- China

- /

- Commercial Services

- /

- SZSE:300864

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

In the wake of recent global market shifts, U.S. stocks have rallied to record highs as investors anticipate potential economic growth and lower corporate taxes following a significant political shift. Amid these developments, dividend stocks remain an attractive option for many investors seeking stable income streams in a dynamic economic landscape. Understanding what makes a good dividend stock involves evaluating factors such as consistent payout history and the company's ability to sustain dividends through varying market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.69% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.21% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.50% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.42% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.52% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.53% | ★★★★★★ |

Click here to see the full list of 1947 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Acter Technology Integration Group (SHSE:603163)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Acter Technology Integration Group Co., Ltd. (SHSE:603163) operates in the technology integration sector with a market capitalization of CN¥2.52 billion.

Operations: Unfortunately, the provided text does not include specific information on the revenue segments for Acter Technology Integration Group Co., Ltd. (SHSE:603163). Therefore, I am unable to summarize the company's revenue segments. If you have additional details or another source of information regarding their revenue breakdown, please share it so I can assist you further.

Dividend Yield: 3.2%

Acter Technology Integration Group's recent earnings report shows a decline in net income, impacting its profit margins. Despite this, the company's dividend yield of 3.18% ranks it among the top 25% of dividend payers in China. With a payout ratio of 80.9%, dividends are covered by earnings and cash flows, suggesting sustainability for now. However, given that dividends have only recently started, stability and growth remain uncertain at this time.

- Unlock comprehensive insights into our analysis of Acter Technology Integration Group stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Acter Technology Integration Group shares in the market.

Academy of Environmental Planning and DesignLtd. Nanjing University (SZSE:300864)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Academy of Environmental Planning and Design Ltd., Nanjing University (SZSE:300864) is engaged in environmental planning and design services with a market cap of CN¥3.61 billion.

Operations: The company generates revenue from its service industry segment, amounting to CN¥815.11 million.

Dividend Yield: 3.5%

Academy of Environmental Planning and Design, Nanjing University has demonstrated strong earnings growth, with net income rising to CNY 131.45 million for the first nine months of 2024. The company offers a dividend yield of 3.46%, placing it among the top quartile in China. Dividends are well-covered by both earnings (73.4% payout ratio) and cash flows (69.6% cash payout ratio), although they have only been paid for three years, indicating limited historical stability despite recent increases.

- Dive into the specifics of Academy of Environmental Planning and DesignLtd. Nanjing University here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Academy of Environmental Planning and DesignLtd. Nanjing University is priced lower than what may be justified by its financials.

Fujii Sangyo (TSE:9906)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Fujii Sangyo Corporation operates in Japan, selling electrical construction materials, electrical equipment, machine tools, information equipment, and civil engineering and construction machinery with a market cap of ¥20.75 billion.

Operations: Fujii Sangyo Corporation's revenue segments include the Material Innovations Company at ¥50.68 billion, Infrastructure Solutions Company at ¥32.80 billion, and Komatsu Tochigi at ¥7.15 billion.

