) Shares Could Introduce Price Risks After 34% Bounce

The Zhuzhou Huarui Precision Cutting Tools Co.,Ltd. (SHSE:688059) share price has done very well over the last month, posting an excellent gain of 34%. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

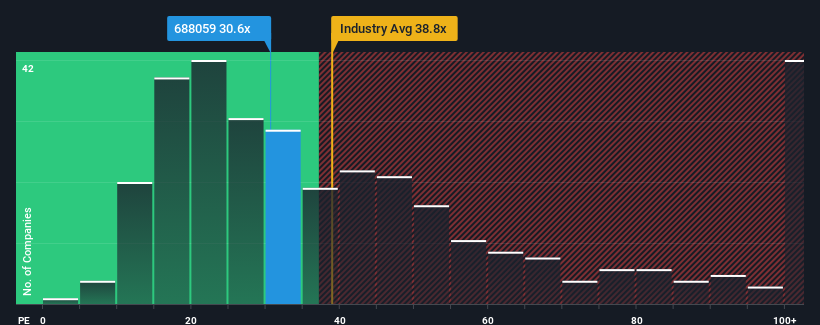

Although its price has surged higher, Zhuzhou Huarui Precision Cutting ToolsLtd's price-to-earnings (or "P/E") ratio of 30.6x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 38x and even P/E's above 74x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Zhuzhou Huarui Precision Cutting ToolsLtd has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Zhuzhou Huarui Precision Cutting ToolsLtd

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Zhuzhou Huarui Precision Cutting ToolsLtd's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 21%. The last three years don't look nice either as the company has shrunk EPS by 23% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 39% over the next year. Meanwhile, the rest of the market is forecast to expand by 37%, which is not materially different.

In light of this, it's peculiar that Zhuzhou Huarui Precision Cutting ToolsLtd's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Despite Zhuzhou Huarui Precision Cutting ToolsLtd's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Zhuzhou Huarui Precision Cutting ToolsLtd's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Zhuzhou Huarui Precision Cutting ToolsLtd (at least 2 which are significant), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zhuzhou Huarui Precision Cutting ToolsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688059

Zhuzhou Huarui Precision Cutting ToolsLtd

Zhuzhou Huarui Precision Cutting Tools Co.,Ltd.

High growth potential with solid track record.

Market Insights

Community Narratives