- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600712

Would Nanning Department Store (SHSE:600712) Be Better Off With Less Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Nanning Department Store Co., Ltd. (SHSE:600712) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Nanning Department Store

How Much Debt Does Nanning Department Store Carry?

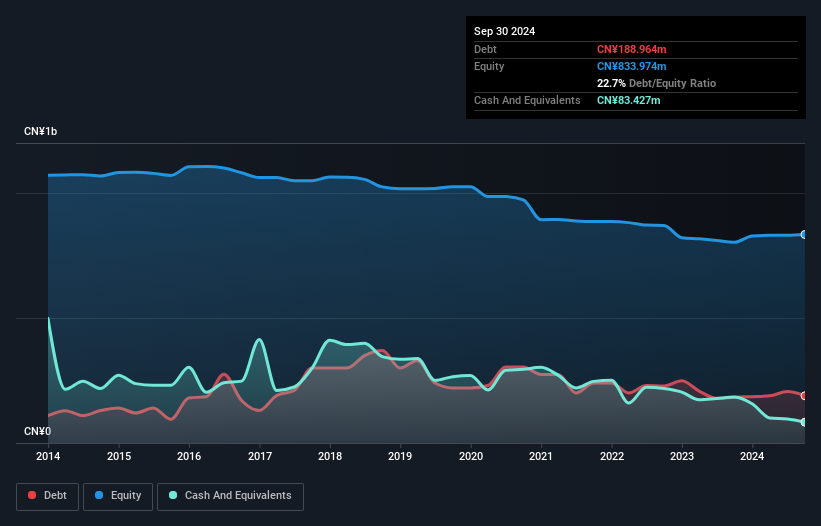

As you can see below, Nanning Department Store had CN¥189.0m of debt, at September 2024, which is about the same as the year before. You can click the chart for greater detail. However, it also had CN¥83.4m in cash, and so its net debt is CN¥105.5m.

How Strong Is Nanning Department Store's Balance Sheet?

We can see from the most recent balance sheet that Nanning Department Store had liabilities of CN¥552.4m falling due within a year, and liabilities of CN¥18.3m due beyond that. Offsetting this, it had CN¥83.4m in cash and CN¥53.9m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥433.4m.

Given Nanning Department Store has a market capitalization of CN¥3.68b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. When analysing debt levels, the balance sheet is the obvious place to start. But it is Nanning Department Store's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Nanning Department Store made a loss at the EBIT level, and saw its revenue drop to CN¥596m, which is a fall of 9.4%. That's not what we would hope to see.

Caveat Emptor

Importantly, Nanning Department Store had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at CN¥13m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled CN¥118m in negative free cash flow over the last twelve months. So suffice it to say we do consider the stock to be risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Nanning Department Store , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Nanning Department Store might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600712

Nanning Department Store

Operates department stores and supermarkets in the People’s Republic of China.

Excellent balance sheet with weak fundamentals.

Market Insights

Community Narratives