AA Industrial Belting (Shanghai)Ltd (SHSE:603580) shareholders notch a 24% CAGR over 3 years, yet earnings have been shrinking

AA Industrial Belting (Shanghai) Co.,Ltd (SHSE:603580) shareholders might be concerned after seeing the share price drop 19% in the last quarter. But that doesn't change the fact that the returns over the last three years have been pleasing. After all, the share price is up a market-beating 88% in that time.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for AA Industrial Belting (Shanghai)Ltd

Given that AA Industrial Belting (Shanghai)Ltd only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

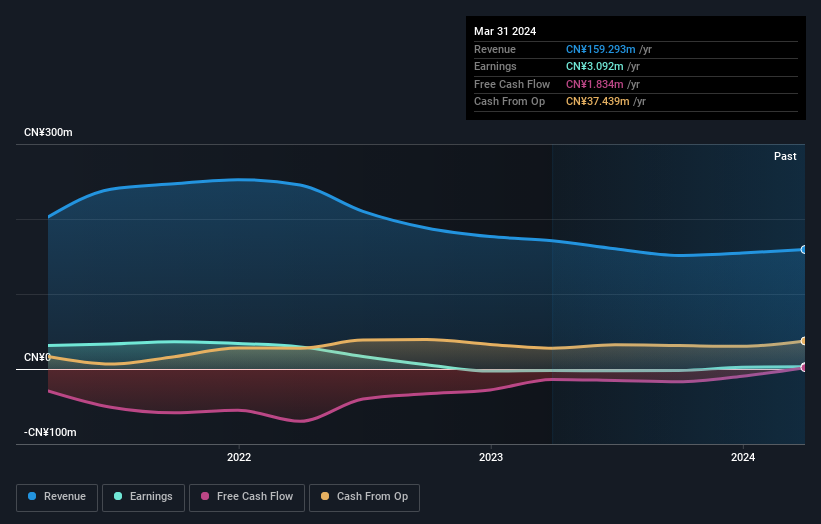

In the last 3 years AA Industrial Belting (Shanghai)Ltd saw its revenue shrink by 17% per year. Despite the lack of revenue growth, the stock has returned 23%, compound, over three years. If the company is cutting costs profitability could be on the horizon, but the revenue decline is a prima facie concern.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling AA Industrial Belting (Shanghai)Ltd stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for AA Industrial Belting (Shanghai)Ltd the TSR over the last 3 years was 91%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that AA Industrial Belting (Shanghai)Ltd shareholders have received a total shareholder return of 41% over one year. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 9% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand AA Industrial Belting (Shanghai)Ltd better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for AA Industrial Belting (Shanghai)Ltd you should be aware of, and 2 of them shouldn't be ignored.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603580

AA Industrial Belting (Shanghai)Ltd

AA Industrial Belting (Shanghai) Co., Ltd produces and sells belts in China.

Excellent balance sheet low.