- China

- /

- Semiconductors

- /

- SHSE:688630

3 Growth Stocks With High Insider Ownership Growing Earnings Up To 39%

Reviewed by Simply Wall St

In a week marked by volatile markets and cautious earnings reports, global indices experienced mixed performances, with major U.S. indexes like the Nasdaq Composite and S&P MidCap 400 hitting record highs before retreating. Amidst this backdrop of economic uncertainty and fluctuating market dynamics, investors often look to growth companies with high insider ownership as potential opportunities due to their alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Pharma Mar (BME:PHM) | 11.8% | 55.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

Here's a peek at a few of the choices from the screener.

Adicon Holdings (SEHK:9860)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Adicon Holdings Limited operates medical laboratories in the People's Republic of China with a market cap of HK$4.85 billion.

Operations: The company generates revenue of CN¥3.12 billion from its Healthcare Facilities & Services segment in the People's Republic of China.

Insider Ownership: 22.4%

Earnings Growth Forecast: 20.2% p.a.

Adicon Holdings has been added to the S&P Global BMI Index, highlighting its growing market presence. Despite a recent decline in sales and net income, the company is forecasted to achieve significant annual earnings growth of 20.2%, outpacing the Hong Kong market's average. Revenue growth is expected at 9% annually, surpassing local benchmarks but remaining below high-growth thresholds. Insider ownership remains stable with no substantial insider trading activity reported recently.

- Dive into the specifics of Adicon Holdings here with our thorough growth forecast report.

- According our valuation report, there's an indication that Adicon Holdings' share price might be on the expensive side.

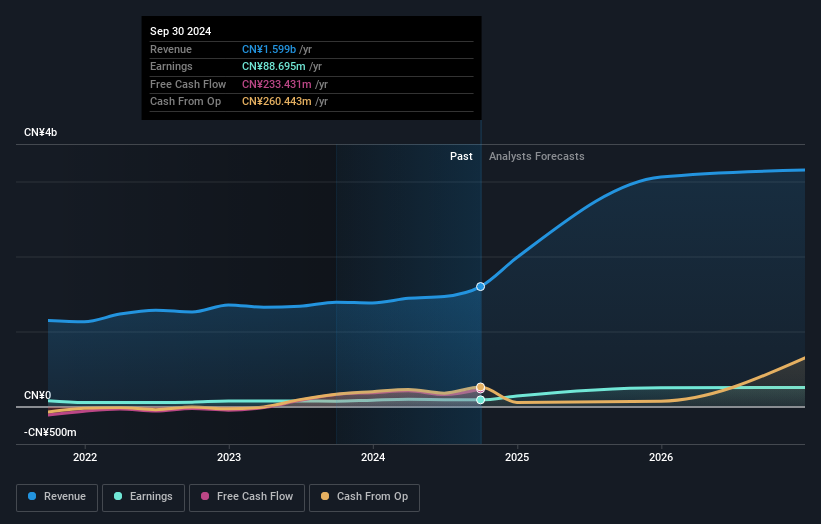

Jiangsu Seagull Cooling TowerLtd (SHSE:603269)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Seagull Cooling Tower Co., Ltd. specializes in the design, research and development, manufacturing, and installation of cooling towers both in China and internationally, with a market cap of CN¥2.08 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 37.6%

Earnings Growth Forecast: 40% p.a.

Jiangsu Seagull Cooling Tower Ltd. is experiencing robust growth, with earnings forecasted to rise by 40% annually, outpacing the Chinese market's average. The company reported a revenue increase to CNY 1.10 billion for the first nine months of 2024, up from CNY 882.6 million last year. Despite trading significantly below its estimated fair value and having high-quality earnings, its return on equity is expected to be low in three years.

- Click to explore a detailed breakdown of our findings in Jiangsu Seagull Cooling TowerLtd's earnings growth report.

- The valuation report we've compiled suggests that Jiangsu Seagull Cooling TowerLtd's current price could be quite moderate.

