As Chinese equities have recently experienced declines following unexpected rate cuts by the central bank, investors are closely monitoring the market for opportunities. Amidst this backdrop, dividend stocks in China present a compelling option for those seeking stable returns and income generation. In such fluctuating times, good dividend stocks typically exhibit strong fundamentals, consistent earnings growth, and a history of reliable dividend payments.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Anhui Anke Biotechnology (Group) (SZSE:300009) | 3.08% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.91% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 4.00% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.79% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.13% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.92% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.69% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.96% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.97% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.60% | ★★★★★★ |

Click here to see the full list of 267 stocks from our Top Chinese Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

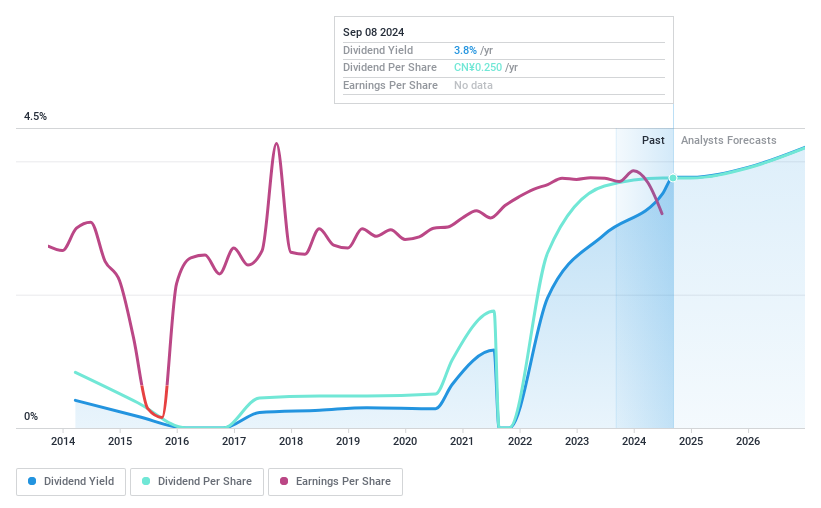

Inner Mongolia First Machinery GroupLtd (SHSE:600967)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inner Mongolia First Machinery Group Co., Ltd. (SHSE:600967) operates in the manufacturing sector, focusing on machinery and equipment production, with a market cap of approximately CN¥12.53 billion.

Operations: Inner Mongolia First Machinery Group Co., Ltd. (SHSE:600967) generates its revenue primarily from Equipment Manufacturing, amounting to CN¥9.70 billion.

Dividend Yield: 3.4%

Inner Mongolia First Machinery Group Ltd. offers a dividend yield of 3.4%, placing it in the top 25% of dividend payers in China, though its dividends have been volatile over the past decade. Despite a reasonable payout ratio of 52.9%, dividends are not covered by free cash flows and earnings quality is impacted by non-cash items. The company’s P/E ratio of 15.6x suggests good value compared to the CN market average of 27.4x.

- Delve into the full analysis dividend report here for a deeper understanding of Inner Mongolia First Machinery GroupLtd.

- Insights from our recent valuation report point to the potential overvaluation of Inner Mongolia First Machinery GroupLtd shares in the market.