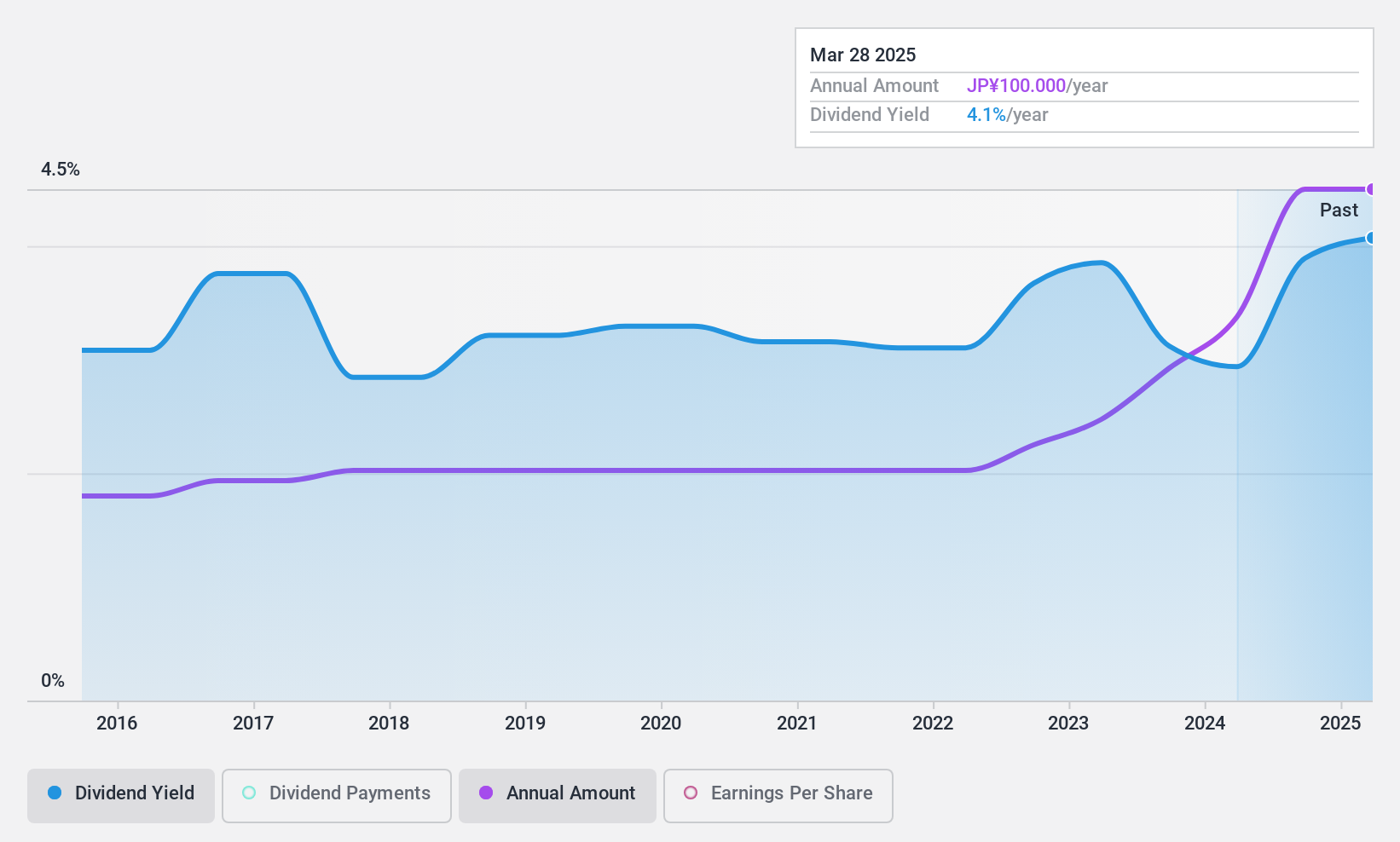

Dividend Yield: 4.1%

Fujii Sangyo's dividends are well-supported by earnings, with a payout ratio of 23.3%, and cash flows, maintaining a 50% cash payout ratio. The company's dividend yield of 4.08% ranks in the top quartile of the Japanese market, reflecting its attractiveness to income-focused investors. Over the past decade, dividends have been stable and growing consistently, supported by robust earnings growth of 21% in the past year and trading at a discount to estimated fair value.

- Take a closer look at Fujii Sangyo's potential here in our dividend report.

- Our expertly prepared valuation report Fujii Sangyo implies its share price may be lower than expected.

Next Steps

- Click here to access our complete index of 1947 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300864

Academy of Environmental Planning and DesignLtd. Nanjing University

Academy of Environmental Planning and Design, Co.,Ltd.

Flawless balance sheet, good value and pays a dividend.