- China

- /

- Electrical

- /

- SHSE:603738

TKD Science and Technology Co.,Ltd. (SHSE:603738) Stocks Shoot Up 28% But Its P/E Still Looks Reasonable

Those holding TKD Science and Technology Co.,Ltd. (SHSE:603738) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 27% in the last twelve months.

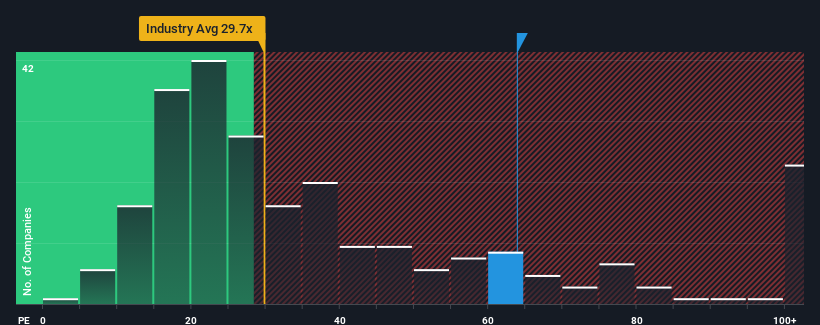

Since its price has surged higher, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 30x, you may consider TKD Science and TechnologyLtd as a stock to avoid entirely with its 63.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

TKD Science and TechnologyLtd has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for TKD Science and TechnologyLtd

Does Growth Match The High P/E?

In order to justify its P/E ratio, TKD Science and TechnologyLtd would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 66%. Even so, admirably EPS has lifted 337% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 108% over the next year. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that TKD Science and TechnologyLtd's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On TKD Science and TechnologyLtd's P/E

The strong share price surge has got TKD Science and TechnologyLtd's P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of TKD Science and TechnologyLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for TKD Science and TechnologyLtd you should be aware of.

Of course, you might also be able to find a better stock than TKD Science and TechnologyLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if TKD Science and TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603738

TKD Science and TechnologyLtd

Researches, develops, produces, and sells quartz frequency control components and production equipment in primarily China.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives