Undiscovered Gems Three Promising Stocks To Explore In October 2024

Reviewed by Simply Wall St

As global markets navigate the challenges posed by rising U.S. Treasury yields and a cautious economic outlook, small-cap stocks have faced increased pressure, with indices like the Russell 2000 experiencing notable declines. Amid this backdrop, identifying promising stocks requires a focus on companies with robust fundamentals and potential for growth despite broader market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Shanghai Shenqi Pharmaceutical Investment Management (SHSE:600613)

Simply Wall St Value Rating: ★★★★★☆

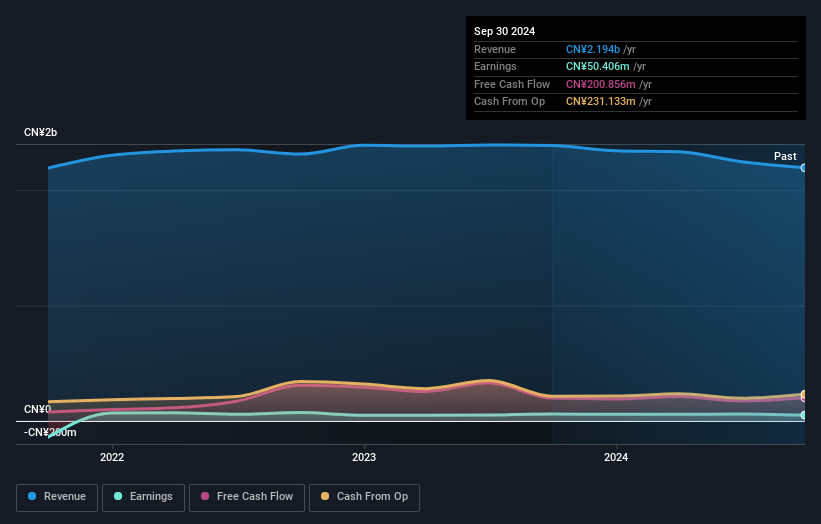

Overview: Shanghai Shenqi Pharmaceutical Investment Management Co., Ltd. operates as a pharmaceutical manufacturing holding investment company in China, with a market capitalization of CN¥4.08 billion.

Operations: Shanghai Shenqi Pharmaceutical Investment Management generates its revenue primarily through its pharmaceutical manufacturing operations. The company has a market capitalization of CN¥4.08 billion, indicating its significant presence in the industry.

Shanghai Shenqi Pharmaceutical Investment Management, a smaller player in the pharmaceutical sector, has shown earnings growth of 17.1% over the past year, outpacing the industry's -0.9%. Despite an increase in its debt to equity ratio from 4.4 to 9.4 over five years, it maintains more cash than total debt and covers interest payments well at 41.8 times EBIT. Recent financial results were affected by a one-off loss of CN¥44.9 million as of June 2024, yet it remains free cash flow positive with no immediate runway concerns due to profitability and robust operational management.

Guangzhou Guangri StockLtd (SHSE:600894)

Simply Wall St Value Rating: ★★★★★☆

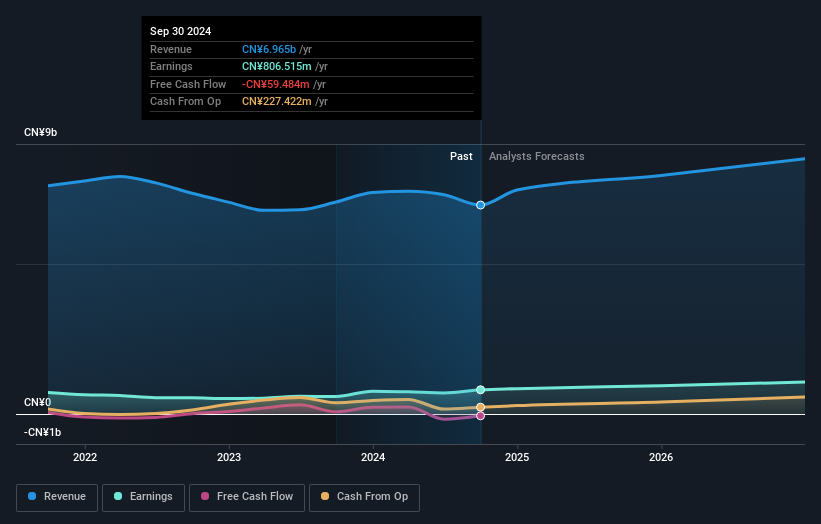

Overview: Guangzhou Guangri Stock Co., Ltd. is a Chinese company that specializes in the manufacturing and sale of elevators and related parts, with a market capitalization of CN¥10.97 billion.

