- China

- /

- Metals and Mining

- /

- SHSE:600295

Yunnan Yuntianhua And Two More Premier Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate through varying economic signals, China's recent measures to support its troubled housing sector highlight a proactive approach amidst broader concerns of persistent inflation and interest rate policies. In this context, evaluating dividend stocks like Yunnan Yuntianhua becomes particularly relevant as investors look for stable returns in a fluctuating market environment.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.11% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.60% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.19% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.09% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.21% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.47% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.52% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.29% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.08% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.97% | ★★★★★★ |

Click here to see the full list of 197 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Yunnan Yuntianhua (SHSE:600096)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yunnan Yuntianhua Co., Ltd. operates in China, focusing on chemical fertilizers and agriculture, phosphate mining, fine chemicals, and trade and logistics with a market capitalization of CN¥38.48 billion.

Operations: Yunnan Yuntianhua Co., Ltd. generates revenue primarily through its involvement in chemical fertilizers and agriculture, phosphate mining, fine chemicals, as well as trade and logistics sectors.

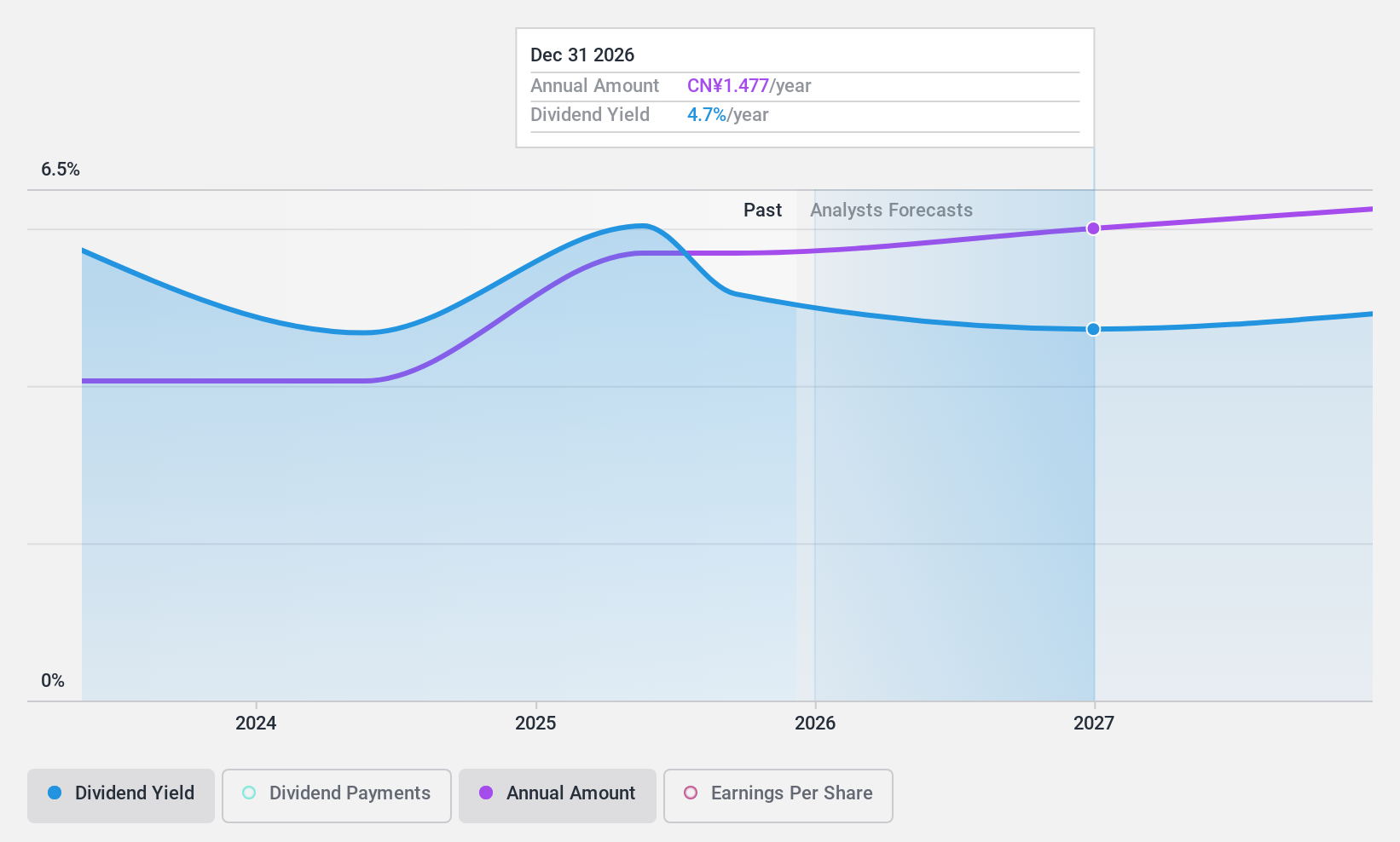

Dividend Yield: 4.7%

Yunnan Yuntianhua offers a dividend yield of 4.72%, placing it in the top 25% of dividend payers in the Chinese market. Despite this, its dividend history has been volatile over the past decade, with inconsistent growth and fluctuations exceeding 20% annually. The dividends are well-supported financially, evidenced by a payout ratio of 41.5% and a cash payout ratio of 21.1%. However, recent financial performance shows declining revenues and net income year-over-year as of Q1 2024, raising concerns about sustained profitability amidst high debt levels.

- Dive into the specifics of Yunnan Yuntianhua here with our thorough dividend report.

- Our expertly prepared valuation report Yunnan Yuntianhua implies its share price may be lower than expected.

Inner Mongolia ERDOS ResourcesLtd (SHSE:600295)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inner Mongolia ERDOS Resources Co., Ltd. operates in various sectors including garment, energy, chemical, and metallurgy in China, with a market capitalization of approximately CN¥29.61 billion.

Operations: Inner Mongolia ERDOS Resources Co., Ltd. generates revenue through its operations in the garment, energy, chemical, and metallurgy sectors.

