- China

- /

- Trade Distributors

- /

- SHSE:600546

Discovering Three Chinese Dividend Stocks With Yields Up To 3.9%

Reviewed by Simply Wall St

As global markets navigate mixed signals, with some regions showing signs of recovery while others grapple with economic challenges, investors continue to seek stable returns amidst the uncertainty. In this context, dividend stocks in China present a compelling case for those looking to diversify their portfolios and potentially tap into yields up to 3.9%, especially considering the recent tentative signs of recovery in China's property sector and its broader economic activities. A good dividend stock typically offers not just yield but also stability and potential for long-term growth, qualities that are particularly valuable in the current fluctuating market environment.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.06% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.60% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.39% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.39% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.44% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.61% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.48% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.17% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.22% | ★★★★★★ |

Click here to see the full list of 210 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Shanxi Coal International Energy GroupLtd (SHSE:600546)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shanxi Coal International Energy Group Co., Ltd operates in coal production both domestically in China and internationally, with a market capitalization of approximately CN¥30.87 billion.

Operations: Shanxi Coal International Energy Group Co., Ltd generates its revenue primarily from coal production activities across both domestic and international markets.

Dividend Yield: 4%

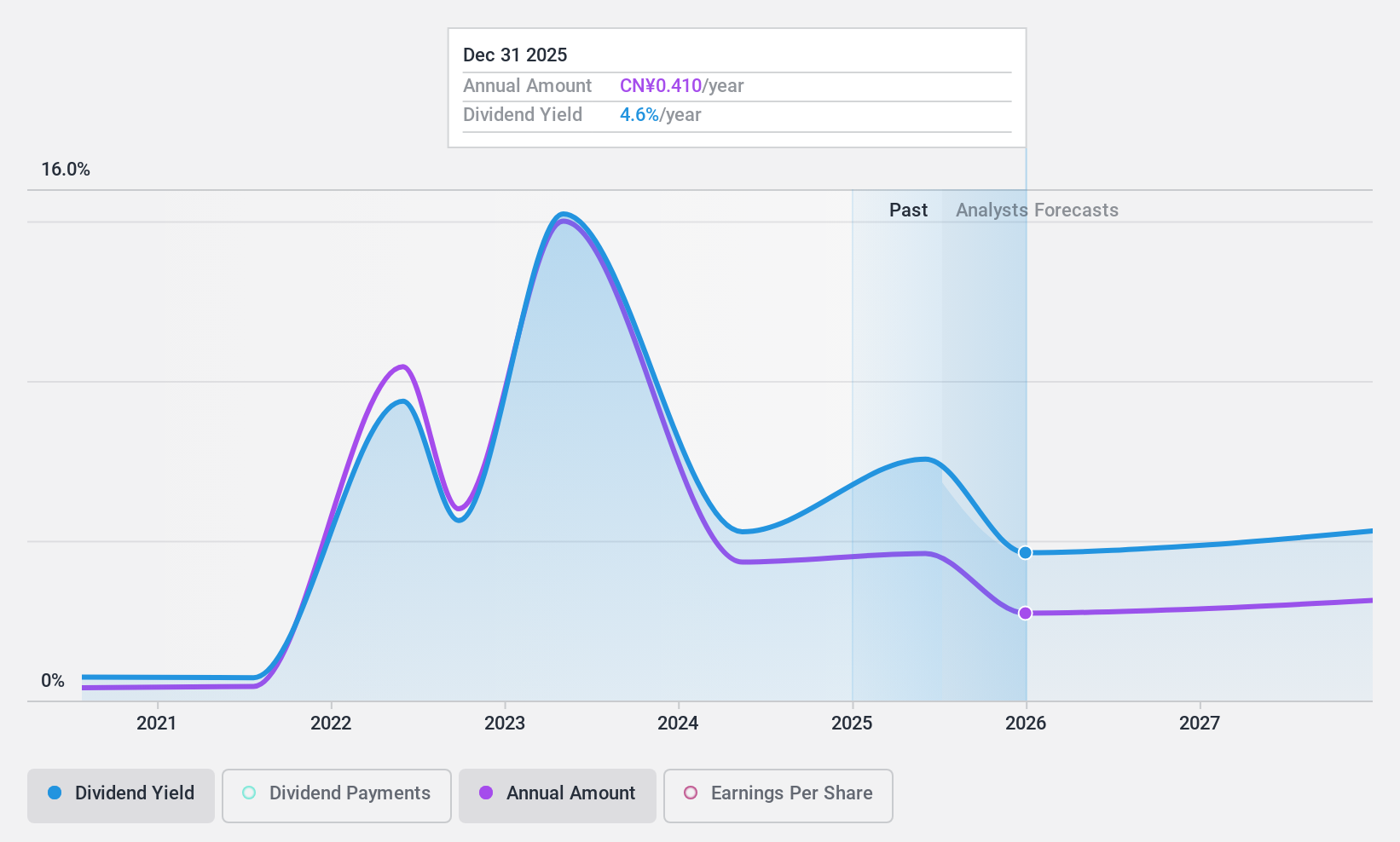

Shanxi Coal International Energy GroupLtd has seen a significant decline in quarterly and annual earnings, with Q1 2024 sales dropping to CNY 6.36 billion from CNY 10.65 billion the previous year, and net income falling to CNY 583.22 million from CNY 1.71 billion. Despite these challenges, the company maintains a dividend yield of 3.96%, supported by a conservative payout ratio of 41.2% and cash payout ratio of 50.6%. However, its dividend history shows volatility over the past decade, raising concerns about future stability even as dividends are currently well-covered by earnings and cash flow.

- Take a closer look at Shanxi Coal International Energy GroupLtd's potential here in our dividend report.

- Upon reviewing our latest valuation report, Shanxi Coal International Energy GroupLtd's share price might be too pessimistic.

L&K Engineering (Suzhou)Ltd (SHSE:603929)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: L&K Engineering (Suzhou) Ltd. specializes in providing cleanroom engineering services across China, with a market capitalization of CN¥5.37 billion.

Operations: L&K Engineering (Suzhou) Ltd. generates its revenue primarily from cleanroom engineering services throughout China.

Dividend Yield: 3.8%

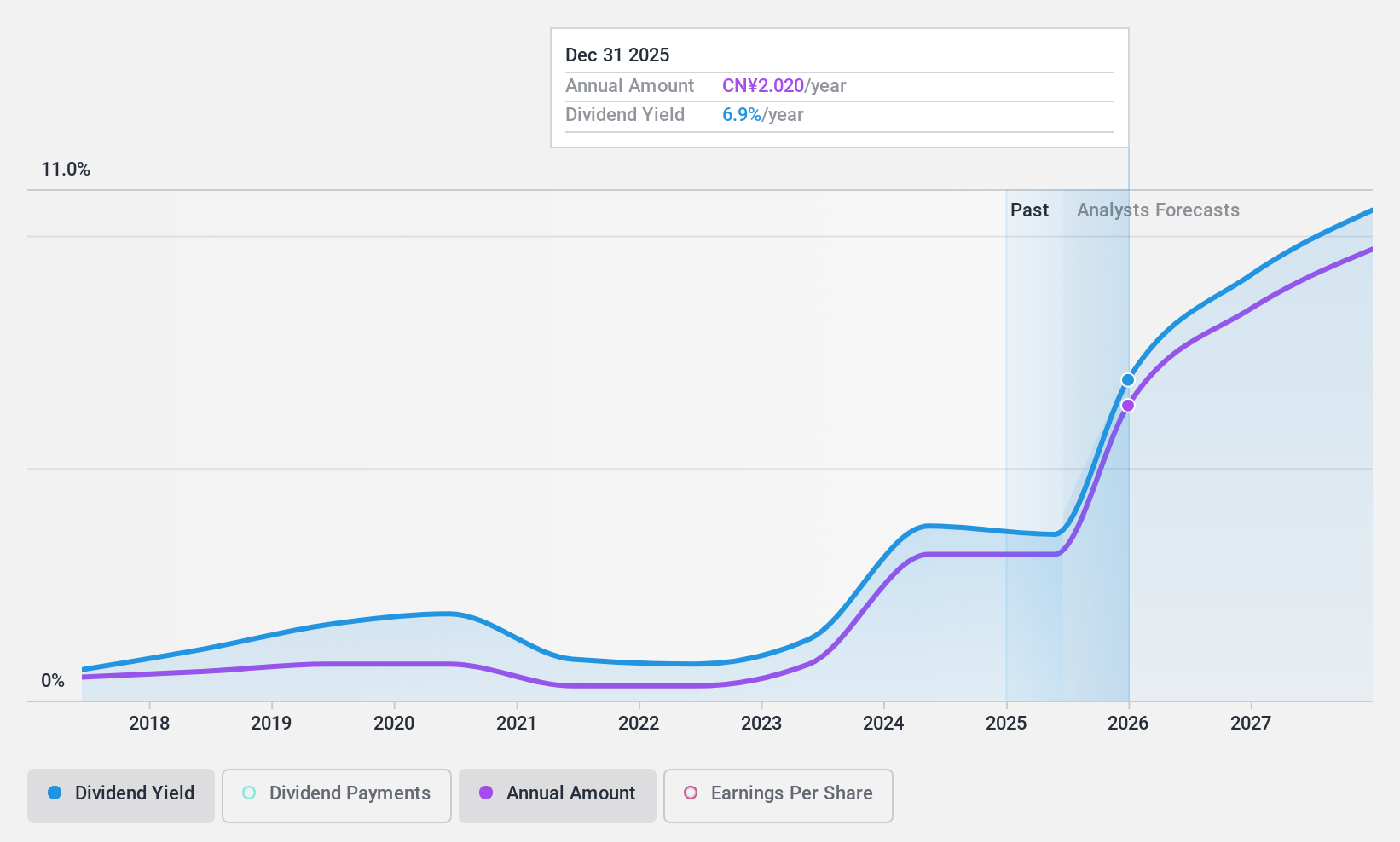

L&K Engineering (Suzhou) Ltd. demonstrated robust growth with Q1 2024 sales tripling to CNY 1.10 billion from CNY 322.76 million year-over-year, and net income also showing a significant increase to CNY 116.84 million from CNY 32.62 million. Despite this financial improvement, the company's dividend history is less consistent, having paid dividends for only seven years with some volatility in payments; however, its current dividend yield stands at a competitive 3.81%. The dividends are well-supported by earnings and cash flow with payout ratios of 57.4% and 36.4% respectively, suggesting sustainability despite past fluctuations.

- Navigate through the intricacies of L&K Engineering (Suzhou)Ltd with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that L&K Engineering (Suzhou)Ltd is trading beyond its estimated value.

Jiangsu Huachang Chemical (SZSE:002274)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Huachang Chemical Co., Ltd is a Chinese company engaged in the manufacturing and sale of agrochemicals, basic chemicals, fine chemicals, and biochemical products, with a market capitalization of approximately CN¥7.28 billion.

Operations: Jiangsu Huachang Chemical Co., Ltd generates its revenue primarily from the sale of agrochemicals, basic chemicals, fine chemicals, and biochemical products across China.