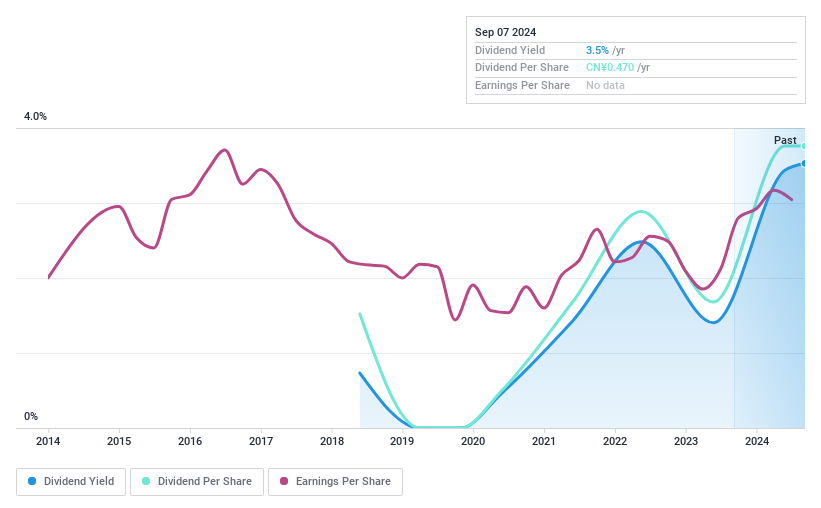

Xinjiang Torch Gas (SHSE:603080)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinjiang Torch Gas Co., Ltd operates as a gas service company in China with a market cap of CN¥1.94 billion.

Operations: Xinjiang Torch Gas Co., Ltd generates revenue primarily through its gas service operations in China.

Dividend Yield: 3.4%

Xinjiang Torch Gas has seen its dividend payments increase, though it has only paid dividends for 6 years and the track record is unstable. The company offers a yield of 3.43%, placing it in the top 25% of CN dividend payers. With a payout ratio of 45.6% and cash payout ratio of 27.8%, dividends are well covered by earnings and cash flows, but past payments have been volatile despite recent earnings growth of 69.8%.

- Unlock comprehensive insights into our analysis of Xinjiang Torch Gas stock in this dividend report.

- According our valuation report, there's an indication that Xinjiang Torch Gas' share price might be on the expensive side.

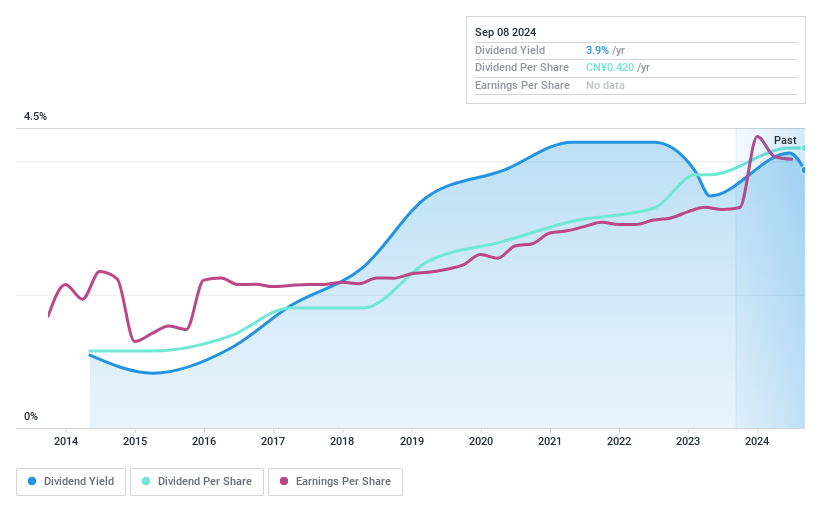

Central China Land MediaLTD (SZSE:000719)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Central China Land Media CO.,LTD engages in the editing, publishing, printing, marketing, distribution, and material supply of various media products and has a market cap of CN¥9.97 billion.

Operations: Central China Land Media CO.,LTD generates revenue from the editing and publishing, printing and reproduction, marketing and distribution, and material supply of books, periodicals, newspapers, electronic audio-visual products, online publications, and other media products.

Dividend Yield: 4.3%

Central China Land Media LTD's dividend payments are not well covered by earnings, with a high payout ratio of 402%. Despite this, the company has maintained stable and reliable dividends over the past decade. Recent earnings results showed a decline in net income to CNY 353.58 million for H1 2024 from CNY 471.67 million a year ago, though sales increased slightly. The final cash dividend was announced at CNY 4.20 per 10 shares for FY2023.

- Get an in-depth perspective on Central China Land MediaLTD's performance by reading our dividend report here.

- Our expertly prepared valuation report Central China Land MediaLTD implies its share price may be lower than expected.

Next Steps

- Dive into all 267 of the Top Chinese Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000719

Central China Land MediaLTD

Engages in the editing and publishing, printing and reproduction, marketing and distribution, and material supply of books, periodicals, newspapers, electronic audio-visual products, online publications, and other media products.

Undervalued with solid track record and pays a dividend.