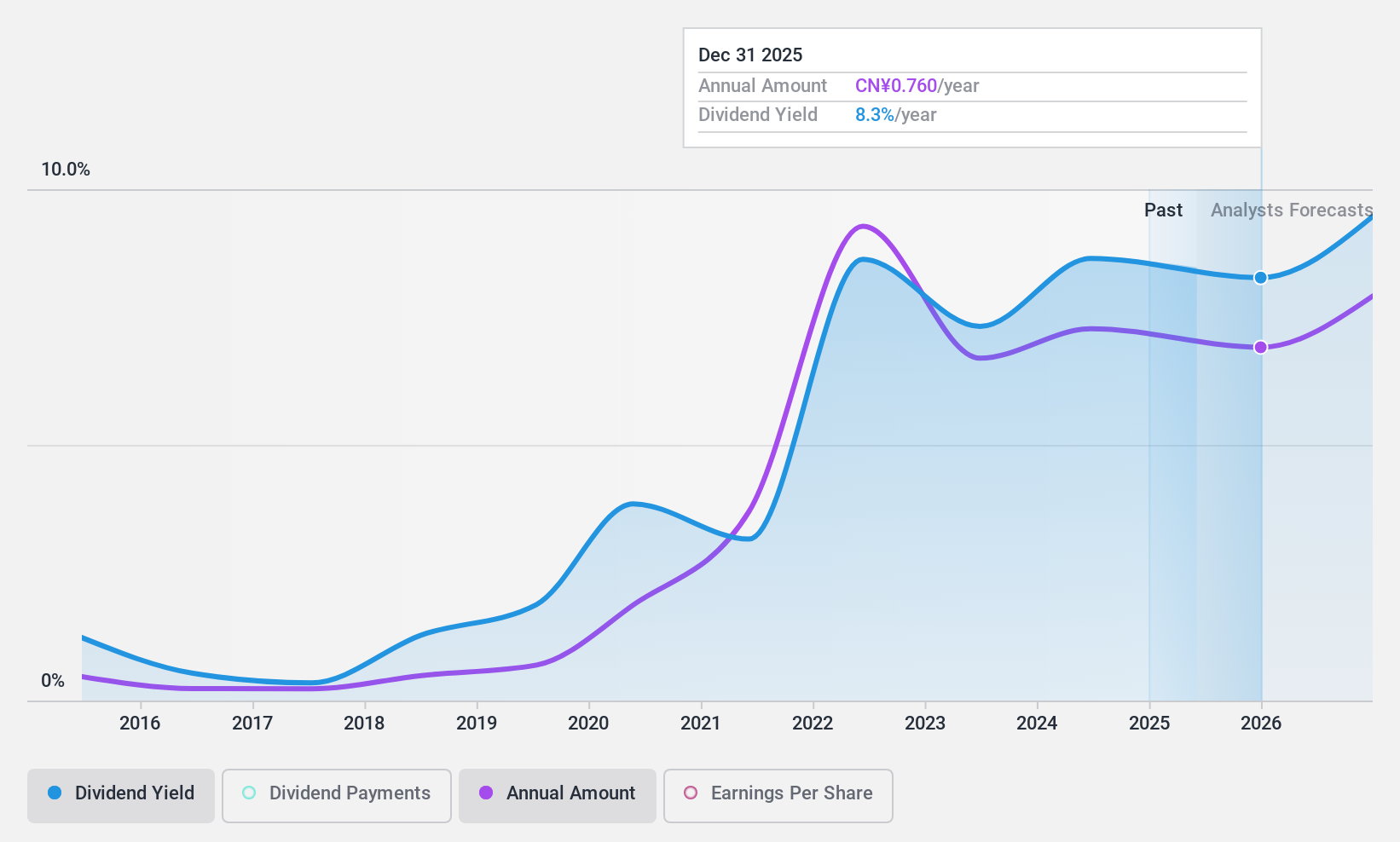

Dividend Yield: 6.1%

Inner Mongolia ERDOS Resources Ltd. reported a decrease in quarterly and annual revenues and net income, with the latest quarter showing sales of CNY 6.7 billion and net income of CNY 346.59 million, both declines from previous periods. The company's dividend yield stands at 6.09%, ranking it among the top dividend payers in China, but its sustainability is questionable due to a high payout ratio of 100.2% and volatile history over the last decade. Despite trading at a 22.2% discount to estimated fair value, concerns about its profit margins and inconsistent earnings coverage could affect future dividend reliability.

- Navigate through the intricacies of Inner Mongolia ERDOS ResourcesLtd with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Inner Mongolia ERDOS ResourcesLtd's share price might be too pessimistic.

Xi'an Shaangu Power (SHSE:601369)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Xi'an Shaangu Power Co., Ltd. specializes in providing systematic solutions and services across various industries in the People’s Republic of China, with a market capitalization of approximately CN¥15.22 billion.

Operations: Xi'an Shaangu Power Co., Ltd. generates its revenue primarily through the provision of systematic solutions and services across multiple industries in China.

