Exploring December 2024's Undiscovered Gems with Potential on None

Reviewed by Simply Wall St

As global markets continue to navigate economic uncertainties, U.S. small-cap stocks have recently joined their larger peers in reaching record highs, with the Russell 2000 Index hitting an intraday peak not seen in over three years. This surge highlights a renewed investor interest in smaller companies, driven by domestic policy shifts and geopolitical developments that have shaped broader market sentiment. In this dynamic environment, identifying promising stocks often involves looking for companies with solid fundamentals and growth potential that can capitalize on current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.72% | -3.47% | -13.16% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Heilongjiang ZBD Pharmaceutical (SHSE:603567)

Simply Wall St Value Rating: ★★★★★☆

Overview: Heilongjiang ZBD Pharmaceutical Co., Ltd. is a pharmaceutical company with a market cap of CN¥11.47 billion, focusing on the development and production of various medical products.

Operations: ZBD Pharmaceutical generates revenue primarily from the sale of its medical products. The company's net profit margin stands at 15.6%.

Heilongjiang ZBD Pharmaceutical, a smaller player in the pharmaceutical sector, exhibits impressive financial resilience. Its earnings growth of 162% over the past year significantly outpaced the industry average of -2.5%, highlighting its robust performance. The company reported net income for the nine months ending September 2024 at CNY 397.73 million, up from CNY 217.08 million a year prior, reflecting strong operational efficiency. With a price-to-earnings ratio of 17.6x against the broader CN market's 36.9x, it appears undervalued relative to peers and maintains a satisfactory net debt to equity ratio at 28%.

KTK Group (SHSE:603680)

Simply Wall St Value Rating: ★★★★★☆

Overview: KTK Group Co., Ltd. engages in the research, development, production, sale, and servicing of interior systems, electrical controlling systems, and vehicle equipment for high-speed trains, metro systems, light rail vehicles (LRV), and ordinary rail passenger cars both in China and internationally with a market capitalization of approximately CN¥7.21 billion.

Operations: KTK Group generates revenue through the production and sale of interior systems, electrical controlling systems, and vehicle equipment for various rail vehicles. The company has a market capitalization of approximately CN¥7.21 billion.