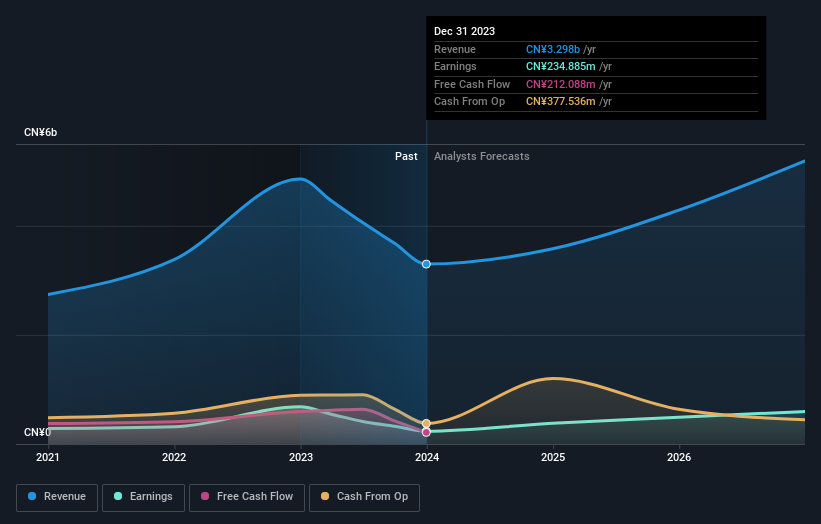

Circuit Fabology Microelectronics EquipmentLtd (SHSE:688630)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Circuit Fabology Microelectronics Equipment Co., Ltd. operates in the microelectronics equipment industry and has a market cap of CN¥8.64 billion.

Operations: Unfortunately, there is no specific information provided about the revenue segments for Circuit Fabology Microelectronics Equipment Co., Ltd. in the text you have given.

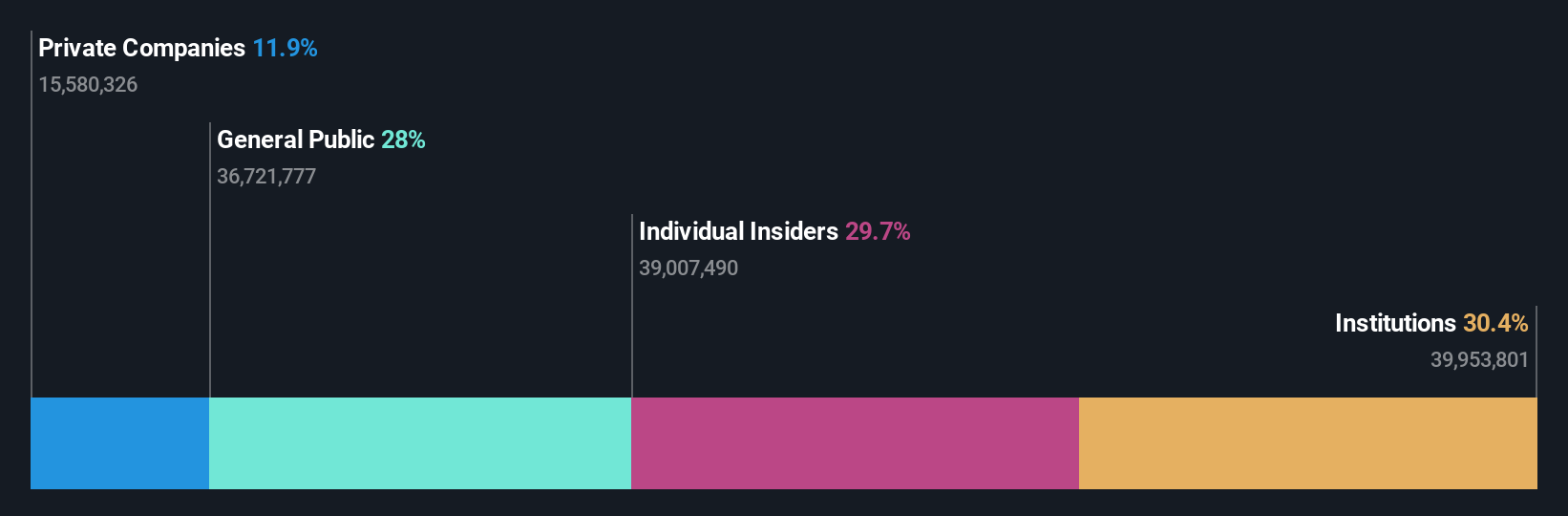

Insider Ownership: 29.8%

Earnings Growth Forecast: 31.6% p.a.

Circuit Fabology Microelectronics Equipment Ltd. is showing strong growth potential, with earnings expected to increase by 31.6% annually, surpassing the broader Chinese market's average growth rate. Recent earnings reports highlight a rise in net income to CNY 155.08 million for the first nine months of 2024 from CNY 118.43 million last year. Despite high share price volatility and a low forecasted return on equity, its price-to-earnings ratio of 40x suggests good value relative to industry peers.

- Navigate through the intricacies of Circuit Fabology Microelectronics EquipmentLtd with our comprehensive analyst estimates report here.

- Our valuation report here indicates Circuit Fabology Microelectronics EquipmentLtd may be undervalued.

Seize The Opportunity

- Click here to access our complete index of 1100 Fast Growing Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688630

Circuit Fabology Microelectronics EquipmentLtd

Circuit Fabology Microelectronics Equipment Co.,Ltd.

High growth potential with adequate balance sheet.