Stock Analysis

- China

- /

- Electrical

- /

- SZSE:300763

Insider-Owned Growth Companies On Chinese Exchanges To Watch In May 2024

Reviewed by Simply Wall St

As global markets exhibit mixed signals, Chinese stocks have shown resilience and optimism, buoyed by strong holiday spending and positive trade data. In this context, companies with high insider ownership in China may offer unique growth opportunities, as such ownership can signal confidence in the company's prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| YanKer shop FoodLtd (SZSE:002847) | 29.2% | 23.9% |

| Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

| Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 24.8% |

| UTour Group (SZSE:002707) | 24% | 27.3% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Fujian Wanchen Biotechnology Group (SZSE:300972) | 15.3% | 75.9% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 28.3% | 28.5% |

| Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 69.2% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 72.3% |

Let's review some notable picks from our screened stocks.

Ming Yang Smart Energy Group (SHSE:601615)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ming Yang Smart Energy Group Limited, based in China, specializes in the R&D, design, manufacturing, sales, maintenance, and operation of energy equipment including wind turbines and core components with a market capitalization of CN¥23.71 billion.

Operations: The company generates its revenue primarily through the design, manufacturing, and sale of wind turbines and related energy equipment.

Insider Ownership: 15.6%

Revenue Growth Forecast: 15.9% p.a.

Ming Yang Smart Energy Group, a Chinese growth company with high insider ownership, demonstrates a robust financial trajectory. Despite a lower Return on Equity forecast of 11.6% in three years and profit margins declining from 6.9% to 3%, the firm’s earnings are expected to grow by an impressive 37.6% annually, outpacing the broader Chinese market's forecast of 23.4%. Recent activities include significant share buybacks totaling CNY 232.36 million and a strong Q1 performance with revenue doubling to CNY 5.08 billion and net income shifting from a loss to CNY 304.18 million profit year-over-year, underscoring its recovery and growth potential.

- Click here to discover the nuances of Ming Yang Smart Energy Group with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Ming Yang Smart Energy Group's share price might be too pessimistic.

Hoymiles Power Electronics (SHSE:688032)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hoymiles Power Electronics Inc. specializes in manufacturing and selling module level power electronics (MLPE) solutions, operating both in China and globally, with a market capitalization of CN¥21.38 billion.

Operations: The company generates revenue primarily from the manufacture and sale of MLPE solutions in domestic and international markets.

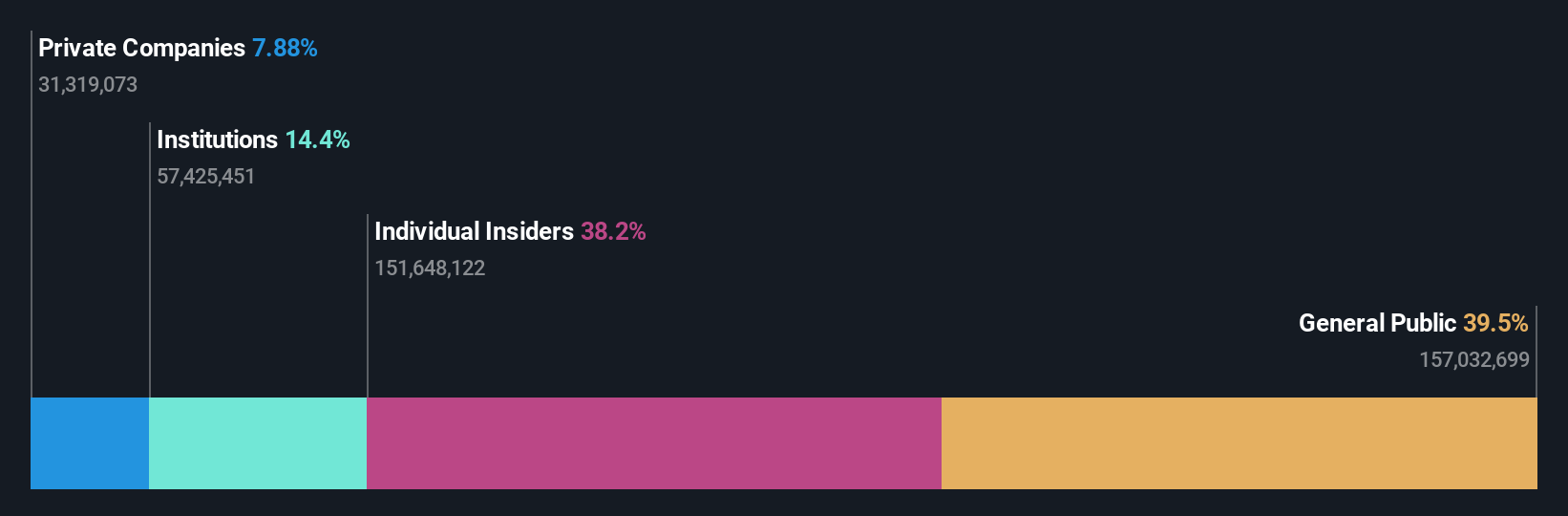

Insider Ownership: 11.2%

Revenue Growth Forecast: 38% p.a.

Hoymiles Power Electronics, a Chinese company with high insider ownership, faces challenges despite growth prospects. Its revenue is expected to grow at 38% annually, outpacing the market forecast of 14.1%, and earnings could increase by 35.5% per year. However, recent financials show a significant drop in Q1 revenue and net income from the previous year, with earnings dropping from CNY 176.32 million to CNY 67.3 million. Additionally, its return on equity is predicted to remain low at 13.8%. The company has also been active in share buybacks, spending CNY 178.83 million recently to repurchase shares.

- Dive into the specifics of Hoymiles Power Electronics here with our thorough growth forecast report.

- Our valuation report unveils the possibility Hoymiles Power Electronics' shares may be trading at a premium.

Ginlong Technologies (SZSE:300763)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ginlong Technologies Co., Ltd. specializes in the research, development, production, service, and sale of string inverters globally with a market capitalization of CN¥24.49 billion.

Operations: The company generates its revenue primarily from the global sale and service of string inverters.

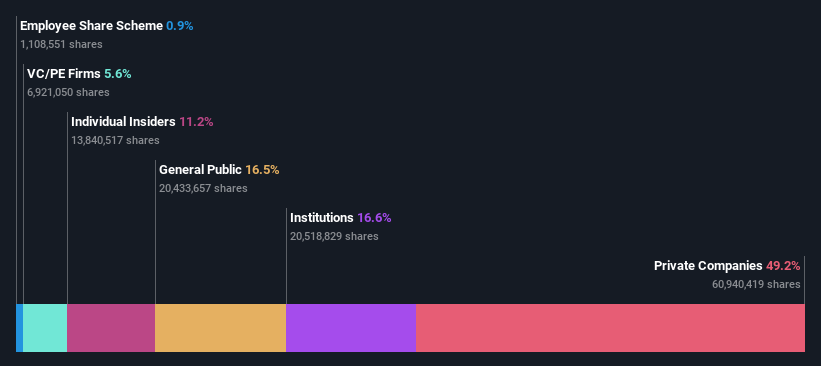

Insider Ownership: 30.5%

Revenue Growth Forecast: 18.5% p.a.

Ginlong Technologies, a Chinese growth company with high insider ownership, is expected to see its revenue grow by 18.5% annually, surpassing the market's 14.1%. However, its profit margins have declined from 18.9% to 8.1%, and recent earnings reports show a significant drop in net income from CNY 1,059.73 million to CNY 779.36 million year-over-year. Despite these challenges, the company's earnings are forecasted to increase by an impressive 26.7% annually over the next three years.

- Click here and access our complete growth analysis report to understand the dynamics of Ginlong Technologies.

- In light of our recent valuation report, it seems possible that Ginlong Technologies is trading beyond its estimated value.

Where To Now?

- Investigate our full lineup of 407 Fast Growing Chinese Companies With High Insider Ownership right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Ginlong Technologies is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300763

Ginlong Technologies

Engages in the research, development, production, service, and sale of string inverters worldwide.

Reasonable growth potential and overvalued.