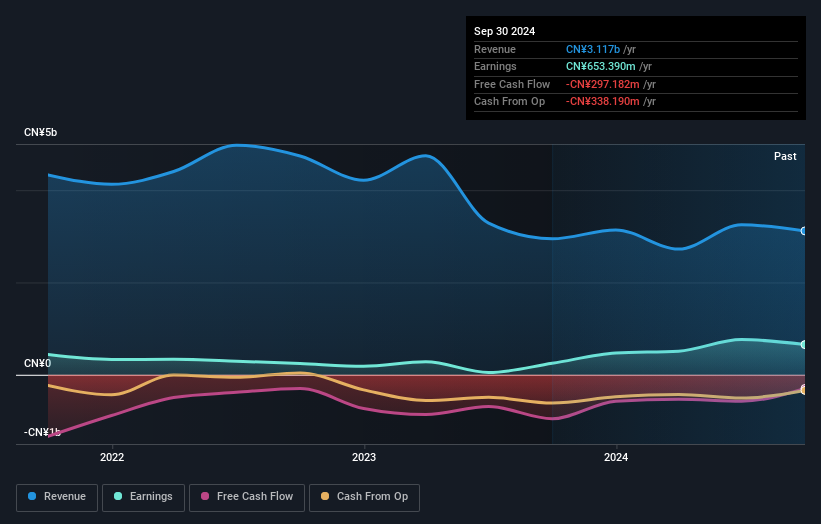

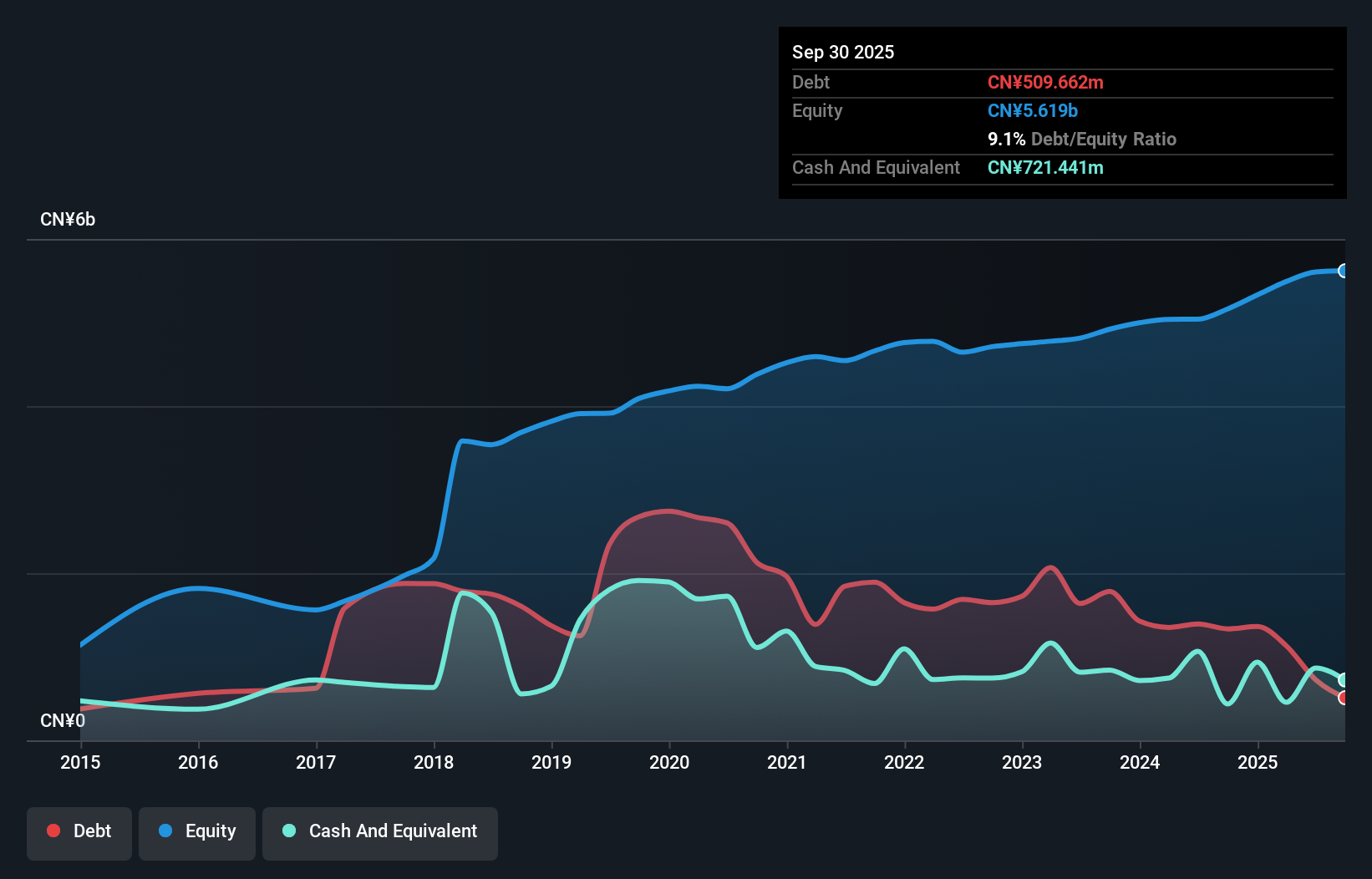

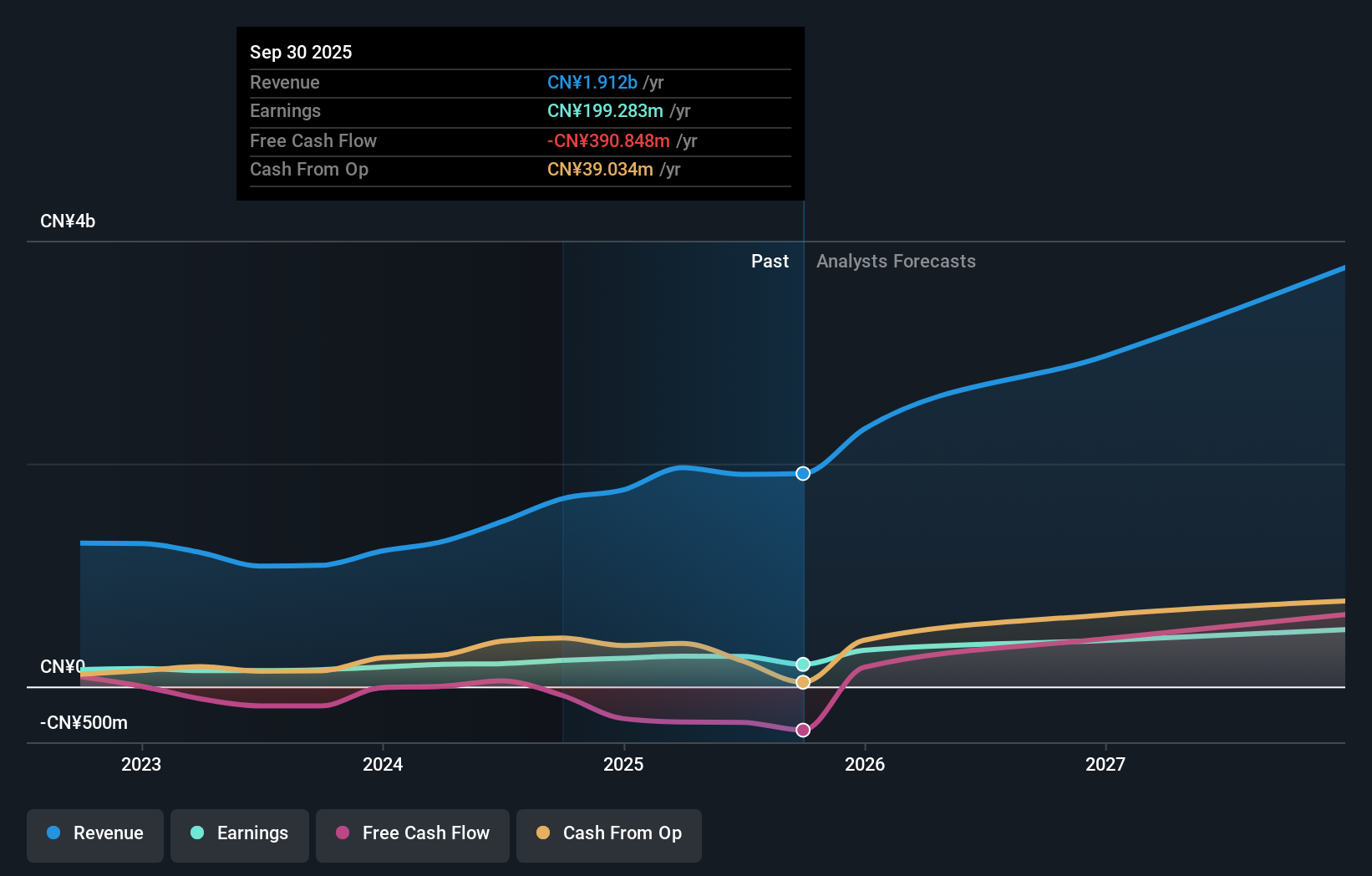

KTK Group, a notable player in the machinery sector, showcases promising financial metrics with a satisfactory net debt to equity ratio of 17.4%, indicating sound financial health. The company's price-to-earnings ratio of 20.3x is attractively below the CN market average of 36.9x, suggesting potential undervaluation. Recent earnings growth has been impressive at 32.4% over the past year, outpacing industry trends which saw a -0.4% dip, highlighting its robust performance amidst challenging conditions. Additionally, KTK's revenue for the first nine months of 2024 reached CNY 3 billion compared to CNY 2.66 billion last year, reflecting solid operational momentum and strategic execution within its market niche.

- Navigate through the intricacies of KTK Group with our comprehensive health report here.

Gain insights into KTK Group's historical performance by reviewing our past performance report.

Suzhou Alton Electrical & Mechanical Industry (SZSE:301187)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Alton Electrical & Mechanical Industry Co., Ltd. operates in the electrical and mechanical sector with a market capitalization of CN¥5.34 billion.

Operations: Suzhou Alton generates revenue primarily through its electrical and mechanical products. The company focuses on optimizing production costs to enhance profitability, achieving a notable gross profit margin trend over recent periods.

Suzhou Alton Electrical & Mechanical Industry, a nimble player in its sector, showcases robust financial health with earnings surging 54.9% over the past year, outpacing the Consumer Durables industry. The company's debt is well-managed, as evidenced by interest payments covered 27.6 times by EBIT and a debt-to-equity ratio rising to 39.4% from zero over five years. Despite recent volatility in share price, it trades at nearly 32% below estimated fair value. Recent figures highlight sales of CNY 1.31 billion for nine months ending September 2024, significantly up from CNY 836 million last year, with net income climbing to CNY 184 million from CNY 125 million previously.

Key Takeaways

- Embark on your investment journey to our 4642 Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KTK Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603680

KTK Group

Research, develops, produces, sells, and service interior systems, electrical controlling systems, and vehicle equipment for high-speed trains, metro, LRV, and ordinary rail passenger cars in China and internationally.

Excellent balance sheet with proven track record.