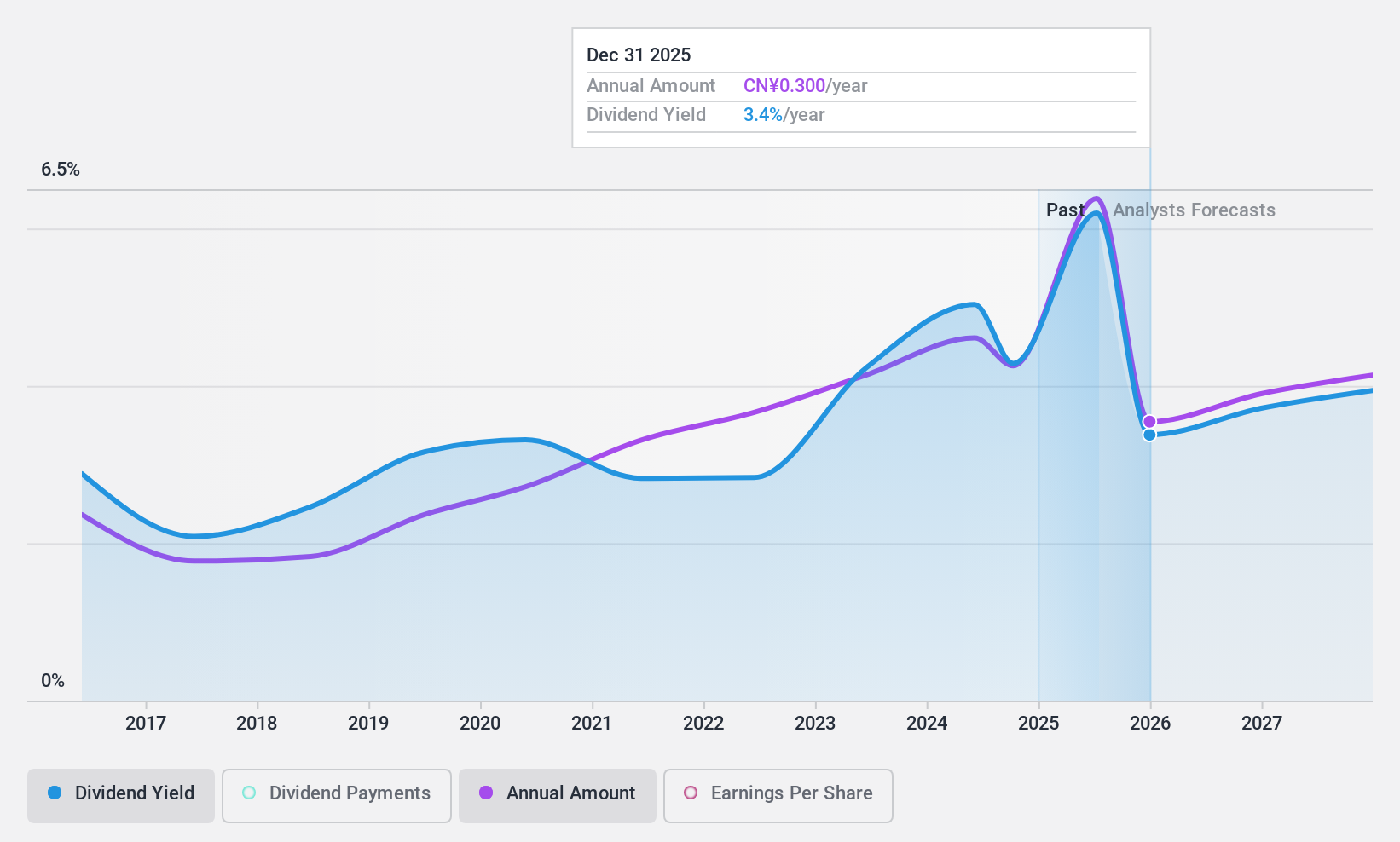

Dividend Yield: 4.3%

Xi'an Shaangu Power Co., Ltd. experienced a dip in quarterly sales and net income, reporting CNY 2.49 billion and CNY 234.63 million respectively, reflecting declines from the previous year. Despite a volatile dividend history over the past decade, the company's current dividend yield places it in the top quartile of Chinese dividend payers. Dividends are reasonably covered by both earnings and cash flows, with payout ratios at 66.8% and 69% respectively, suggesting a sustainable payout despite market challenges.

- Unlock comprehensive insights into our analysis of Xi'an Shaangu Power stock in this dividend report.

- Our valuation report here indicates Xi'an Shaangu Power may be undervalued.

Seize The Opportunity

- Discover the full array of 197 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600295

Inner Mongolia ERDOS ResourcesLtd

Inner Mongolia Erdos Resources Co.,ltd. engages in garment, energy, chemical, metallurgy, and other businesses in China.

Excellent balance sheet, good value and pays a dividend.