Operations: Guangzhou Guangri Stock Co., Ltd. generates revenue primarily through the manufacturing and sale of elevators and related parts. The company has a market capitalization of CN¥10.97 billion. It is important to note that financial performance metrics such as gross profit margin or net profit margin are not provided in the available data, limiting further analysis on profitability trends.

Guangzhou Guangri Stock Ltd. has shown impressive earnings growth of 38.1% over the past year, outpacing the Machinery industry's -3.9%. The company is trading at a compelling 51.9% below its estimated fair value, suggesting potential undervaluation in the market. Its debt to equity ratio has significantly improved from 1.2 to 0.2 over five years, indicating stronger financial health and reduced leverage risk. Despite a dip in sales from CNY 5,363 million to CNY 4,944 million for the nine months ending September 2024, net income rose to CNY 545 million from CNY 500 million last year, reflecting resilient profitability amidst challenges.

- Click here and access our complete health analysis report to understand the dynamics of Guangzhou Guangri StockLtd.

Learn about Guangzhou Guangri StockLtd's historical performance.

Xizi Clean Energy Equipment Manufacturing (SZSE:002534)

Simply Wall St Value Rating: ★★★★★☆

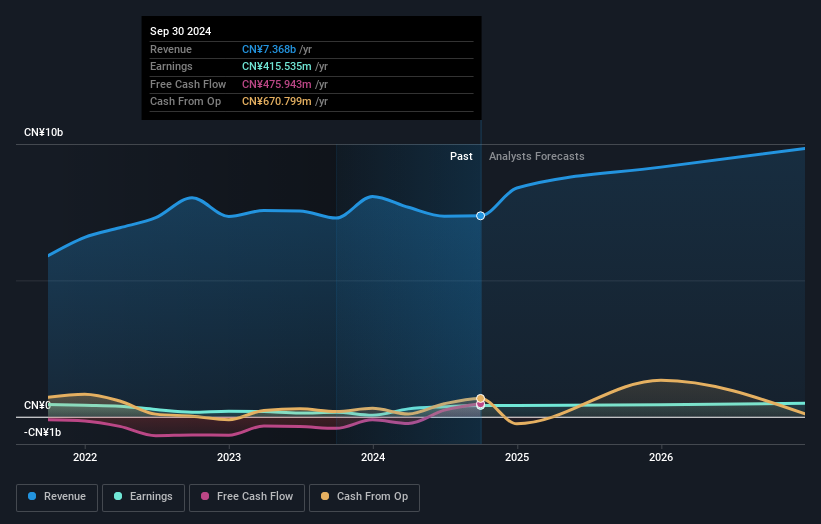

Overview: Xizi Clean Energy Equipment Manufacturing Co., Ltd. is involved in the development, production, consultation, sales, and installation of boilers, pressure vessels, environmental protection equipment, and new energy equipment both domestically and internationally with a market cap of CN¥9.52 billion.

Operations: The company generates revenue through the sale and installation of boilers, pressure vessels, and new energy equipment. A significant portion of its costs is associated with production and sales activities. The net profit margin has shown variability over recent periods, reflecting changes in cost management or pricing strategies.

Xizi Clean Energy Equipment Manufacturing has been making waves with its impressive earnings growth of 154% over the past year, significantly outpacing the Machinery industry's -3.9%. Despite a dip in sales to CNY 4.88 billion from CNY 5.59 billion, net income surged to CNY 423 million from just CNY 62 million, showcasing high-quality earnings and robust profitability. Trading at a notable discount of 53% below estimated fair value, Xizi seems undervalued given its financial strength. The company is also exploring share repurchase plans, which could potentially enhance shareholder value further down the line.

Turning Ideas Into Actions

- Discover the full array of 4739 Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002534

Xizi Clean Energy Equipment Manufacturing

Develops, produces, consults, sells, and installs boilers, pressure vessels, environment protection equipment, new energy equipment, and other products in China and internationally.

Excellent balance sheet, good value and pays a dividend.