- China

- /

- Trade Distributors

- /

- SHSE:600826

Discovering Undiscovered Gems in Asia This September 2025

Reviewed by Simply Wall St

As global markets navigate economic shifts, the Asian market presents intriguing opportunities, particularly for small-cap stocks that are often more sensitive to interest rate movements. With recent developments in key indices and economic indicators painting a complex picture, identifying promising stocks requires a keen eye for companies with strong fundamentals and potential resilience in fluctuating conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shandong Link Science and TechnologyLtd | 9.09% | 11.63% | 18.76% | ★★★★★★ |

| Lelon Electronics | 17.92% | 5.19% | 9.27% | ★★★★★★ |

| Shanghai Guangdian Electric Group | 1.14% | -2.80% | -30.27% | ★★★★★★ |

| Shenzhen Tongye TechnologyLtd | 11.85% | 16.14% | -6.98% | ★★★★★★ |

| Wison Engineering Services | 28.12% | -0.65% | 12.25% | ★★★★★★ |

| Daoming Optics&ChemicalLtd | 33.44% | 2.17% | 6.83% | ★★★★★☆ |

| Jiangsu Rainbow Heavy Industries | 20.56% | 20.70% | -0.41% | ★★★★★☆ |

| TianJin JinRong TianYu Precision Machinery | 41.98% | 12.40% | 7.00% | ★★★★★☆ |

| DYPNFLtd | 26.11% | 13.24% | 0.06% | ★★★★★☆ |

| Luyuan Group Holding (Cayman) | 79.86% | 9.14% | 20.10% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Dlg Exhibitions & Events (SHSE:600826)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dlg Exhibitions & Events Corporation Limited, along with its subsidiaries, specializes in offering conference and exhibition services across China with a market capitalization of CN¥9.23 billion.

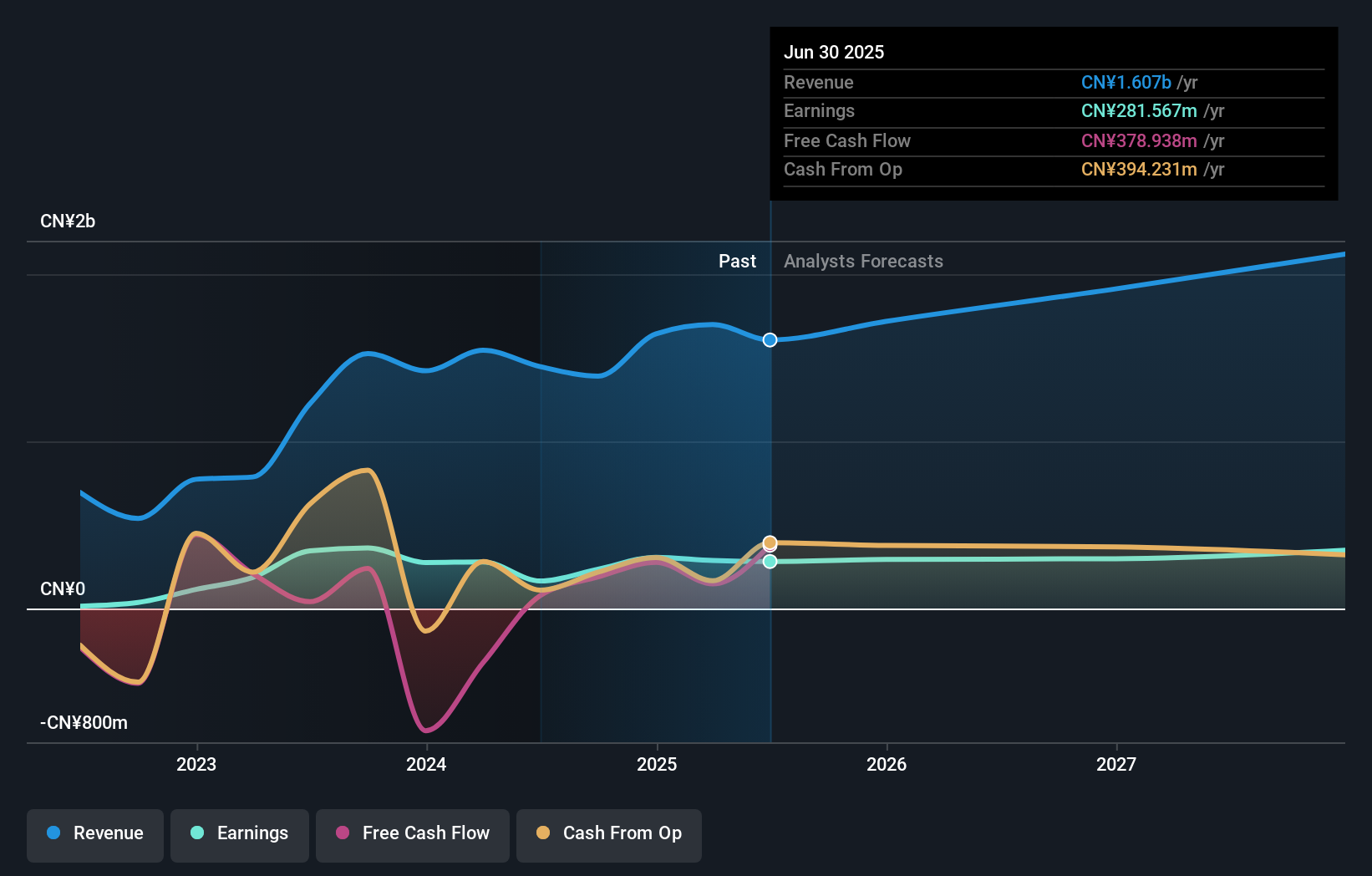

Operations: Dlg Exhibitions & Events generates revenue primarily from its trading segment, totaling CN¥1.61 billion.

Dlg Exhibitions & Events, a company with a market presence in Asia, has shown significant earnings growth of 71% over the past year, outpacing the Trade Distributors industry which saw a -21.8% change. Despite this growth, recent financial results for the half-year ended June 2025 indicate sales of CNY 548.83 million and net income of CNY 56.93 million, both down from last year's figures. The company's price-to-earnings ratio stands at 32.8x, offering better value compared to the broader CN market at 44.4x. With more cash than total debt and positive free cash flow generation, its financial health appears robust despite some volatility in share price recently observed over three months.

Dai-Dan (TSE:1980)

Simply Wall St Value Rating: ★★★★★★

Overview: Dai-Dan Co., Ltd. specializes in the design, supervision, and construction of electrical, air conditioning, plumbing and sanitary, and firefighting facilities works in Japan with a market cap of ¥265.60 billion.

