Stock Analysis

Yantai Eddie Precision Machinery (SHSE:603638) stock falls 3.3% in past week as three-year earnings and shareholder returns continue downward trend

Investing in stocks inevitably means buying into some companies that perform poorly. But the long term shareholders of Yantai Eddie Precision Machinery Co., Ltd. (SHSE:603638) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 66% drop in the share price over that period. And the ride hasn't got any smoother in recent times over the last year, with the price 29% lower in that time. The falls have accelerated recently, with the share price down 14% in the last three months. But this could be related to the weak market, which is down 7.2% in the same period.

If the past week is anything to go by, investor sentiment for Yantai Eddie Precision Machinery isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Yantai Eddie Precision Machinery

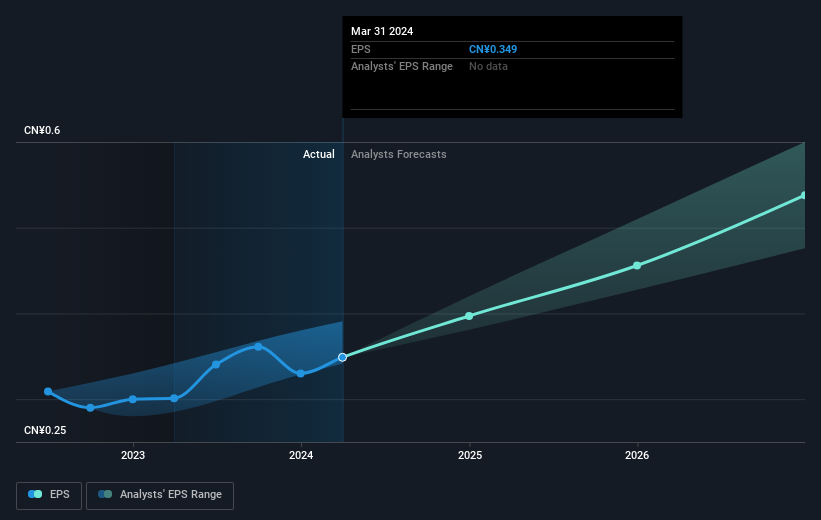

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Yantai Eddie Precision Machinery saw its EPS decline at a compound rate of 23% per year, over the last three years. The share price decline of 30% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Yantai Eddie Precision Machinery has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

We regret to report that Yantai Eddie Precision Machinery shareholders are down 28% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 17%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 3%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Yantai Eddie Precision Machinery better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Yantai Eddie Precision Machinery you should know about.

We will like Yantai Eddie Precision Machinery better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Yantai Eddie Precision Machinery is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Yantai Eddie Precision Machinery is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603638

Yantai Eddie Precision Machinery

Engages in the development, production, and sale of attachments for construction machinery and marines in China.

Proven track record with adequate balance sheet.