- China

- /

- Trade Distributors

- /

- SHSE:603300

Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology Co., Ltd.'s (SHSE:603300) Share Price Boosted 29% But Its Business Prospects Need A Lift Too

Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology Co., Ltd. (SHSE:603300) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 7.2% isn't as impressive.

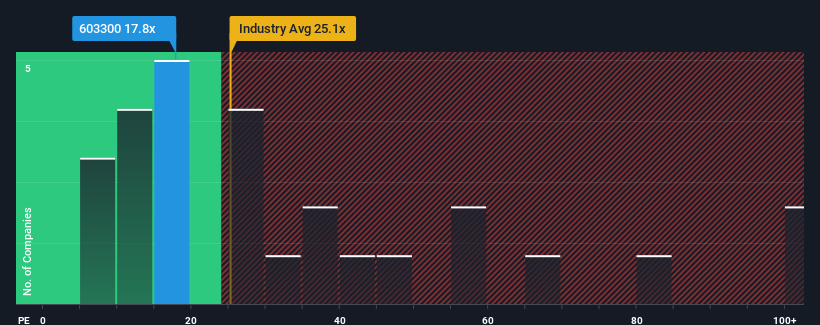

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 36x, you may still consider Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology as a highly attractive investment with its 17.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times haven't been advantageous for Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology

What Are Growth Metrics Telling Us About The Low P/E?

Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 4.8%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 25% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 18% as estimated by the six analysts watching the company. With the market predicted to deliver 38% growth , the company is positioned for a weaker earnings result.

With this information, we can see why Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology's recent share price jump still sees its P/E sitting firmly flat on the ground. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology (1 doesn't sit too well with us!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603300

Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology

Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology Co., Ltd.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives