- China

- /

- Construction

- /

- SHSE:603163

Undiscovered Gems In Asia Featuring Three Promising Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic indicators and central bank policies, the Asian market presents unique opportunities amidst broader uncertainties. In this environment, identifying promising stocks involves looking for companies with strong fundamentals and growth potential that can weather interest rate fluctuations and economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Chudenko | NA | 4.69% | 17.78% | ★★★★★★ |

| Guangdong Lingxiao Pump IndustryLtd | NA | -1.23% | 2.72% | ★★★★★★ |

| Qingdao CHOHO IndustrialLtd | 38.36% | 12.96% | 8.25% | ★★★★★☆ |

| KC | 2.84% | 8.17% | -0.54% | ★★★★★☆ |

| Hefei Lifeon Pharmaceutical | 5.70% | -5.35% | 5.82% | ★★★★★☆ |

| DYPNFLtd | 26.11% | 13.24% | 0.06% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

| Toho Bank | 108.44% | 5.50% | 35.31% | ★★★★☆☆ |

| Nippon Sharyo | 52.23% | -0.59% | -8.32% | ★★★★☆☆ |

| Wuhan Huakang Century Clean Technology | 57.04% | 17.95% | 6.20% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Acter Technology Integration Group (SHSE:603163)

Simply Wall St Value Rating: ★★★★★★

Overview: Acter Technology Integration Group Co., Ltd. operates within the technology sector, focusing on integration services and solutions, with a market cap of CN¥5.16 billion.

Operations: Acter Technology Integration Group generates revenue primarily from its technology integration services and solutions. The company's financial performance is highlighted by a net profit margin that reflects its operational efficiency.

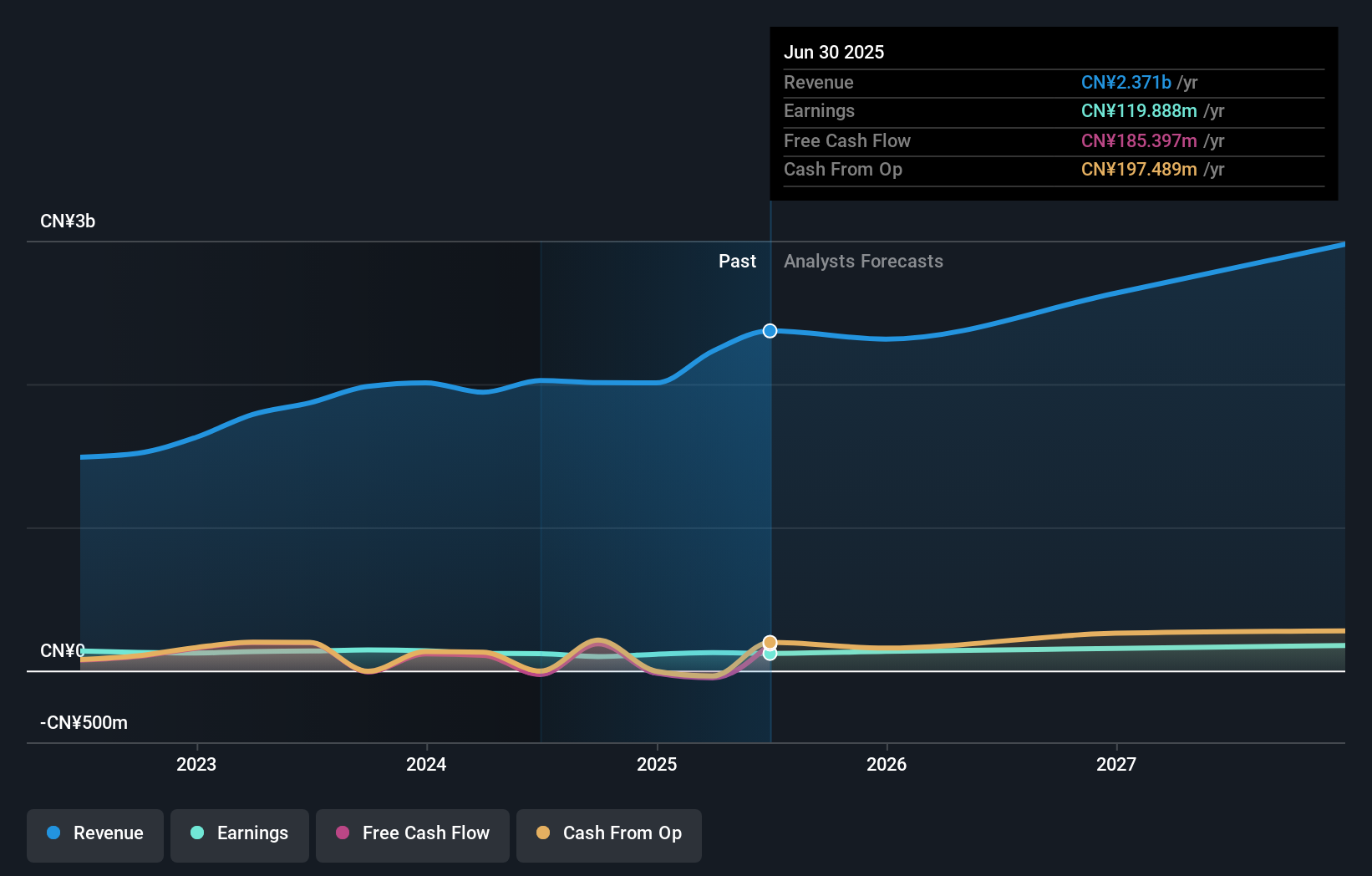

Acter Technology Integration Group, a dynamic player in the tech landscape, reported impressive half-year sales of CNY 1.29 billion, up from CNY 930 million last year. Net income rose to CNY 62.46 million compared to the previous year's CNY 56.98 million, showcasing its robust financial health. The company’s price-to-earnings ratio stands at an attractive 43x against the broader CN market's 44.5x, indicating good value potential for investors seeking growth opportunities in Asia's tech sector. Despite a volatile share price recently, Acter’s strategic committee changes and governance updates signal proactive management aiming for sustainable development and future growth prospects.

East China Engineering Science and Technology (SZSE:002140)

Simply Wall St Value Rating: ★★★★☆☆

Overview: East China Engineering Science and Technology Co., Ltd. is a company engaged in engineering services with a market cap of approximately CN¥8.11 billion.

Operations: East China Engineering Science and Technology generates revenue primarily from the chemicals industry, contributing CN¥7.92 billion, followed by the environmental governance infrastructure industry at CN¥889.64 million.

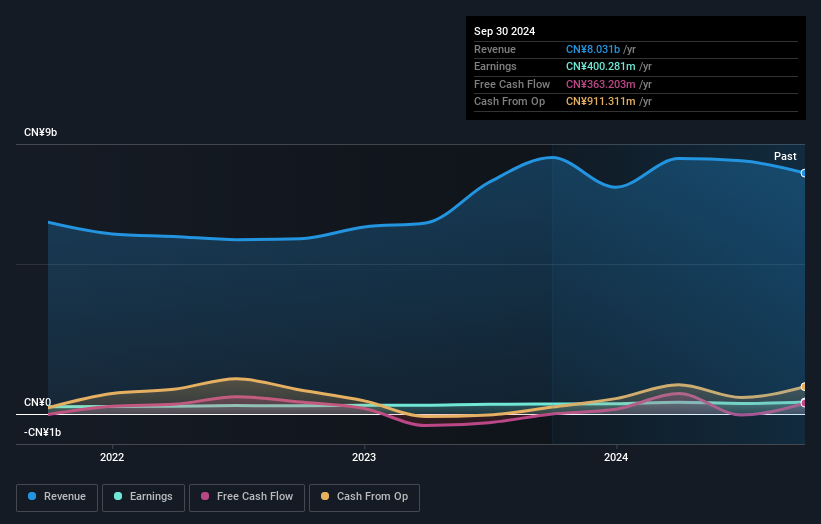

East China Engineering Science and Technology, a small player in the construction sector, has shown promising growth with earnings up 25.8% over the past year, outpacing the industry’s -8.2%. The company reported a net income of CNY 240.23 million for H1 2025, an improvement from CNY 209.56 million last year. Trading at a price-to-earnings ratio of 18.4x below the market average of 44.5x suggests good relative value compared to peers. Although its debt-to-equity ratio increased to 44.7% over five years, it holds more cash than total debt, indicating financial stability despite negative free cash flow trends recently observed in its operations.

Keli Motor Group (SZSE:002892)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Keli Motor Group Co., Ltd. focuses on the research, development, manufacture, and sale of micro motors in China with a market capitalization of approximately CN¥11.42 billion.

Operations: Keli Motor Group generates revenue primarily from Intelligent Control Electronics and Motors, contributing CN¥1.55 billion, and Industrial Automation, Robotics & 3D Printing, which adds CN¥221.49 million.

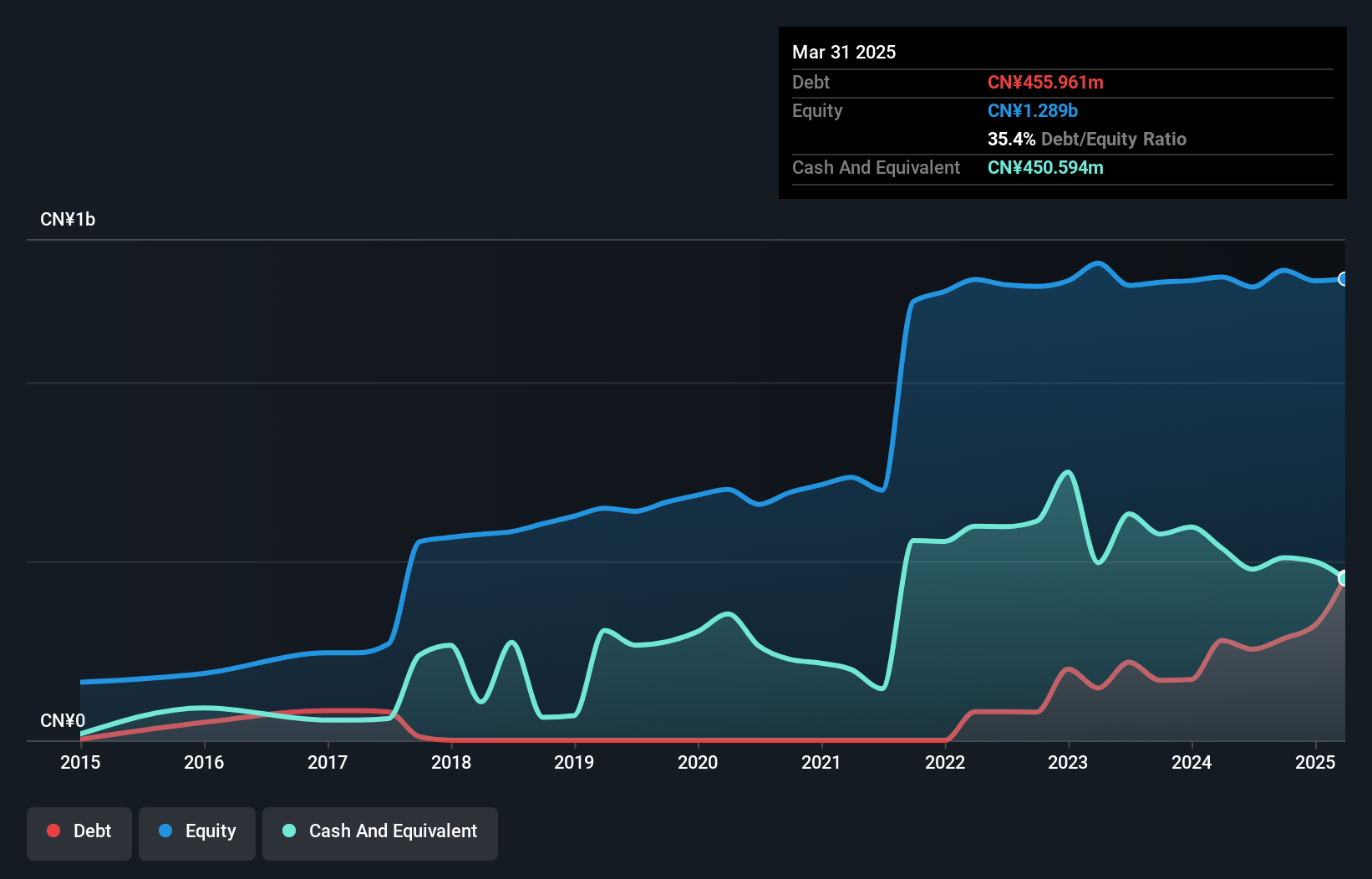

With a focus on innovation, Keli Motor Group has shown impressive financial performance recently. The company's net income rose to CNY 29.18 million for the first half of 2025, up from CNY 23.66 million the previous year, while revenue increased to CNY 907.31 million from CNY 796.52 million. Despite a debt-to-equity ratio climbing to 42.7% over five years, its interest payments are well covered with EBIT at a solid 3.9 times coverage and earnings growth outpacing industry norms by reaching an impressive rate of nearly 65%. However, free cash flow remains negative amidst these developments.

- Take a closer look at Keli Motor Group's potential here in our health report.

Examine Keli Motor Group's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Dive into all 2401 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603163

Acter Technology Integration Group

Acter Technology Integration Group Co., Ltd.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives