- China

- /

- Trade Distributors

- /

- SHSE:600811

Some Shareholders Feeling Restless Over Orient Group Incorporation's (SHSE:600811) P/S Ratio

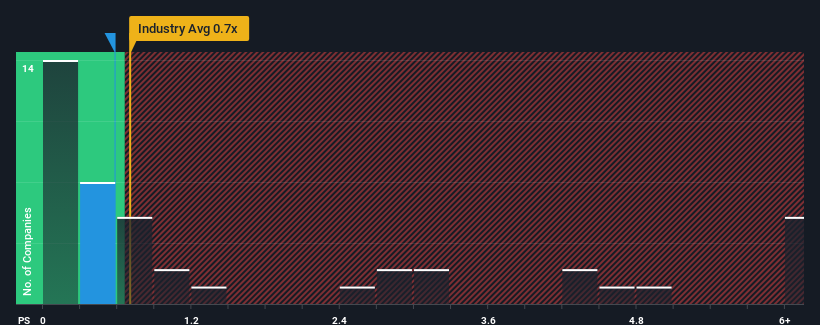

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Trade Distributors industry in China, you could be forgiven for feeling indifferent about Orient Group Incorporation's (SHSE:600811) P/S ratio of 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Orient Group Incorporation

What Does Orient Group Incorporation's Recent Performance Look Like?

For example, consider that Orient Group Incorporation's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Orient Group Incorporation, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Orient Group Incorporation's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Orient Group Incorporation's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. As a result, revenue from three years ago have also fallen 24% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 17% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Orient Group Incorporation's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Bottom Line On Orient Group Incorporation's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Orient Group Incorporation currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Before you take the next step, you should know about the 2 warning signs for Orient Group Incorporation that we have uncovered.

If you're unsure about the strength of Orient Group Incorporation's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600811

Orient Group Incorporation

Engages in financial, agriculture and health food, urbanization and development, and port transportation businesses in China.

Low with imperfect balance sheet.