As global markets navigate a complex landscape marked by rate cuts and trade truces, Asian economies are also feeling the ripple effects of these developments. Amidst this backdrop, growth companies with high insider ownership in Asia present intriguing opportunities as they often demonstrate strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 113.4% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31.2% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Underneath we present a selection of stocks filtered out by our screen.

APR (KOSE:A278470)

Simply Wall St Growth Rating: ★★★★★★

Overview: APR Co., Ltd. manufactures and sells cosmetic products for men and women, with a market cap of ₩9.79 billion.

Operations: The company's revenue segments include Cosmetics at ₩1.25 billion, Coordination with a negative contribution of -₩285.69 million, and Apparel Fashion generating ₩43.61 million.

Insider Ownership: 34.7%

APR Co., Ltd. exhibits strong growth prospects with earnings expected to grow 34.3% annually, outpacing the KR market's 28.4%. Despite recent share price volatility, its revenue is forecast to increase by 30.4% per year, significantly above the market average of 10.4%. The company trades at a slight discount to its estimated fair value and maintains high insider ownership, though its dividend coverage is weak due to insufficient free cash flows.

- Dive into the specifics of APR here with our thorough growth forecast report.

- The valuation report we've compiled suggests that APR's current price could be inflated.

Asian Star Anchor Chain Jiangsu (SHSE:601890)

Simply Wall St Growth Rating: ★★★★★☆

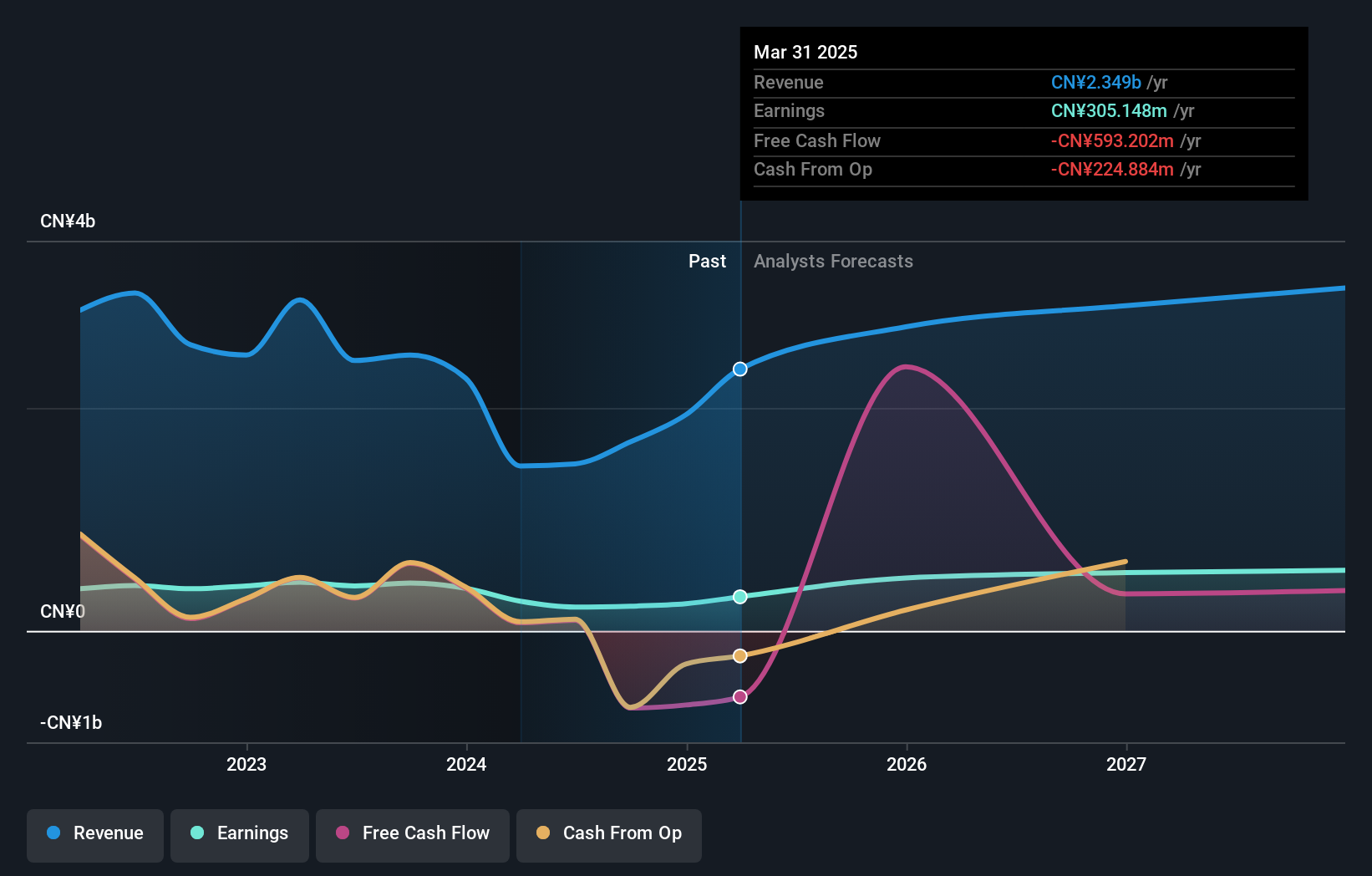

Overview: Asian Star Anchor Chain Co., Ltd. Jiangsu, along with its subsidiaries, manufactures and sells anchor chains, marine mooring chains, and related accessories globally, with a market cap of CN¥10.72 billion.

Operations: Asian Star Anchor Chain Co., Ltd. Jiangsu generates revenue primarily through the production and distribution of anchor chains, marine mooring chains, and associated accessories on a global scale.

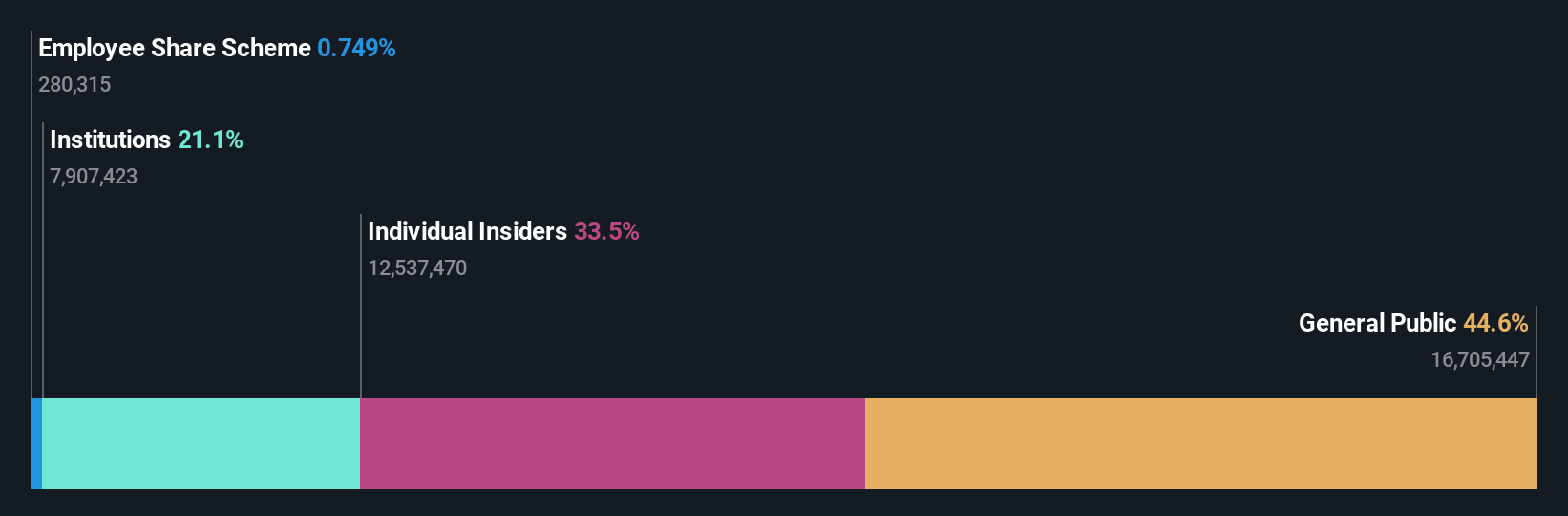

Insider Ownership: 37%

Asian Star Anchor Chain Jiangsu demonstrates robust growth potential with earnings projected to increase 27.7% annually, surpassing the CN market's 26.9%. Revenue is expected to grow at a substantial rate of 32.6% per year, significantly above the market average of 14.3%. Despite these strong growth forecasts, its dividend yield of 0.72% is not well supported by free cash flows, and recent financial results show moderate profit increases without significant insider trading activity.

- Click to explore a detailed breakdown of our findings in Asian Star Anchor Chain Jiangsu's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Asian Star Anchor Chain Jiangsu shares in the market.

Zhejiang Huace Film & TV (SZSE:300133)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Huace Film & TV Co., Ltd. is involved in the production, distribution, and derivative of film and television dramas both in China and internationally, with a market cap of CN¥15.04 billion.

Operations: The company generates revenue primarily through the creation, distribution, and related activities of film and television dramas across domestic and international markets.

Insider Ownership: 17.4%

Zhejiang Huace Film & TV is poised for significant growth with earnings projected to rise 32.6% annually, outpacing the CN market's 26.9%. Revenue is also expected to grow faster than the market at 18.5% per year. Recent transactions saw a shift in insider ownership, with Fu Meicheng and Hangzhou Dace Investment reducing their stakes as various asset managers acquired shares worth approximately CNY 500 million, reflecting continued confidence in the company's prospects despite recent share price volatility.

- Get an in-depth perspective on Zhejiang Huace Film & TV's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Zhejiang Huace Film & TV implies its share price may be too high.

Key Takeaways

- Investigate our full lineup of 618 Fast Growing Asian Companies With High Insider Ownership right here.

- Contemplating Other Strategies? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601890

Asian Star Anchor Chain Jiangsu

Engages in the manufacture and sale of anchor chains, marine mooring chains, and related accessories worldwide.

High growth potential with proven track record.

Market Insights

Community Narratives