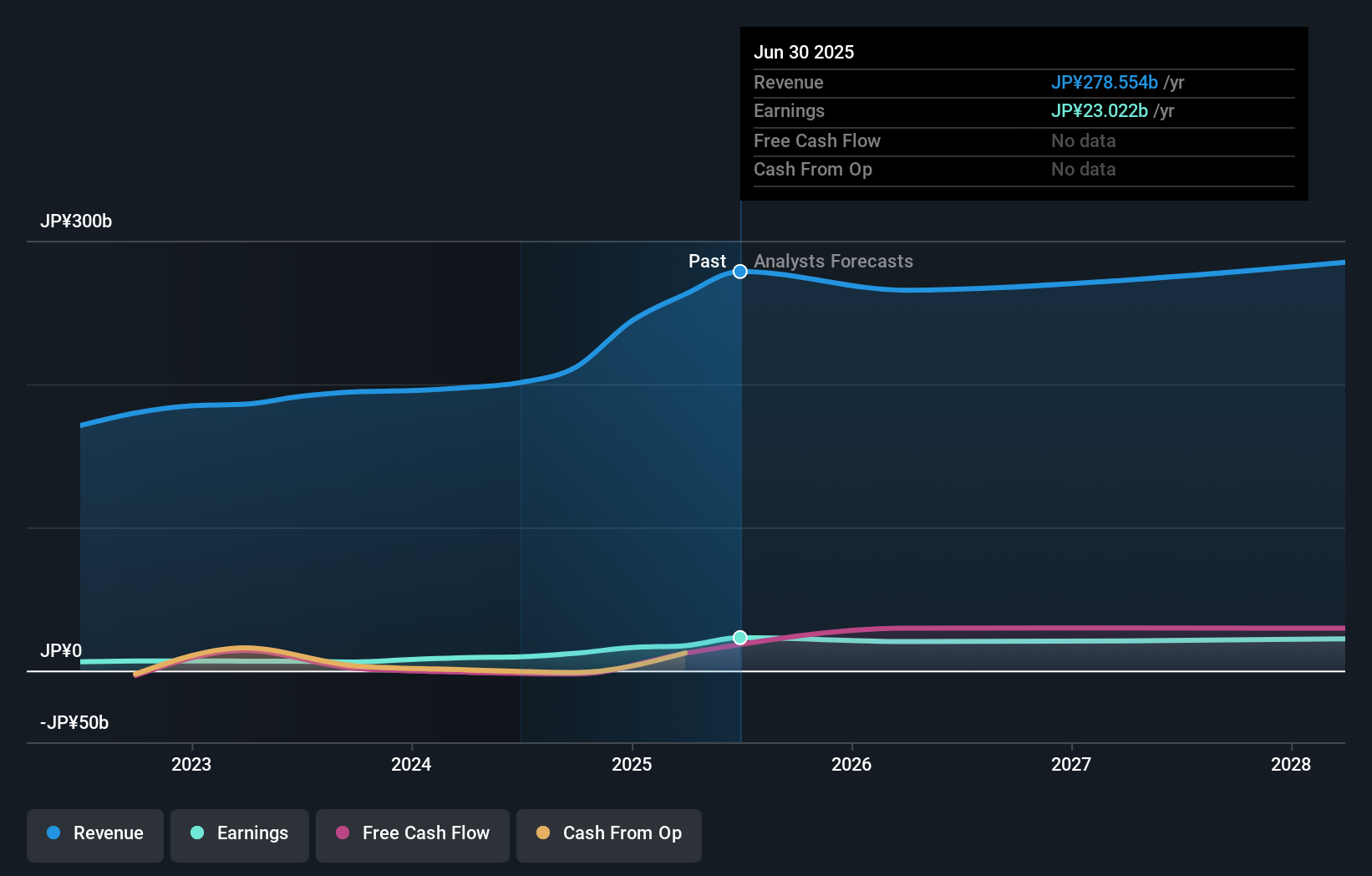

Operations: Dai-Dan generates revenue primarily from its Equipment Construction Business, which reported ¥278.55 billion. The company's financial performance can be analyzed through its net profit margin, which reflects the efficiency of converting revenue into actual profit.

Dai-Dan, a small player in the construction sector, has shown impressive earnings growth of 138.9% over the past year, far outpacing the industry's 19.4%. Its debt to equity ratio has improved significantly from 7.6% to 3.1% in five years, indicating prudent financial management. Despite high volatility in its share price recently, Dai-Dan trades at nearly half its estimated fair value and offers good relative value compared to peers. The company is free cash flow positive and holds more cash than total debt, suggesting a robust financial position amidst industry fluctuations.

- Delve into the full analysis health report here for a deeper understanding of Dai-Dan.

Understand Dai-Dan's track record by examining our Past report.

Wacoal Holdings (TSE:3591)

Simply Wall St Value Rating: ★★★★★★

Overview: Wacoal Holdings Corp. is a global company involved in the manufacturing, wholesale, and retail sale of intimate apparel, outerwear, sportswear, and other textile products across Japan, Asia, Oceania, the United States, and Europe with a market capitalization of ¥293.13 billion.