Dividend Yield: 3.7%

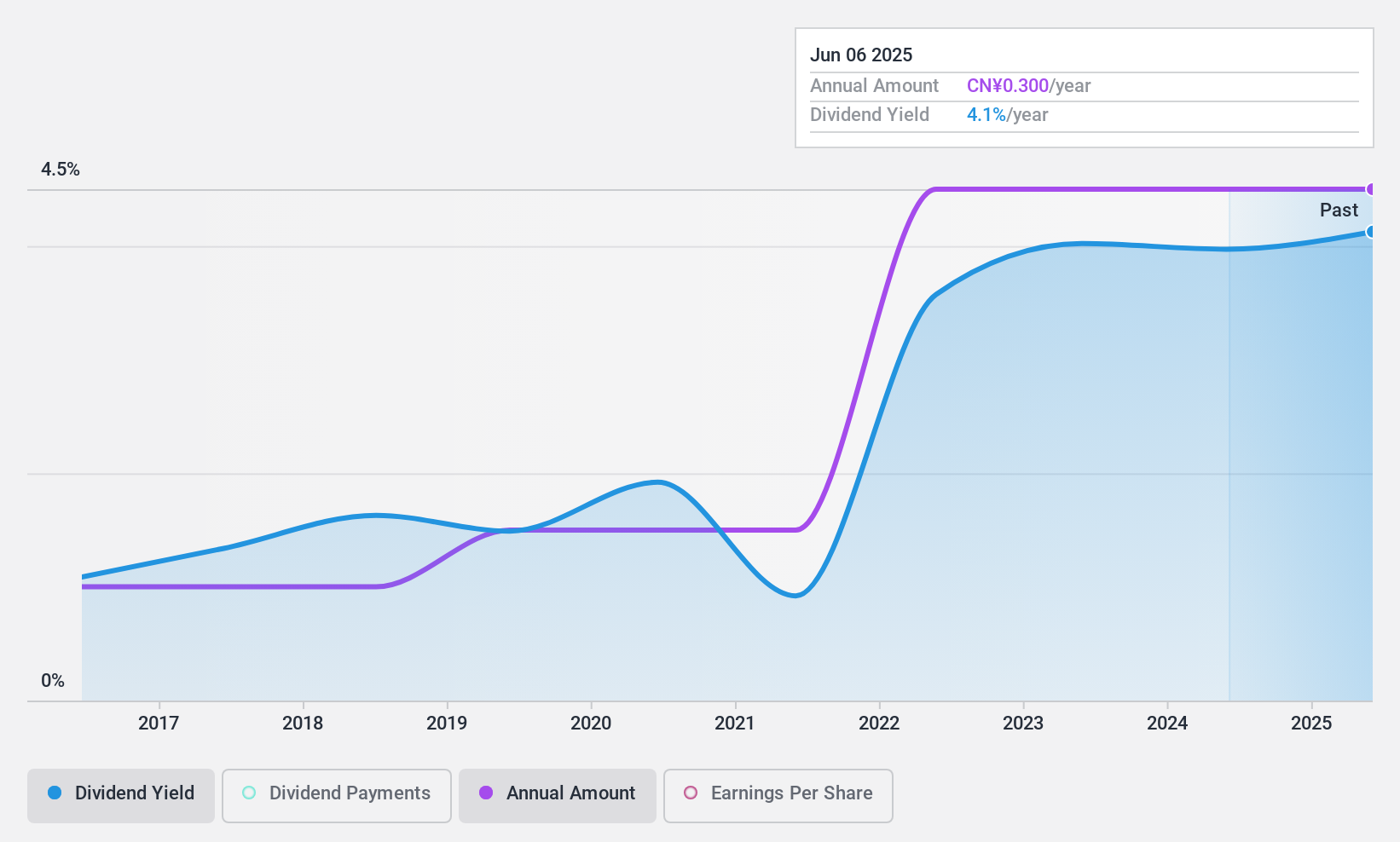

Jiangsu Huachang Chemical Co. Ltd., despite a recent dip in annual sales to CNY 8.19 billion from CNY 9.02 billion, has maintained a steady dividend with the latest confirmation of CNY 3 per 10 shares. The company's dividends are well-supported by both earnings and cash flow, with payout ratios of 37.3% and 51.4% respectively, indicating sustainability despite its relatively short dividend history of eight years. While the firm's net income rose to CNY 242.52 million in Q1 2024 from CNY 205.52 million in the previous year, it continues to trade slightly below its estimated fair value, offering potential value for investors looking for income stocks in China’s market where Jiangsu Huachang’s yield is notably higher than average.

- Delve into the full analysis dividend report here for a deeper understanding of Jiangsu Huachang Chemical.

- Our comprehensive valuation report raises the possibility that Jiangsu Huachang Chemical is priced lower than what may be justified by its financials.

Summing It All Up

- Unlock our comprehensive list of 210 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600546

Shanxi Coal International Energy GroupLtd

Engages in the coal production business in China and internationally.

Flawless balance sheet established dividend payer.