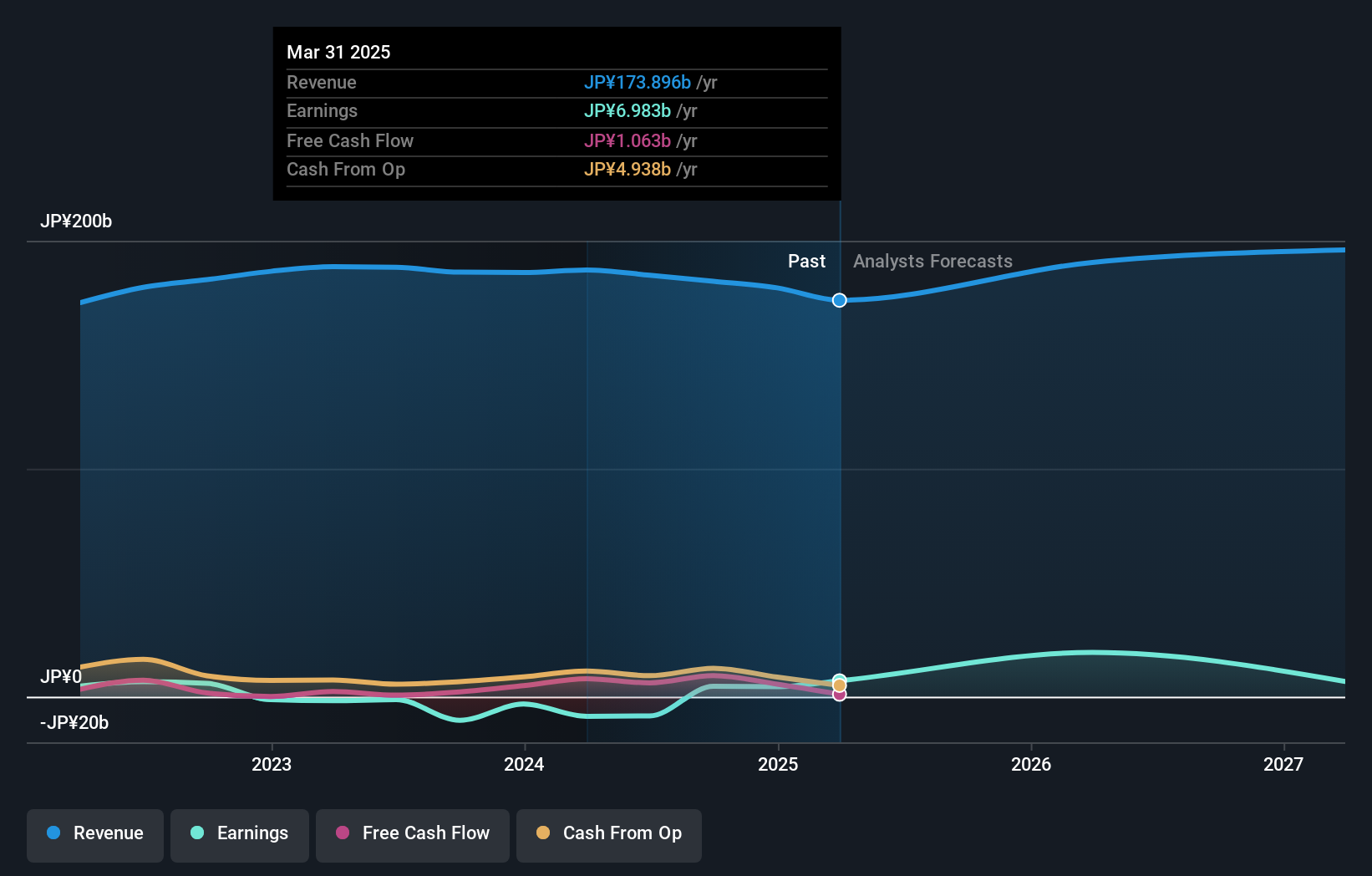

Operations: Wacoal Holdings generates revenue primarily from its Wacoal Business, with ¥88.21 billion coming from domestic operations and ¥79.87 billion from abroad. The Peach John Business contributes an additional ¥10.85 billion to the company's revenue streams.

This under-the-radar player, Wacoal Holdings, has shown resilience in the luxury industry with a recent turn to profitability. Over the past five years, its debt-to-equity ratio improved from 19.4% to 6.3%, indicating stronger financial health. The company is free cash flow positive and recently completed a share buyback of approximately 1.59% worth ¥3,968 million (US$27 million). Despite these positives, earnings are expected to decline by an average of 47% annually over the next three years. For fiscal year ending March 2026, projected revenue stands at ¥187 billion (US$1.26 billion), reflecting cautious optimism amidst challenges ahead.

- Unlock comprehensive insights into our analysis of Wacoal Holdings stock in this health report.

Gain insights into Wacoal Holdings' past trends and performance with our Past report.

Turning Ideas Into Actions

- Delve into our full catalog of 2407 Asian Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600826

Dlg Exhibitions & Events

Provides conference and exhibition services in China.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives